A fable about a safety net.

Catacumba park in Rio is a replanted hillside overlooking the upmarket Rio lagoon. It was once occupied by a favela forcibly demolished in 1970 for the greater good, they said. It includes a (paying) adventure trail, with a longish rope walk at two levels: a high one for adults, paralleled by a low one for children, only a metre off the ground. Users of both have to wear a Serious hard hat and a harness clipped to a safety line. The attraction is a success with middle-class parents and children, though it costs too much for the poor. For some reason when we were there the customers were all small girls (footnote).

This got me thinking about safety nets more generally.

Their prime effect is to protect people from various extremely bad consequences of their poor luck or judgement: debt slavery, indigence, loss of life and limb. Only the worst designed fail to achieve this primary goal. Conservatives often object to safety nets (except it seems Paul Ryan) because they claim the secondary effects are negative and outweigh the good ones, or at least make them bad value for money: moral hazard, encouraging excessive risk-taking; promoting laziness; and the waste of resources when the net is actually unnecessary.

Now you could argue that this young adventurer illustrates the third point: perhaps she didn’t need the safety rope at all.

But consider another girl. I don’t think that without the rope she would have got very far.

The safety net here liberates: it allows some people to take good, life-enhancing risks they otherwise could not have faced. This is not a trivial effect: look at her face when she’d finished. She’s not the same person as when she started. The value for her parents’ money is off the charts.

My fable is, you object, a rigged metaphor. By design, there’s no moral hazard or laziness effect. True; I’ve chosen it not as a representative model but to make a point, a proof of principle by example. Every time you read a conservative railing against safety nets on the standard grounds, check if the pundit has considered the positive secondary impact as well: the liberation of people to try new things. If not, ignore her. That even goes for the otherwise great Rabbi Hillel‘s gutting of the Deuteronomic Jubilee cancellation of debts.

Do we have any evidence about the net balance of the various social safety nets? I don’t have a detailed analysis for you (bleg here). But in the grand sweep of history, it’s obvious that the steady reinforcement of the social safety net in developed countries over the last two centuries - bankruptcy (footnote 2), limited liability, poor laws, last-resort central banking, unemployment insurance, state pensions, public health care, etc - has not prevented a colossal economic boom.

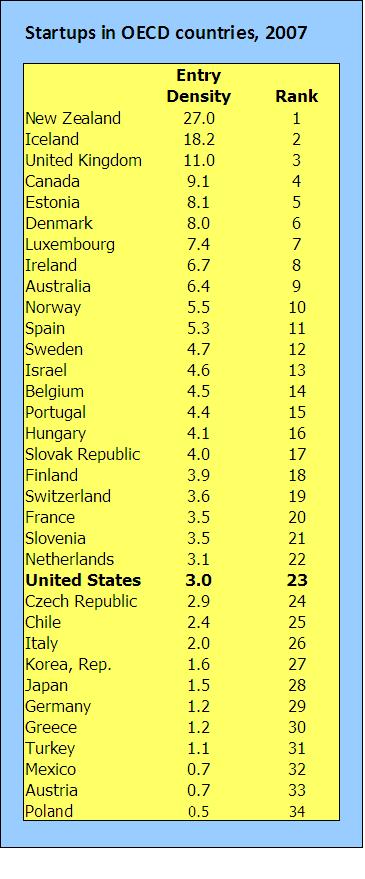

Here’s a contemporary data point, on comparative rates of business startups. I’ve taken 2007 as the last pre-crisis year - a lot of startups in recessions are acts of desperation not hope. The entry density is the rate of registration of new limited liability companies per thousand adults of working age.

Spreadsheet here with sources.

Spreadsheet here with sources.

The USA is not, contrary to popular myth, a particularly welcoming ground for startups, in spite of low regulatory barriers, good access to venture capital, and a vast domestic market. (Note to data buffs: the Kaufmann index for the USA uses a narrower age band as the denominator than the World Bank dataset I used for everybody else. Correcting this would push the US rate up by 10-15%, gaining one place in the rankings at the expense of the idle Dutch [update] lower the US one place in the rankings, below the go-ahead Czechs. (H/t: Marcel in comments catches my arithmetic howler.)

It’s striking that the countries with significantly higher startup rates than the USA are those with stronger, more comprehensive, and more centralised social safety nets, along with correspondingly higher taxation.

How many Americans are locked into jobs they hate by the fear of losing health benefits? No Dane ever has to worry about losing her right to medical care by quitting her job to go it alone. Norwegians could in conservative theory decide that work isn’t worth it and live comfortably off the dole, but in practice they don’t. In New Zealand, the insurance principle has been largely abandoned: most benefits have nothing to do with contribution records.

American exceptionalists can try to get round the embarrassing data by special pleading, making the Protestant work ethic do overtime to explain those entrepreneurial Nordics (passing over the Calvinist Dutch who invented it); or alternatively claiming that the USA does a better class of startup, with a few Googles making up for many corner stores. Pending evidence, I’ll stick with the old conservative CW that startups matter for innovation and sustainable growth, more than the absolute number of small businesses.

The real puzzle in the table (apart from the - on the face of it - incredible number for New Zealand) is the very low startup rates in Germany and Austria, with very successful and reasonably innovative economies. Bleg: is there some guild protection there for small businesses that makes it unnecessary to set up limited liability companies? Or are there very large bureaucratic, cultural or financial obstacles to startups that pose a long-run threat to their continued growth? [Update: see Katya’s answer in comments.]

******************************************************

Footnote

I hope that nobody feels that publishing these photos is a violation of the kids’ privacy. The girls can’t be identified by me or you; they were appropriately dressed (unlike Alice Liddell in Charles Dodgson’s disturbing and brilliant photograph); they were in the company of parents or caregivers; and IMHO what they were doing was in a sense a public performance. Feedback welcome.

Footnote 2

John Adams’ response to the aftermath of a land bubble, the US’ first bankruptcy law of 1800, looks more vigorous that Obama’s ineffective HAMP.

What’s always weird to me is how, despite those secondary effects being so hard to quantify and measure, we all tend to have pretty strong feelings either way. Either this is because we (those of us who are right) intuitively grasp some truth about human behavior, or we are simply projecting the world as we want it to be.

Keith, startups in Germany, Austria, and Switzerland tend to predominantly have the form of individual enterprises (“Einzelunternehmen”) or other non-LLC types, not LLCs (GmbH, or “Gesellschaft mit beschränkter Haftung” in German).

The reason is simple: An Einzelunternehmen is easy to start with a minimum of red tape. This is most extreme in Switzerland, where, unless your revenue exceeds CHF 100,000, there are practically no legal requirements whatsoever; you don’t even have to register your business with the Handelsregister (which is still beneficial, so most businesses do it, anyway). The constituting act for such a business is simply to start doing business (taxes still have to be paid, of course, and that includes social taxes for any employees). Legal requirements in Germany and Austria are only marginally stricter (you basically register your business at the local Gewerbeamt for a small fee and, I think, may have to apply for a tax number for your business).

Conversely, it requires much more effort to set up a GmbH. First of all, there is a minimum requirement for the founding capital (EUR 25,000 in Germany, EUR 35,000 in Austria, CHF 20,000 in Switzerland). You require a lawyer to draft articles of association, which then also have to be notarized (for an additional fee, of course). In short, starting a GmbH is a comparatively expensive and time-consuming process (largely for historical reasons).

Note that there also other legal forms for new businesses, such as the GbR, OG, or KG (none of which have limited liability). GbRs are the most common of these; it’s the basic form for a business with multiple owners.

To illustrate this, the German Federal Statistical Office listed 65,319 new business registrations for July 2011, out of which 52,388 were Einzelunternehmen and 8,637 were GmbHs. A further 3,292 were GbRs.

As far as statistics are concerned, the German Federal Statistical Office listed 707,569 registrations for new businesses in 2007.

Thanks Katya for the information. So it’s a combinationo flow barriers to unincorporated business formation, and high ones for incorporation. A subsidy for banks in a way. But why then is the startup rate for limited-liability firms so much higher in Switserland? Is it the tax evasion (see footmote in the spreadsheet, identifying CH, Luxembourg ansd Ireland as offshore financial centres)?

I honestly don’t know. My family lived in Germany for five years when I was a teenager, and I have German relatives (through my mother, who is from Germany). And I still occasionally watch German TV and, speaking the language fluently, can research stuff on the internet. But I’ve still lived most of my life in the United States and my cultural background is very much that of an American, so there are very many holes in my knowledge of continental Europe.

In general, I would guess that aside from the fact that Switzerland has a reputation for being business-friendly, the minimum capital requirements in Switzerland are considerably lower.

I’m not sure how much taxes factor into this; Switzerland has a lower corporate tax rate than the UK, Denmark, or Norway (and it’s not that much lower than what businesses have to pay in Germany and Austria).

I live in Switzerland and have recently transitioned my creative business into an LLC here, basically because of better control of liability. I was a “Einzelfirma” for some years before and it was incredibly simple. You can run a business as a Single Person without having to care for a lot. And you can grow quite big (and have employees etc) before you should/ought to change your business structure.

There is a really smooth transition possibility from Single Ownership to LLC to corporation. All of these structures are beneficial in their own niche, and the transition is easy. But from what I know is that many people keep their “Einzelfirma” because it works quite nicely for them - possibly they would have incorporated in other countries.

I cannot really compare with abroad, but from my own experience US companies are similarly easy to setup, although you need somebody to help you through the formalities. From conversations with German friends in the same field I get the impression that it’s really complicated to run a small company (LLC or corporation) there and leads to miles and miles of red tape.

Why I wrote Keith when I meant James is beyond me. I must be getting old. 🙂

John Stuart Mill, in Principles of Political Economy:

“Energy and self-dependence are, however, liable to be impaired by the absence of help, as well as by its excess. It is even more fatal to exertion to have no hope of succeeding by it, than to be assured of succeeding without it. When the condition of any one is so disastrous that his energies are paralyzed by discouragement, assistance is a tonic, not a sedative: it braces instead of deadening the active faculties: always provided that the assistance is not such as to dispense with self-help, by substituting itself for the person’s own labour, skill, and prudence, but is limited to affording him a better hope of attaining success by those legitimate means. This accordingly is a test to which all plans of philanthropy and benevolence should be brought, whether intended for the benefit of individuals or of classes, and whether conducted on the voluntary or on the government principle.”

http://www.econlib.org/library/Mill/mlP73.html#Bk.V,Ch.XI

A question that appears too trivial for words, except it makes clear that I do not understand the numbers in the chart.

You explain the figures as, “The entry density is the rate of registration of new limited liability companies per thousand adults of working age.”

In the note to data buffs, you write, “… the Kaufmann index for the USA uses a narrower age band as the denominator than the World Bank dataset I used for everybody else. Correcting this would push the US rate up by 10-15%, gaining one place in the rankings at the expense of the idle Dutch.”

If the figures for the USA use a narrower age band as the denominator, doesn’t that inflate the ratio relative to the rest of the world? If you correct for it, wouldn’t that make the ratio smaller, pushing the US down, perhaps below the idle Czechs?

Oops. You are of course right. Post corrected.

The opposition to social safety nets from conservatives comes from the fact that they don’t use them. They don’t anticipate ever using them. So they can’t comprehend why anyone would use them unless they were “bad people”. Utilitarian arguments will not sway them.

I agree with your larger point about safety nets encouraging risk-taking, but it’s still hard for me to take seriously any economic ranking that has Estonia > Norway > Hungary > Finland > Slovenia > US > Germany. If anything, this list demonstrates the difficulty of international comparisons. Katja already highlighted some of these issues regarding Germany and Austria, and I suspect similar caveats could be found with other countries. Do some of these countries better reward shell companies with tax breaks than others? Are there incentives to register them earlier?

There’s also the question of whether these start-ups are successful. Without sufficient financing, an entrepreneur in say Slovakia may launch multiple failed ventures in a few years. The metric above would count this as a sign of a robust, innovative economy; it is nothing of the sort. Lastly, dividing start-ups by the number of work-eligible people misses the fact that in a well-developed economy like the US, talented people can find high compensations at established companies. The dearth of such opportunities in developing economies make start-ups relatively more appealing, but this is more of a bug than a feature.

Why don’t you take the ranking seriously? Do you think that US economic performance has been significantly better than that of these other countries over the last decade?

For the record, Norway isn’t a developing country; its real GDP per head is 11% higher than the USA’s according to the OECD ($47k against $42k at 2007 prices). The other Nordics, without oil, come in at about 15% lower: $30k-$33k. The World Bank table shows much lower rates of limited-liability startups in the less developed OECD countries like Turkey and Mexico, and in poor non-OECD ones (I supplied the full table), as you would expect.

The Nordic data are genuinely surprising and counter-intuitive. They aren’t tax havens but well-ordered social democracies. Show me the shell companies! Katya answered the German puzzle with data. Speculative hypotheses don’t do the job you want them to.

I suspect the ex-communist countries have at least in part a high number of start ups because their economies are still immature,

Just to say that “springboard” or “platform” are much better metaphors than “trampoline,” which suggests a certain wildness and riskiness.

Social support programs provide tens of millions of people with stable platforms, springboards to move up into the realm of productive entrepreneurial enterprises.

http://www.asymptosis.com/springboard-not-safety-net.html

Your metaphors both work. But in the context of startups, the risks are real and very high, so springboards and trampolines are fair enough.

For some groups like Vincent’s friends, it’s unrealistic to think of reinsertion into economically productive life, so we should be careful not to oversell the rebound argument. I just feel strongly that it must not be ignored.

You don’t hear much objection from the right about a safety net for business — e.g., mortgage and loan guarantees that protect builders and lenders and allow them to take greater risks.

Nor, indeed, about limited liability for corporations and their owners - perhaps the biggest safety net of all.

I always thought this should have been the principal rationale for a public health-care option. Entrepreneurs and small businesses create jobs. A public safety net supports entrepreneurs. Therefore a public health-care option would be good for the economy as a whole. Unfortunately I never saw that rationale pressed hard by the Obama administration and the public option died an ignominious death.

But of course corporations — especially old, not-very-good, not-very-imaginative corporations — do not want a public safety net, because it would eliminate the last reason for their best employees to stay in their jobs, instead of striking it out on their own and perhaps becoming (gasp!) competitors.