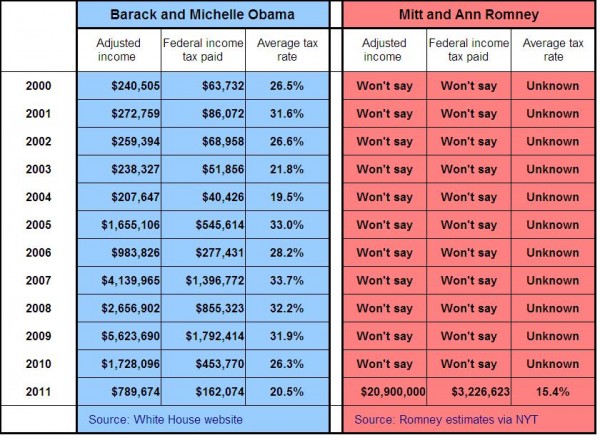

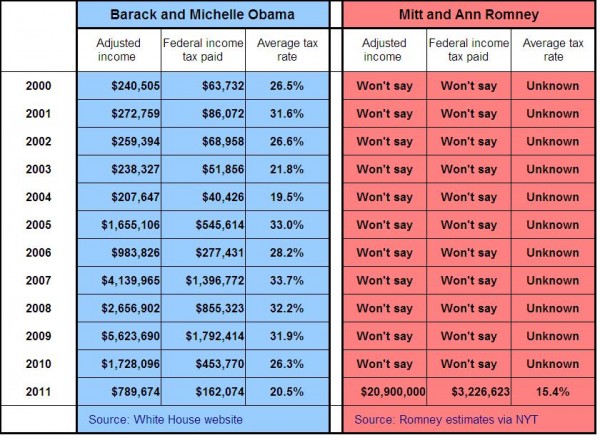

A summary table of the Obamas’ and Romneys’ federal income taxes since 2000.

Following Keith’s eirenic suggestion about how Obama should play the candidate tax issue in a high-minded way, I’ve made an instructive little table comparing the federal income taxes of the Obama and Romney households since 2000.

Corrections welcome. [2007 corrected already, thanks to commenters!] I’ll update it if necessary. Spreadsheet here with sources. Feel free to reuse without acknowledgement (the data are in the public domain and the processing trivial), and improve the graphics. (My software won’t generate good resolution in jpg format.) However, in this case - and contrary to normal good visual practice - I think it’s important to keep the precise numbers.

The Biden table can readily be prepared when he has an opposite number, who will presumably follow his leader’s model of non-disclosure.

Author: James Wimberley

James Wimberley (b. 1946, an Englishman raised in the Channel Islands. three adult children) is a former career international bureaucrat with the Council of Europe in Strasbourg. His main achievements there were the Lisbon Convention on recognition of qualifications and the Kosovo law on school education. He retired in 2006 to a little white house in Andalucia, His first wife Patricia Morris died in 2009 after a long illness. He remarried in 2011. to the former Brazilian TV actress Lu Mendonça. The cat overlords are now three.

I suppose I've been invited to join real scholars on the list because my skills, acquired in a decade of technical assistance work in eastern Europe, include being able to ask faux-naïf questions like the exotic Persians and Chinese of eighteenth-century philosophical fiction. So I'm quite comfortable in the role of country-cousin blogger with a European perspective. The other specialised skill I learnt was making toasts with a moral in the course of drunken Caucasian banquets. I'm open to expenses-paid offers to retell Noah the great Armenian and Columbus, the orange, and university reform in Georgia.

James Wimberley's occasional publications on the web

View all posts by James Wimberley

I think the Obama’s tax rate for 2007 is closer to 33% than 52.6%, if the other two figures are correct.

Shouldn’t the tax rate for 2007 be 33.7% rather than 52.6%?

Thanks to both. Error in pasting the the formula, fixed.

…the Obamas’…!

Why not? They are joint declarations. See the source here. Michelle had a good salary as a hospital administrator before the 2008 campaign.

Sigh. November can’t come fast enough.

(It’s not that I have any sympathies for Mitt Romney, but I do remember a time when this blog was discussing interesting policy issues rather than the tax history of a used car salesman [1] with presidential ambitions.)

[1] My apologies to all actual used car salesmen for this figure of speech.

Point taken. My next post will either be about the Olympics again or energy.

Fair enough I suppose. But keeping the heat on Romney is no insignificant thing.

One thing we know: The culture tends to back-burner Republican misdeeds.

Or morally ameliorate them by claiming “both sides do it”.

Anybody clicking in to this site and seeing James’s naked reminder, gets a face full of blowback….

Along with Katja, I like the substantive policy discussions on this blog. Relalted to discussions of policy, it would be great to have opportunities to find out occasionally from well-informed readers what they think of various policy books which I am not competent to assess. For example, one Scott McCleskey has written “When Free Markets Fail.” I heard an interview with him regarding this book, and it sounds like a book worth buying and reading, but I am utterly unable to detect egregious howlers when it comes to issues of appropriate measures to regulate financial markets. The author sounded level-headed enough in his interview at http://www.youtube.com/watch?v=VwVVWIaoYic , and a lay reader may gain enough orientation to the subject matter to detect the difference between sense and nonsense in public discussion in this area. But I will wager that there are contributors to this blog, commenters and regulars alike, who could point out things that may be missing from the author’s analysis.

Not that this site needs to turn into a book review forum, but just an occasional recommendation or word of precaution about books that have the potential to help us understand responsible policy debates, if by some miracle they should appear in the public sphere.

I thought that the President’s salary was round about $400,000/year, what are they doing to make 10x that?

Primarily book sales, as I understand it. The president also happens to be a bestseller author.

Also a grammy-winning audiobook reader, though I don’t know what the sales volume was like.

What I found striking was the Obamas’ joint income before 2005: two senior professional jobs and totals well under $300,000.

A yawning wealth gap will do that.

I think you have “adiusted” or “adlusted” up at the top on both sides.

Thanks, equal opportunity typo fixed. At least it wasn’t about the Clintons.

I can’t help but notice the failure of Obama to release his returns from the 20th century. Wasn’t that the same century that Communists and National Sicialusts slaughtered millions of people? Mighty suspicious if you ask me.

You may notice that in fact Obama released his returns from 2000, the last year in the 20th century, what with there having been no year zero.

Stephen Jay Gould had the best answer to you calendar prescriptivists: The first decade only had nine years.

If you’re going to play that game, you might as well decide that the first decade had eight years, and the fifth decade had eleven. Arbitrary redefinition of the word “decade” seem less desirable than deciding to follow the rules of simple arithmetic.

Apparently there is a lovely new word summing up the degeneracy of Romney’s fiscal plans:

http://livewire.talkingpointsmemo.com/entries/obama-calls-mitts-tax-plan-romney-hood?ref=fpblg

Romney-hood for the win!

One more delicious Romney tax story:

http://www.latimes.com/news/nationworld/nation/la-na-romney-property-tax-20120806,0,4926772.story

There goes the neighborhood!

What does this show? Obama sets tax policy, and Romney follows the rules (unlike half of Obama’s cabinet). The IRS certainly checked Romney’s returns to make sure they followed all the rules. Romney donates something like 14% of his income above and beyond taxes. I support the right of everyone to pay as little in taxes as they legally owe, and do with the rest what they like (especially if it includes giving away a large chunk of it). If you report on rate of money kept after taxes and donations, the Obama’s look a little more greedy.

I can dig your perspective CS Five!

Yet, the skills Romney has chosen to hone while playing by the rules have led to many a concerned outcome, like a controversy regarding Italian communications systems, and the public welfare of the Italian citizenry. I can accept Romney as a very efficient and effective venture capitalist, but I can’t accept Romney as the person in charge of the executive branch of my beloved nation!

Will he, once occupying the White House, relentlessly pursue less occupancy taxes for Anne and himself at the expense of say foreign policy, while in DC?

How do you know that Romney follows the rules, CS Five? Have YOU seen his tax returns? Also, can you justify the “half” of Obama’s cabinet claim?

Q1 - he pays a lot of lawyers to make sure they’re accurate, I’m sure. And the IRS hires even more people to make sure they’re not getting screwed out of millions. Q2 - do you not remember all the nomination fiascos from early in his term?

Note: I’m not saying Romney is automatically better, but I do feel that his taxes are irrelevant. While countless rich people do lobby for specific tax advantages, I’ve not seen any evidence that Romney has ever done that (nor would that be in his tax returns). In my mind, asking for his tax returns is 100% the same as asking for Obama’s birth certificate. It just distracts from the real issues. The request would at least be credible if it was coming from people undecided about who they want to vote for (as if a effective federal tax rate of 16% is OK, but 15% isn’t, or something), but it’s only coming from people that hate him with a passion, and mock him for using the tax system he didn’t design. The fact that his effective tax rate is above the long term capital gains tax rate, despite his extensive donations, tells me he’s not gaming it that much. Can we talk about his lack of a tax policy proposal now?

CS Five, leaving aside the fact that birtherism was a racist conspiracy theory while releasing tax returns as part of full disclosure is perfectly legitimate, perhaps we can agree that both issues can be resolved the same way -release the documents! What is Romney afraid of? Obama has released multiple years of tax returns and his birth certificate while Romney has released very little. Why is Romney such a coward? If he can’t handle the precedent set by his own father perhaps he should look for another line of work.

CS Five has proved that rich people who hire a lot of lawyers simply cannot cheat on their taxes.

… Besides, the point isn’t really the law — it’s fairness. If Romney had an effective tax rate of 5% one year, that is likely to annoy some undecided voters, law or not.

Since Romney is an advocate for the idea that people like him should pay even less in taxes than they do now, it’s a relevant issue.

So, in essence CS Five, you actually don’t have an answer. You’ve evaded the issue twice, which, given your taste for exaggeration and endorsement of falsehood suggests that you don’t have much too contribute to the discussion. Had you considered running for the GOP nomination in 2016? You would fit in really well with Bachmann, Cain, Gingrich and Perry next time around.

Over the period shown, the Obama’s made about 10% less than the Romneys. However, they paid 275% more than the Romneys in taxes. However, that really understates the amount that the Romneys avoided in taxes since none of the income generated from the $20-100 Million in the Cayman Islands is reflected on the return.