British lefty pundit George Monbiot, in a gloomy tirade against the cult of economic growth:

Ignore if you must climate change, biodiversity collapse, the depletion of water, soil, minerals, oil; even if all these issues were miraculously to vanish, the mathematics of compound growth make continuity impossible ….

The trajectory of compound growth shows that the scouring of the planet has only just begun. As the volume of the global economy expands, everywhere that contains something concentrated, unusual, precious will be sought out and exploited, its resources extracted and dispersed, the world’s diverse and differentiated marvels reduced to the same grey stubble.

Some people try to solve the impossible equation with the myth of dematerialisation: the claim that as processes become more efficient and gadgets are miniaturised, we use, in aggregate, fewer materials. There is no sign that this is happening.

Monbiot’s argument is wrong. I dug out a nice oddball paper on dematerialization by Austrian scholar Julia K. Steinberger et al, Development and Dematerialization: An International Study, in online peer-reviewed journal PLoS ONE. Snark if you like, but read it first. They used standardised material flow data still produced by national statistics agencies (perhaps in response to Leontief’s input-output analysis). The three basic categories - fossil fuels, biomass, and minerals - are aggregated by weight into “domestic material consumption”, DMC. It’s a measure of the mass of material resources we consume. Not very helpful for helium and yttrium, but these are of marginal importance.

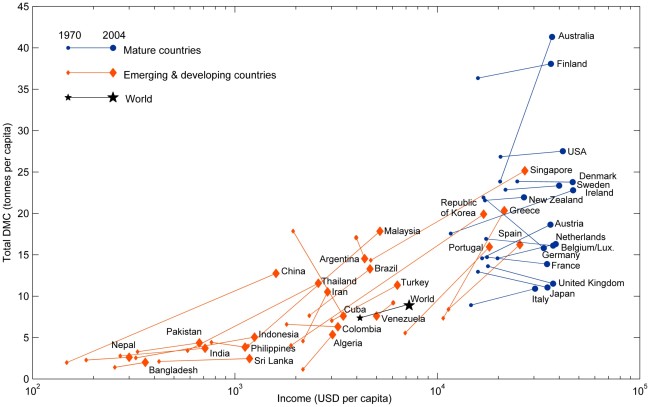

The chart over the jump shows the trends for a good number of rich and developing countries.

Figure 1. Income and Total Domestic Material Consumption per capita, 1970-2004

Figure 1. Income and Total Domestic Material Consumption per capita, 1970-2004

Our intuition is that as countries get richer, their growth becomes less resource-intensive, and the link may indeed go into reverse. The data clearly support this proposition. A significant number, including France, Germany, Japan, the Netherlands, and the UK, had a negative elasticity of material consumption against income. Germany had an astonishingly large one (-0.4), which reunification with the inefficient DDR (a five-year shock) can only partly explain. The USA was flat. Among advanced countries, only Australia, Austria and Ireland showed a large increase.

Dematerialized growth is already here. Machinery like cars is getting better and longer-lived; electronic gadgets get smaller - the $500 iPhone, more powerful than a 5 kg desktop computer of 1990, weighs 112 grammes; we consume more restaurant meals, online entertainment, and concerts. There is little reason to think these trends will be reversed. Indeed, Steinberger’s data stop before anybody got serious about climate change and started investing in renewable energy. Since 2004, over 140 GW of solar panels have been installed, and the total is growing by 40-50 GW a year.

Monbiot’s doomsday argument fails. We do not face an impossible dilemma of global “limits to growth”.

What we do have is a limited problem, but a real, large and difficult one. Developing countries are still increasing their material consumption, and rapidly. They will clearly stop doing so, at or before current OECD levels of income per head. Similarly global population will very probably plateau, maybe around 10 billion. That many humans at current German or Japanese levels of material consumption is still a huge increase in annual claims on natural resources. The burning of fossil fuels has to stop completely, and soon, to save a livable climate. There remain huge problems over creating a sustainable food supply while preserving or increasing the remaining forests. The cultural shift among young people, away from cars as foci of aspiration towards instant communication, should be welcomed and encouraged. Countries addicted to suburban sprawl, like the USA and Australia, will need to shift back to European densities of urban living. It looks difficult, but not impossible, to live and prosper within our global means.

In the long run, is an economy of immaterial scarcity plausible? The material base of living will always be there, but as a steadily decreasing share of expenditure. At some point the administrative hassle of charging for ball-point pens, T-shirts and 3D-printed toasters ceases to be worth it, and communism becomes less trouble. At the other end of the scale, the best seats for grand opera and duplexes overlooking Central Park will always be scarce and their price has no natural limit. A society where the mass of Morlocks live off an adequate dole of bread and e-circuses and the few Eloi compete like Renaissance princes for positional goods is not attractive, and looks uncomfortably close - but it can be ecologically sustainable.

* * * * *

The title refers to Prospero’s great envoi.

Update February 2016

Two follow-up posts: A walkback (January 2016) based on new research, plus a correction on the Steinberger paper; and a recantation of the walkback based on even newer data. Actually Cranmer is a hero of mine.

All these scaling problems would be more tractable if the human population was smaller.

Contraception is the highest-leverage and least expensive technology that mitigates water shortage, energy consumption, climate change, etc.

Absolutely. It makes a big difference whether world population plateaus at 10 billion or 12. Americans should stop looking down at Europe's static population. The good news is that the demographic transition is happening, and merely needs to be nudged ahead. The way to do it is to treat it as an issue of empowering women to make their own choices - they always choose fewer than patriarchal men. Barack Obama should make his official portrait in US embassies in Africa one with Michelle and his two daughters. Jacob Zuma, the president of South Africa, has 20 children.

I think I'd put it in the opposite order James: "What we do have is a real, large and difficult problem. That's the bad news. The good news is this: that problem is limited."

But when it's a good news/ bad news scenario, I like the bad news first.

Are you sure that you’re reading Monbiot accurately? What he seems to me to be arguing is the global point. Certainly a relatively few (albeit mature, high-consumption) countries have moved down rather than up, but the world trend is still upwards, and will be either until the “emerging” economics reach mature-country levels of consumption or until something breaks. Dematerialization has to contend against an ever-increasing market. (Companies that sold a few million desktop computers in 1990 were having a very good year; now a good year is selling 100 million mobile phones or more).

And for the time being, at least, not nearly enough of this consumption of raw materials is of renewable items. So even if the tons-per-capita flatten out, the cumulative tons are monotonically increasing. Unless we can get to net-zero or net-negative, Monbiot’s prediction of grey stubble still pretty much holds.

Technically, flat consumption still exhausts all limited resources sometime. But it's a perfectly reasonable hope, based on the five countries cited, and a little more policy effort, that material consumption in rich countries will decline. It's already happening with fossil fuels. You would need to get into the weeds to see if there are any specific materials that can plausibly run out in a 200-year horizon. If prices go up, then there will be more recycling, and substitution of more abundant materials. Very little gold is lost annually. We should compare this worry with the imminent threats of climate disaster and forest collapse. This generation's challenge is to fix these, and leave the ytttrium (etc) exhaustion issue to our grandchildren.

One reason for declibe in western countries isthat a lot of the material consumption is now made in China, i.e. no net reduxtion.

The Steinberger study uses consumption, not production, so the exporting of pollution and use of materials by exporting manufacturing is covered AFAICT. Of course, there's also deliberate exporting of pollution like toxic waste, but the big item is ordinary trade.

He wrote "As the volume of the global economy expands, everywhere that contains something concentrated, unusual, precious will be sought out and exploited, its resources extracted and dispersed, the world’s diverse and differentiated marvels reduced to the same grey stubble."

Hmmm … the inevitability and irreversibility of entropy has has always been a gloomy reality for physicists who think "in the long term." Fortunately for us, the long term in cosmology is measured in VERY big numbers.

Now it's come to the world of economics, where perhaps the time scale isn't quite so large.