We all love a David-and-Goliath story. Elon Musk is a great showman and has played this narrative for all it’s worth in the spectacular rise of his electric car company Tesla. A few weeks ago Tesla launched the Model 3, hyped as the first mass-market full-range all-electric car. But what we really want to know is not whether Tesla will beat Ford and GM and VW, and whose shareholders will make or lose money. It is the answers to two questions:

- Is the electric vehicle revolution is on track to take over from fossil-fuel vehicles in the coming decades?

- If yes, will the revolution happen fast enough to be consistent with the Paris 2 degree C warming cap and net zero emissions not too long after 2050?

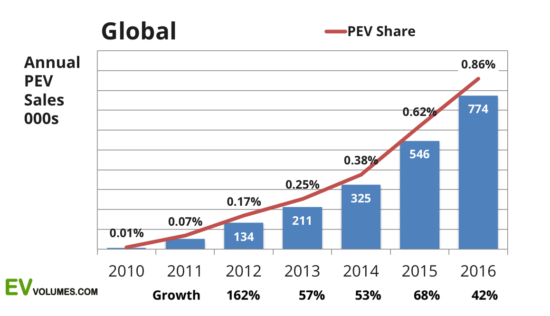

Here is a growth chart for global sales of plug-in electric vehicles (EVs).

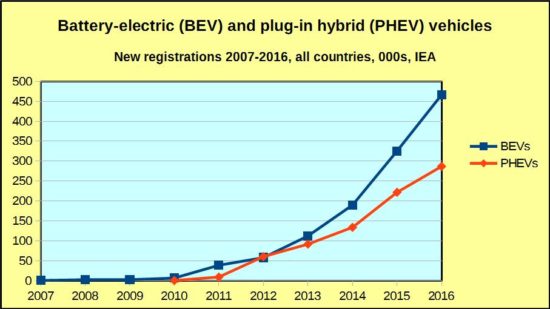

Another one from me, using IEA data – copied into a spreadsheet here. The growth rate for pure battery cars is higher than for hybrids, a complex transitional technology that is fated to fade out.

Another one from me, using IEA data – copied into a spreadsheet here. The growth rate for pure battery cars is higher than for hybrids, a complex transitional technology that is fated to fade out.

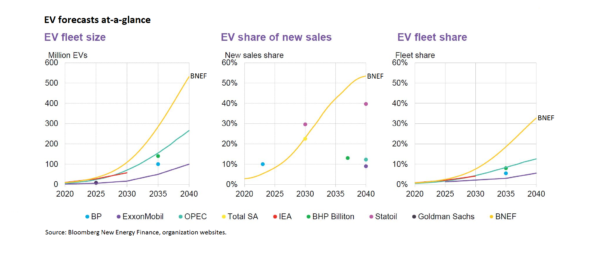

The rate bounces around and hasn’t settled down, so it would be hazardous to pick a CAGR as a prediction. You can pick a rate and find an expert who predicts it. A nice chart from BNEF shows the scatter.

BNEF leaves out the outlier, Stanford professor Tony Seba, who predicts EVs will be 100% of new sales by 2030. His growth rate is not particularly high – 33% CAGR by my calculations. He does expect self-driving plus rideshare to slash the size of the market by two-thirds.

I see no reason not to join the party with my own blunderbuss. The growth rate looks to be higher than the 42% that gives a doubling time of 2 years. The global light vehicle market is currently 93.5 million a year, growing at 1.5%. Project the 42% CAGR, and EV sales take all the market in 2031, in line with Seba (my spreadsheet, and footnote). That’s without his rideshare revolution.

In all the professional scenarios, the answer to the first question is yes. Electric cars will take over. So will buses and light commercial vehicles (sooner), and eventually heavy ones.

But the answer to the second question is still very doubtful. The problem is that the stock of ICEVs is huge, over one billion, and they last a long time, about 20 years for cars. Even if no new ICEVs are sold after 2030, emissions from the fleet don’t hit zero until 2050. Rideshare does not affect this problem unless it accelerates scrapping of the legacy stock. Net zero by 2050 requires extremely high growth rates to hold up; follow anybody else’s forecasts than Seba’s and mine, and the deadline is put off. The govrnments of the UK and France have announced ICE cutoffs for cars in 2040: this is not too bad, as cars over 10 years old tend to have low annual mileage. Net zero by 2050 also calls for extension of the technology to trucks. This is all possible, but not at all certain.

It’s easier to argue that this can happen than that it will. I can at least offer you a qualitative list of downside and upside risk factors, over the jump.

Downside risks

1. Unforeseen technology roadblocks

These are always possible, but extremely unlikely. The few cases I can think of where technology has stalled – including supersonic passenger flight and nuclear power generation – arose from cost and complexity. EVs, like solar panels and wind turbines, are fairly simple and individually cheap devices that can be mass-produced, the ideal case for continued improvement. As with solar panels, current technology has reached the point where the performance of leading models (Teslas are the benchmark) is already adequate for most purposes, except in the heavy truck segment. The transition would continue solely on the basis of cost reductions.

2. Running out of raw materials

A lithium-ion battery uses lithium, obviously. Depending on the design, it can also require iron, sulphur, manganese, aluminium, nickel, and cobalt. Most of these are abundant, and resource worries focus on lithium and cobalt. They are not very common elements, but neither are they truly rare, like gold and platinum.

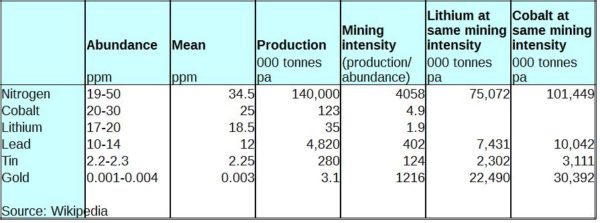

Wikipedia gives the abundance in the crust and annual production of the elements. I’ve calculated the mining intensity of a few.

The difference between lithium and cobalt on the one hand, and tin and lead on the other, is that the latter have been sought after for at least 2,500 years and the former for just a few decades. Unless lithium is freakishly distributed, and the few mining operations suggest that it is not, there is plenty of scope for expansion. If lithium and cobalt were mined at the same intensity as the slightly less common lead, output would be respectively 212 times and 82 times higher than today. EV light vehicles have to grow 133 times to take all the car market, so the order of magnitude looks doable. It is also reasonable to expect that raw materials will be used more efficiently as time passes.

3. Policy reversals

Unlike the first two, these are extremely likely. Growth to date has depended on large subsidies, tax breaks, and regulatory perks. In the USA, the federal income tax credit of $7,500 is topped up by a $2,500 rebate in California and a $5,000 tax credit in Colorado. In Ontario the rebate is C$14,000 rebate plus carpool lane access In France, it’s a rebate of up to €10,000 or 20% of the price. In Norway, electric cars are exempted from purchase tax, VAT, and highway tolls. In China, the subsidies are backed up with the usual big stick. All these are constantly being changed and will go in time. The risk is that they will be withdrawn before EVs hit unsubsidised price parity. The US federal tax break expires for each manufacturer after domestic EV sales pass 200,000, which will soon be the case for Tesla.

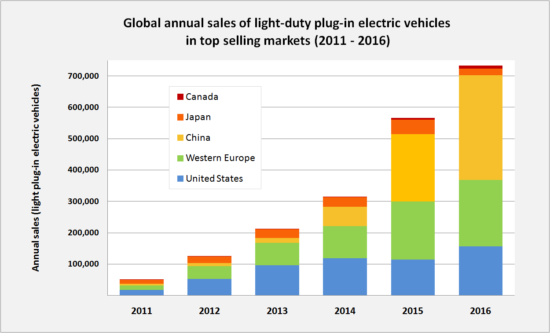

It’s a fair risk in some countries: but not overall. Several countries like Germany are more likely to increase incentives than cut them. More important, in contrast to the early days of mass solar pv, which was cmpletely dependent on the German market, EV sales are roughly equally distributed between the USA, a handful of European countries, and China. The US market should really be split into California and “the rest of the USAâ€.

This robust dispersion provides insurance against a reversal in one market. The Kochs are cranking up a populist campaign in the USA against EVs, but it’s feeble and in any case has no chance of working in California. Pseudoscience on air pollution does not work against the entire US medical profession. In addition, the EV industry is now large enough to pay its own lobbyists: the established automakers are dithering, and the EVs they sell are still a sideline, but they agree that the future is electric, just not yet. They will oppose the Kochs. The well-connected electric utilities love EVs, as they charge mainly offpeak at night, with the future bonus of flexible load management: extra demand with little increase in capacity.

4. A crash in the oil price

The cost equation for EVs depends on cheap electricity compensating for a higher purchase price. If the oil price falls a lot, EVs become less attractive. It’s hard to see how this can become a major downside. Peak cheap oil has already long passed; supply is maintained from more expensive sources, fracking, tar sands, offshore provinces, and secondary recovery. Any further fall in price should be self-limiting from the fall in supply.

It’s more likely that the oil price will spike at least once more before the industry faces its Fimbulwinter. Demand from vehicles is still growing, and investment in exploration and development has been cut following the fall in price. Its immediate cause, the US fracking boom, is necessarily short-lived. A price spike would accelerate the growth of EVs. It’s not so obvious it would trigger another oil investment boom, as by then everybody in the industry will see the end coming. Permanently high oil prices are a possibility. Oil risks are on balance an upside for EVs.

Against these limited downsides, the upside risks are both probable and extensive.

5. Incremental technology improvements

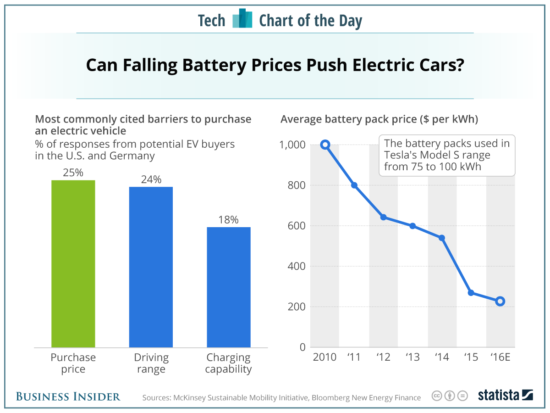

The crucial factor in the growth of electric cars has been lower prices for batteries, from economies of scale and tweaks to technology. Since much of the car is the same in an ICEV (body, seating, wheels, lights, steering, heating/cooling, entertainment) and the costs of these components are similar for all types of car in a market segment, it is all down to the powertrain. A chart of estimated battery cost up to last year (this year’s price is lower still). Very estimated – it’s an oligopolistic market and the actual contracts hammered out between a handful of sellers at scale and a handful of buyers are commercial secrets.

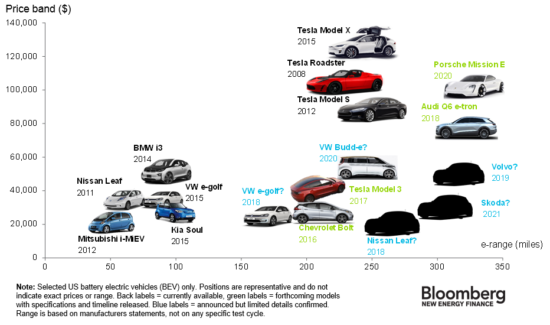

The quality of electric cars has improved enormously. The first iPhone in 2007 had all the functions of today’s except the fingerprint reader: phone, touchscreen, browser, music player, app store, wifi, camera. All of these have got better and faster, but it’s the same device really. Similarly a solar panel of 1997 did the same job as one of 2017, just at somewhat lower efficiency. EVs have gained much more, in range and charging speed. Here are some all-electric ranges:

If you bought a BEV in 2007, you normally had to sacrifice range and accept the need to plan long trips like a hike in the wilderness. Now you don’t.

It seems likely that these improvements in quality and cost are already built into the trend growth rate, so continuance will not necessarily accelerate it. Indeed, range is subject to diminishing returns. A jump from 100 miles to 200 is significant. From 200 to 400 miles, barely. However, the selection of models and styles on offer will certainly increase. No large company yet is offering an electric pickup to meet this strange fad that Americans share with Third World rebels, though you can get one from niche manufacturer Workhorse.

6. New markets

Commercial and utility vehicles are more important for carbon and other emissions than their raw numbers suggest, because they typically do high mileages, often in urban areas. The fleet therefore turns over faster than cars, which is important for the emissions pathway.

- Electric buses are already available, with adequate daily range of 150 miles and a claimed total cost of ownership competitive with diesels. They have a fifth of the Chinese market, 100,000 a year. I expect rapid change in new buys by city operators.

- Light vans (universally used in Europe in place of pickups) are coming on to the market now. The German Post Office designed its own after being rebuffed by VW, and have now gone into partnership with Ford Europe to sell it. Renault and VW are bringing out 3-ton vans (Transit type) in Europe this autumn, with ranges around 100 miles, plenty for urban cycles. Renault/Nissan already sell the small Kangoo van and larger e-NV200.

- Even heavy long-distance trucks are on the way. Tesla claim they will demonstrate an all-electric US semi in September. Volvo, MAN, Eaton and Mercedes are all working on hybrid powertrains. “Hybrid” here can mean anything from “a few electric miles in cities at either end of the run†to “an emergency diesel range extender for a basically electric vehicleâ€. One issue for BEV trucks is that their enormous batteries will need massive chargers, at least 350 KW, in a comprehensive network requiring some local grid upgrades.

7. Getting really cheap

The current policy incentives are designed roughly to equalise costs, not undercut fossil fuel cars. But as we saw with wind and solar electricity (and as I predicted), the price of EVs won’t stop falling once it reaches parity with ICEVs. After parity, the widening price gap will steadily boost EV sales; and as it will be driven by economies of scale, it’s a positive feedback loop – or death spiral for fossil vehicles. This looks highly probable to me. The price drop will not be as spectacular as for solar panels, because of the half of the car that does not change.

8. City policies

In the wake of the Paris Agreement, hundreds of cities across the world have signed up to green clubs and adopted more or less vague and ambitious targets for renewable energy or emissions. They have yet to agree on a rigorous methodology for benchmarking, or systematic peer review. As always, some are serious and others no doubt in it for the photo-op. Among the serious is London, which will introduce an Ultra-Low-Emission Zone in September 2020. Vehicles not meeting a high emission standard will have to pay a daily charge of £12.50, collected in the same way as the existing congestion charge. This policy creates a solid policy pressure on fleet operators of vehicles to go electric earlier. The public transport operator, Transport for London, is already electrifying its single-decker fleet and trialling double-deckers.

Even lesser policies can be effective. Stuttgart is considering bans on diesels triggered by air pollution indicators. If you are the fleet manager of a supermarket chain relying on daily delivery, the prospect of even a few days a year of unpredictable interruptions is very worrying.

How many other cities will join London in adopting effective pro-electric policies? My guess is: enough to make a difference. Sadiq Khan is not suffering from the policy – he is much more popular than Donald Trump.

9. Technology breakthroughs

The workhorse lithium-ion battery, invented by Nobel non-prizewinner John Goodenough, does the job. Many other battery chemistries are being investigated, and within each chemistry new nanomaterials for anodes, cathodes, and membranes. A sudden jump in battery performance or fall in cost is entirely possible and would accelerate change. It’s electric aircraft that really need something new.

10. Grid batteries

Once there was a bright idea: once you have a lot of EVs, there is a massive pool of battery capacity you can in principle use to balance and stabilise the electric grid. Suppose you have a Tesla with a 300 mile range, but you know that tomorrow your trip will be at most 50 miles. Then you can sell the spare kilowatt-hours to the grid, as long as you can recharge at night. The first studies threw cold water on this, because the additional charge and discharge cycles shorten the life of the expensive battery. However, Warwick University researchers have found that with good software and careful optimisation, grid use actually extends the life of the battery. They used real cars in the university car park. Warwick sits at the centre of the UK car industry and Motorsport Valley. The work was commissioned by Nissan, who have sold more EVs than anybody else. This looks credible. The V2G scheme (vehicle-to-grid) is back on the agenda. If it takes off, it will provide EV owners with revenue, and lower the net cost of EV ownership. This should speed up sales.

11. Self-driving

There is a lot of hype about the potential for fully autonomous cars, coupled with sharing, to reduce the number of vehicles needed. A fleet of robotaxis could on paper replace ten times as many privately owned cars. If this pans out, as Tony Seba predicts, the existing ICE fleet would become obsolete much sooner than in the conventional scenario, and the total number of new EVs needed for the transition would be slashed. Weeell. The technical and regulatory challenges for full autonomy are very severe: Google’s test cars navigate Mountain View safely, but that’s a long way from traffic in Delhi or Bangkok. Still, serious money and seriously clever software engineers are working on this dream, and success must be at least an evens bet.

12. Social pressures

The emotive and social signalling component of car purchase and car use is very strong. Elon Musk made a good decision in starting with an impractical sports car, offering stunning acceleration off the lights, designed for would-be celebrities to pick pretty girls or boys up on Rodeo Drive rather than a worthy vehicle with hairshirt connotations. He must be delighted at the idiots who strip current Tesla saloons down for drag racing. We don’t know how these social effects will work out. Still, there is a real possibility that gasoline cars and a fortiori diesels will come to be looked down on as uncool and antisocial, like smoking or spitting in the street.

13. A unicorn : the carbon tax

I include this for completeness – but clearly the policy tool recommended by most economists is a political non-starter for now. It may happen once it’s too late to matter. The Rube Goldberg contraptions we have - tax breaks, city bans, perks, regulations, research subsidies – are very fortunately good enough to do the job.

It seems pretty clear that there are more ways, and more plausible ones, for the electric transport revolution to speed up than to slow down. A pity that the carriage lamps won’t come back.

*************************************************************

Footnote 1: The exponential curve

It won’t of course hold to saturation. The standard S-shaped logistic curve implies a slowdown as you near it. But for the last few percent, the exact date is immaterial. There is still far too much uncertainty about the trends for the next decade to worry much about the endgame.

Footnote 2: Terminology

If you have not been following this, there are four categories of more or less electric vehicles:

1. Closed hybrids where the battery takes over for short stretches in towns, and is recharged or paralleled by an internal combustion engine (ICE). Example: old Toyota Prius. Known as plain “hybrids.â€

2. Plug-in hybrids with a battery that can be recharged from the grid, known as PHEVs. Example: GM Volt. The all-electric range goes from a token 15 miles to 50 or more.

3. All-battery vehicles, or BEVs. Examples: Nissan Leaf, GM Bolt, any Tesla.

4. Vehicles where the battery is recharged from an on-board fuel cell, FCEVs. Solitary example: Toyota Mirai.

The first and fourth categories are dying. Plain hybrids get the mechanical complication of a double powertrain, but offer no path to zero emissions. Hydrogen fuel cells require a very expensive brand-new fuel distribution system which no private investor is willing to build, and lose efficiency from the double conversion. There is an endian dispute whether PHEVs should count as EVs. I will leave them in, though they only represent a transition technology until batteries are cheaper all round for adequate range.

My hobbyhorse issue (and maybe I should re-examine it if noone else considers it important) is that ICEV will get increasingly less convenient relative to EVs, and that will accelerate conversion.

One cause is external - in many places land is getting more valuable, and gas stations can't keep up in value, so they disappear and the convenience of ICEV lessens.

The more interesting cause is internal, in that as EVs grab real market share they will reduce support for the ICEV gas station and ICE maintenance infrastructure, and that will create a virtuous cycle. This is obviously true at high level EV percentage of vehicle miles traveled, but I think could also have an effect when gas demand is cut just 5-10%. We'll see whether this is true in Norway soon enough, but if accurate then it's an effect that will hit the market but hasn't yet been experienced.

A third factor I haven't thought through as much is R&D. Current investment and production design determines the models that will be offered for sale five-ten years from now. Increasing percentage of R&D goes to EV which is at least partially a zero-sum game that reduces investment in ICEV R&D. There will be fewer ICEV makes and models in ten years than would've been the case in the absence of EVs, and that will also help move the market to EVs.

The effect of Dieselgate inside VW has clearly been to shift power from the ICE crowd towards the EV camp. Not yet a clear changing of the guard, but the forces are better balanced and the product and investment announcements at any rate are going the EV way. I wonder if any significant R is now going to ICEs across the industry, as opposed to D?

I wouldn't worry about not finding ICE mechanics to fix your old car. Their number is vast, and their skills will outlast the vehicles they trained for. The gas stations will just add electric charging bays.

In most places the land value isn't such a big deal (plus moving to charging bays and the minimart part of the station, which in the US typically makes the profits anyway). But what will affect things is the changing economies of scale of the distribution network. A lot of those costs (trucks, drivers, pipelines, storage tanks, refineries) are fairly fixed. So if you start shipping 30% less gas (or 50 or 75) the cost is going to go up even as there's a downward pressure on prices from less demand.

I wouldn't be surprised if there were some regions where gasoline goes away early because the price reaches a tipping point where everyone buys EVs and stocking the burny stuff is no longer economical.

Another thing to consider is the point where EVs become a significant part of the used-car market. There's nothing saying they only have to last as long as ICVs.

Rauch & Lang electric car is just a antic model.I just love the design of it.

I wondered about that, and suspect you are right.

I am not convinced "There is an endian dispute whether PHEVs should count as EVs. I will leave them in, though they only represent a transition technology until batteries are cheaper all round for adequate range." - seems to me there are real advantages to PHEVs now and into the future. One will be our next car, I am pretty sure: 30 miles is as far as we go from home in any trip in a normal month, the IC engine can kick in an handle the range problem for our 3x/year trips to move the kid into/out of college. Refueling is fast, for those rare long trips, rather than sitting around at a charging station in East Overshoe for half to three quarters of an hour. The weight increase for an increase of 30 to 300 miles of range with the battery seems likely to be significant. I could certainly be wrong, but that 's the way it looks to me now

The problem with PHEVs is the complexity of the engineering. ICE powertrains have hundreds, even thousands, of parts; battery ones only a few hundred, few of them moving. Obviously combining a battery drive with an ICE adds parts, it doesn't cut them. So there are very few if any possible economies of scale with a PHEV. Add the fact that the BEV range problem is being rapidly solved, and you can see why the BEV growth rate is higher than the PHEV one. I see no reason why the gap should not widen.

The more weeks and months into the future one projects, the greater the likelihood that unforeseen technological development will upend the entire analysis. Decades-long projections are welcome and useful, so long as that is kept in mind. My take is that fossil-fueled cars remain mightily dominant in 2017, are being remarkably tenacious about not going gentle into that good night, and are something of a moving target technologically. My other take is that all will be at least relatively well if new energy sources (best candidate is photovoltaics) thrive mightly, and likewise for batteres/energy storage. If not, climate armageddon is more likely to upend the whole discussion. In any case, learned projections several decades out are useful and interesting, but don't swallow them.

There are two foundational technology changes rolling through the car industry at the moment; electric and autonomy. Electric is happening right now, largely as a consequence of falling battery prices, while autonomy, or at least full autonomy, is a bit further off - perhaps 5-10 years, depending on how fast some pretty hard computer science problems get solved. Both of these will cycle into essentially the entire global stock of (today) around 1.1bn cars over a period of decades, subject to all sorts of variables, and both of them completely remake the car industry and its suppliers, as well as parts of the tech industry.

[…]

Cars and second order consequences

Benedict Evans on the Future of Cars

There are two foundational technology changes rolling through the car industry at the moment; electric and autonomy. Electric is happening right now, largely as a consequence of falling battery prices, while autonomy, or at least full autonomy, is a bit further off - perhaps 5-10 years, depending on how fast some pretty hard computer science problems get solved. Both of these will cycle into essentially the entire global stock of (today) around 1.1bn cars over a period of decades, subject to all sorts of variables, and both of them completely remake the car industry and its suppliers, as well as parts of the tech industry.

[…]

Cars and second order consequences

Benedict Evans on the Future of Cars

I looked for an interesting contrarian take, but couldn't find one. Even The Economist is on board with the takeover CW, as are the oil companies. The only argument is about the timing.

James, I present a programme/poodcast called Future Tense on Radio National - http://www.abc.net.au/radionational/programs/futu…

I follow John Quiggin on twitter and that's how I came across "The end of fossill-fuelled cars". I'd love to do an interview with you on the points you raise. Is that possible and, if so, how do I contact you? Antony

As someone who has followed automotive technology for many years, I find your scenario quite optimistic. First, gasoline prices HAVE crashed and until new battery chemistries are found, we won't see a dramatic drop in battery costs, or an increase in energy density, or an improvement in recharging time. Batteries are not about economies of scale. Indeed, as an economist, my suspicion is that there are no low-hanging technology fruit left, that diminishing returns thing, which may mean there is no new chemistry out there. We read about breakthroughs on a weekly basis (if you follow the right blogs) but most such never leave the lab. When they do, lab to early commercial production to automotive uptake is a 20-year-long process. Until such time there's no value proposition for consumers, absent policies that "force" high-cost vehicles into the fleet.

Those policies also face diminishing returns. In China this can take the form of moving to the head of the license plate queue and having the fee waived, worth 2 years time and US$12,000 on top of national subsidies. The latter cash subsidies aren't enough to tip the tide, and as the expense has grown, are being pared back. As to the indirect subsidies, with a quota of 50,000 in one city, total 2016 sales were 50,800. Chinese consumers don't want EVs.

In sum, there's no foundation for a continued increase in sales. In any case, a coal-mine-to-wheel analysis shows EVs to be worse for the environment in China relative to gasoline engines, while China is making the transition to low-sulfur diesel for truck engines. So that EVs are not feasible (at least until the late 2020s) is perhaps a good thing.

"coal-mine-to-wheel analysis"

I saw that incorrectly portrayed at a Bloomberg blog as a life-cycle analysis, not a production analysis. When you consider lifetime emissions, EVs are far better environmentally.

So the future won't be like the past for some unstated reason? I prefer to believe that learning curves are real and a more reliable basis for prediction than obstacles turning up from nowhere as in a reverse cargo cult. I wasn't wrong to follow this rule of thumb on wind and solar.

One reason why breakthroughs don't survive is that the incumbent technology keeps improving.

Aside from the "feel good" effect of your new 2018 Tesla etc etc nothing is a gained if you do not order the total destruction of your 2017 Whazzit.

If the old guzzler passes down the food chain it could survive for 50 years like the DeSotos belching along the streets of Havana and be burning 50 cent gas. robertmagill.wordpress.com