I posted an article at Vox today on race-ethnic wealth disparities, and how prior inequalities in the housing market and the stock market become self-replicating.

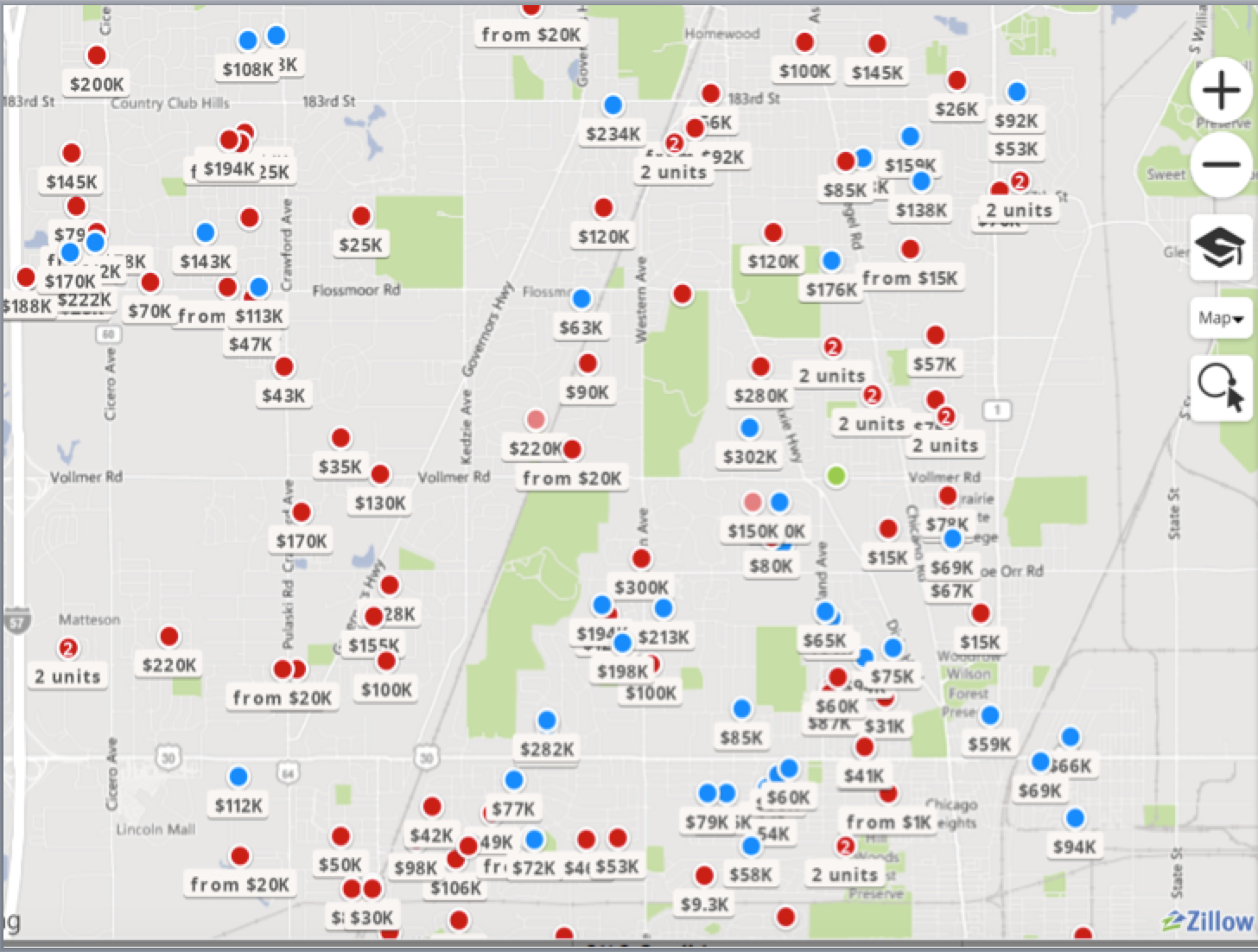

My own majority-African-American community underscores the general problem. Housing values are down more than 30 percent since 2006. I won’t give the full litany of grim statistics. The below screen shots from Zillow probably display the  impact of the subprime crisis better than I can otherwise convey.

The first picture are foreclosed properties in a five-mile square around my house. The red dots are for sale. The blue dots are potential sales. Of course this is eight or nine years after the worst of the crisis. People are still reeling.

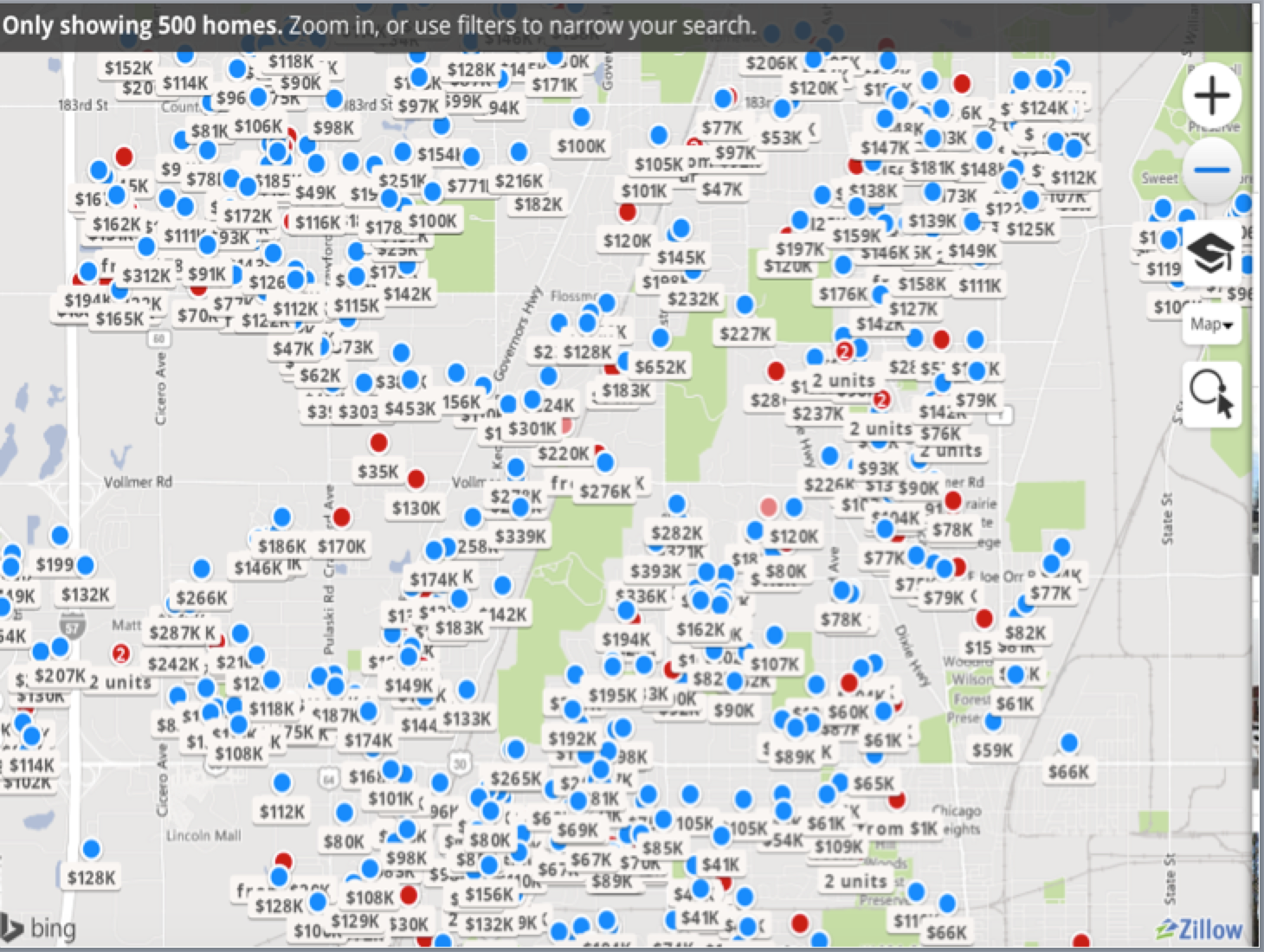

This may not look so bad. But now consider the second picture below. It includes “pre-foreclosure” properties. As Zillow explains things, owners of these properties have received some Notice of Default (in a non-judicial foreclosure) or lis pendens (in a judicial foreclosure), though the property has not yet been put up for auction.

And yes. Only the first 500 properties are shown. More here on the policy and the economics.

Housing policy will go down as one of President Obama's worst failures. It wasn't for once really due to Republican obstructionism. From the half-hearted efforts at foreclosure relief to the failure to use the power of the federal mortgage guarantees to support rooftop solar through PACE lending, the administration's housing policy has been marked throughout by undue deference to Wall Street lenders and lack of fight for the low-income borrowers.

Rather true of virtually all housing policy for the past ~40-50 years, though, isn't it?