“Make thee an ark of gopher wood”, Yahweh told Noah (Genesis 6:14). Gopher is just a transliteration of the otherwise unknown nonce word גפר . Nobody knows what this means; suggestions range from cypress to bulrushes. It isn’t even necessarily a kind of tree: could be “timber” or “any old wood”. The story claims that whatever he used, Noah got the job done. This makes the Ark a good analogy to the Green New Deal. Like the over-specified dimensions of the Ark, parts of the GND are specific, others studiously vague.

The GND in the United States (it’s not likely to work as a meme elsewhere) is a manifesto not a plan. Its promoters have not yet provided one; rational politics by AOC, as she wants to prod establishment Democrats on the committees into action, not engage in a suicidal death ride against them. The lack has created an inviting target for adversaries. However, the conservatives are missing the point about the GND by raising a scare about big numbers. The big numbers are a selling point. Think big! Go for it! Rosie the Riveter can do it! In this, AOC is authentically Rooseveltian.

A conservative think tank (American Action Forum, Holtz-Eakin et al) has charged in anyway and come up with a ridiculous “estimate” of the cost of the GND: $93 trillion. $36 trn of this is the “cost” of Medicare for All, conveniently forgetting the avoided health insurance. (The net cost if any depends on how much it is politically feasible to squeeze medical providers. Net zero cost is technically feasible, based on the universal experience of other OECD countries.) For the jobs guarantee, they put a useless range of “$6.8 trillion to $44.6 trillion”. The only function of this is to create the scary $93 trn total. I have nothing to offer on these areas. What I do know a little about is the energy side, where the GND is groundbreaking.

The Holtz-Eakin estimate for the cost of the decarbonization side of the GND is $8.1 trn: $5.7 for electricity supply over 10 years, $1.3 trillion to $2.7 trillion for transportation. The electricity number is boosted by the ideological decision to assume a lot of super-expensive new nuclear power, at at least twice the LCOE cost of renewables. This antiquated and risky technology has zero support among rational investors like Warren Buffett who actually buy generating plant. Is the total realistic? Surprisingly, yes.

Stanford transition guru Mark Jacobson has already published his own first estimate: $9.5 trn. That’s higher than the hostile Holtz-Eakin guess.

The range of uncertainty is high. Jacobson and Holtz-Eakin are close. But take a look at Clemens Hoffmann’s team at Fraunhofer IWES in Kassel. A paper from 2016 evaluates a medium rapid Energiewende in Germany. This involves net additional investment of €310 bn, over the next 15 years. After that the cash savings outweigh the outlays, modeled at a flat €40bn a year. The US population of 326m is 4 times that of Germany at 83 million, so simple scaling by 4 would give $1.4 trn. The US is less compact and more wasteful than Germany, so a fairer estimate by analogy would plainly be higher: but it can’t be $10 trn.

The first priority for the AOC team is to get some more professional counter-estimates. Several teams of expert modellers are available, in addition to Jacobson’s and Hoffmann’s, there is a team from Finland (LUT) and two from Australia (Blakers at ANU, Teske at UTS Sydney/Melbourne). If I were AOC, I would ask for three studies, including at least one non-American team. The results would differ in detail, perhaps significantly, but the areas of consensus would be a foundation for concrete policy.

The best I can do here is set out a few commonplaces and key questions.

Commonplace: the transition has no net cost over time

It is CW that the energy transition will have negligible net cost over time against current policies, in the narrowest cash terms, before accounting for health and climate externalities. I cited early evidence on this in 2015, here. Since then the evidence has piled up and prices for renewables have fallen much faster than the IPCC expected. Jacobson cites no less than ten teams of modellers who have reached similar conclusions. Expert opinion coincides with common sense reasoning. I won’t bother to argue this, and AOC should not waste time on the issue except in defence. The onus is now on doubters to produce evidence the other way.

Key question 1: How much is the front-loading of investment?

That being said, an ambitious energy transition does involve bringing forward spending. The running costs of renewables, storage and electric vehicles are very low, the capital costs fairly high. So what you are doing is replacing large recurrent fuel costs with one-off capital outlays. Hoffmann’s analysis for Germany surely applies in overall shape to the USA – but the differences between countries are large and important.

Commonplace: Consider the opportunity cost

The Fraunhofer number is lower than Holtz-Eakin’s partly because it correctly incorporates the opportunity cost. Plan B involves far more investment in BAU fossil technologies, which you would be saving. Every electric car, bus or truck on the roads is one less gas-guzzler nobody is buying. Many American coal power stations are nearing the ends of the working lives, and have to be replaced by something: the utilities have decided it won’t be more coal, but a mixture of gas and renewables. The GND cuts fossil fuel investment to near zero in a few years.

To get an idea of the magnitudes here, total gross private US fixed investment was $3.65 trn in 2018, of which $1.24 trn was equipment (download of BEA spreadsheet, at https://www.bea.gov/system/files/2019-03/gdp4q18_3rd.xlsx - won’t embed for some reason). Energy investment was $326bn in 2017 for supply, including $48 bn for renewables, and another $47 bn for efficiency (IEA World Energy Investment 2018, Table 1.1, page 26, pdf). To this we should add $506 bn of household expenditure on motor vehicles, which is conventionally not counted as investment.

To set against the gross investment for the energy side of the GND (say $1 trn a year), we have at least $280 bn of existing annual investment in the fossil fuel infrastructure that can be reallocated. We ignore transport: the electric cars can also be financed simply by reallocation, increasing over time. The high-speed trains are progressive gravy and not IMHO an essential part of the deal – electric buses are much better value. So at most the USA has to find another $720 bn a year of investment in renewable generation storage, transmission, and efficiency. That’s a 20% increase in total investment, not an impossibility. Say 25% with the trains and more research. An effort, but doable. The conservative attempt to paint the GND as fantasy fails.

Key question 2: How much does a rapid transition drive up overall costs compared to a slower one?

I pass here. Some of the difference between the estimates cited can be put down to pace. The GND as advertised is faster than the Fraunhofer assumptions. Some of the extra front-loading will benefit from economies of scale that are insensitive to time, but there is an opportunity cost in not waiting for technical progress. Solar and wind generation is already cheap, and pumped storage and bulk transmission are mature technologies where costs are unlikely to drop much, but EVs and batteries are still relatively expensive. There are not yet any electric passenger aircraft, ocean-going ships, or long-distance trucks on the market. The GND already makes a distinction between electricity, where progress can be rapid, and transport, where a few years’ wait could make a big difference. E

Commonplace: The US energy system is comparatively wasteful.

Key question 3: Can the USA converge on international best practice in energy efficiency?

The USA uses 80% more energy per head than Germany; 42% more per unit of GDP (World Bank). The greater distances between cities are immutable, and the prevalence of low-density housing sprawl can’t be changed in a decade even if AOC & co were rash enough to try. But an American GND creates plenty of opportunities elsewhere for shifting to much better German or other practice. If you are throwing out the oil heating boiler, you should buy good heat pumps, not the cheapest, plus serious insulation. There is no technical reason why the USA should not emulate Australian or German residential solar installation costs, currently doubled by fragmented standards and pointless red tape. Buy electric buses by the hundreds instead of dozens and prices drop. There are still many sodium street lights to be replaced with LEDs and pump motors to be fitted with variable-speed drive controls. And so on. It’s reasonable to target efficiency gains that offset growth entirely, leading to flat final energy consumption over the decade.

Another upside is that the USA has far better conditions for wind and solar than northerly Germany. The LCOE of utility wind and solar in favourable regions in the USA (Lazards pdf) is half to two-thirds that of Germany (Fraunhofer ISE pdf). Some extra transmission will be required to benefit from this. The USA also has far more potential sites for pumped hydro storage in the Rockies and the Appalachians. Dam-building is also manly work, provided exactly in the most poverty-stricken areas. It even involves tunnelling, which miners know all about.

There is no need for any reductions in standards of comfort and convenience. Luckily AOC does not seem to belong to the hair-shirt brigade.

Key question 4: How much do you need to spend on firming renewable electrical generation, and using what technology?

This question enjoys far higher prominence in the minds of opponents like Donald Trump than it deserves. It’s complicated, and this post is already too long, so I’ll need another post. For now, let’s just pencil in the 50% markup that Andrew Blakers (pdf) found in modelling a 100% renewable electricity supply for the Australian East Coast grid (where most Australians live). He used extremely conservative assumptions on technology, using only HVDC transmission and off-river pumped storage, both mature technologies with known costs. If anything else on the extensive research menu pans out, the costs go down. So we add at most $500bn a year for firming.

******************************

Many opponents, I suspect, simply find it hard to imagine a post-transition world. So I had a go at a toy model of a post-transition US economy. The advantage is that you can fiddle with it yourself, tweaking the assumptions.

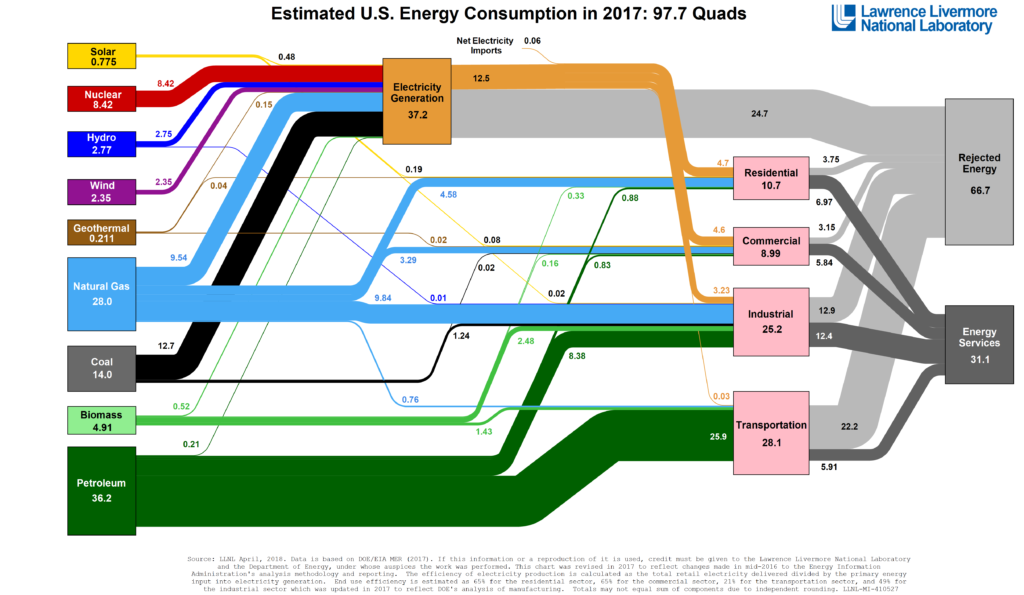

You know the Sankey chart of current US energy flows. Click here for a higher-resolution version.

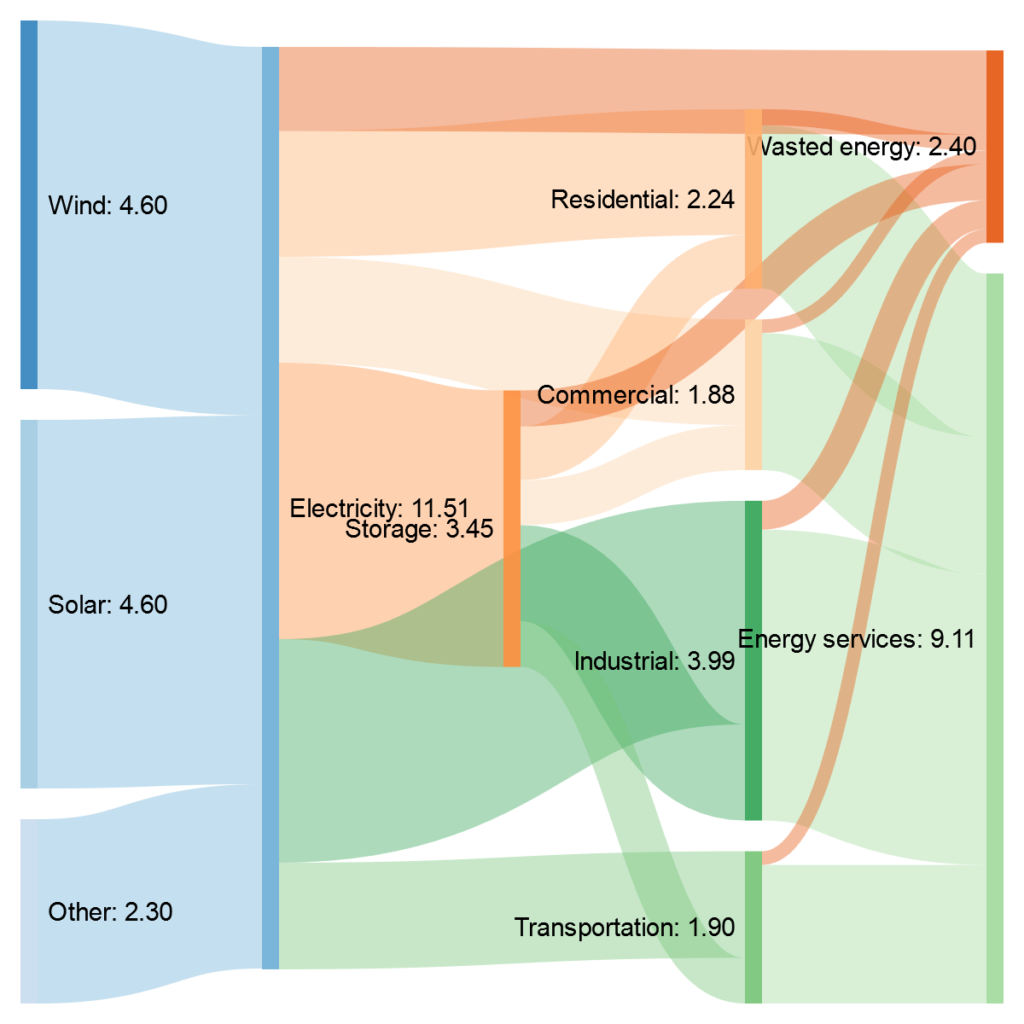

How would this change? I used exactly the same numbers for energy services (useful energy) as the LLNL gives for 2017, and worked back using plausible off-the-cuff estimates for losses (10%) and storage (30% of all electricity). This is, I repeat, not a hair-shirt scenario. It leaves out the end-use efficiency gains that are plausibly attainable, offset by economic growth. Chart courtesy of free online service Sankeymatic .

In this exercise the USA will need 11.5 Pwh (1 petawatt-hour = I billion kilowatt-hours) of renewable output a year after the transition, or 1.3 terawatts-equivalent in continuous output.

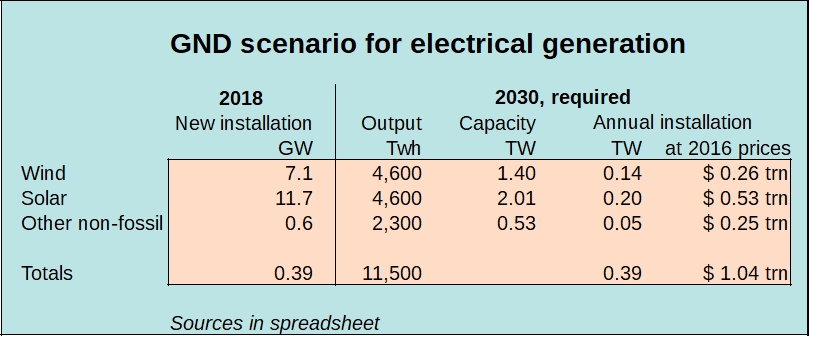

If the horizon is 2030, the US installation rates for wind and solar would have to rise like this.

So $1 trn a year for 10 years for decarbonising electricity at current prices. Say $0.8 trn on average assuming historically normal economies of scale and technical progress. Add at most $0.4 trn for storage. Total at most $1.2 trn a year gross, $12 trn for the decade; at most $9 trn net. It’s in line with Holtz-Eakin and Jacobson, higher than an extrapolation of Hoffmann.

The scenario ignores trade with Canada or Mexico, and the need for a strategic reserve of capacity. Since the latter can be gas, only called on once in a blue moon, the omission is not significant. Incidentally, the fact that the back of my envelope comes out close to Jacobson suggests it’s a reasonable method.

Looks a bargain to me, since (if others join in) you get saving civilisation as a bonus. Did Noah worry about the price of gopher wood?

Surely Noah did not stop to consider the price of gopher wood. He was working under a mandate from above, with a firm deadline.

Sadly, in today’s world most calculations of risk-reward ignore the urgency of a mandate that depends on self-discovery rather than explicit direction from The Boss, and they greatly overestimate (a) the opportunity cost of front-loading inevitable expenses, and (b) the available time window for catching up later.

It’s not nearly as dire a political situation as Noah faced. He was alone with his dysfunctional family and angry God, we have a big movement and growing traction.

The cognitive problem is interesting and important. Partly it’s that people are very slow to update their views, especially if they have a cognitive or financial investment in the old ones. Renewables must be expensive and unreliable, though they aren’t. It may be high rates of time preference: but the cost equation is no longer sensitive to these within a normal range.

Maybe it’s just delusion. The implicit Trump/Koch BAU scenario, burn fossil fuels ad lib and it will turn out all right, is simply unavailable. The real options are (a) crash transition, with high front-loading, and lower risk down the road; and (b) slow transition, with lower front-loading, much higher risk of Really Bad Things, and the probable need for a more expensive and faster crash programme down the road.