The European Union is flaking on climate change, because doing anything about it will hurt GDP in the short run. This is particularly nuts for them, because Europe is a lot further north than most people realize: the latitude of New York is also the latitude of Madrid and Rome; London is up there with lower Hudson’s Bay. Of course, global warming might just put the Scots and Swedes in the wine or even banana business big time. But it also might mess up the Gulf Stream that gives Paris a milder climate than New York rather than the climate of Fargo.

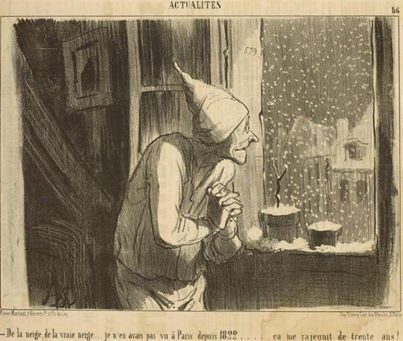

Snow,real snow…I hadn’t seen any in Paris since 1822…it makes me feel thirty years younger!

Snow,real snow…I hadn’t seen any in Paris since 1822…it makes me feel thirty years younger!

Not only will a lot of Europe around the edges be going under water, but a lot more will be Arctifying while the rest of the world broils. This pullback is not surprising, unfortunately. The hard truth about climate stabilization follows from the non-negotiable fact that the atmosphere is well-mixed, so a pound of CO2 released anywhere has about the same warming effect everywhere: the climate benefits of greenhouse gas (GHG) reduction are diluted all over the world. About a ninth of the people in the world live in Europe, so the European benefits of $1m worth of climate stabilization are only about $110,000: to be worth it for them, climate policy has to have a benefit/cost ratio of 9. That’s really hard to achieve, and the math is much more discouraging for any single country in the EU. Even worse, the payoff comes after pretty much everyone in office is retired or dead.

What we have here, friends, is the granddaddy of all prisoners’ dilemmas, implicit in Hedegaard’s remark “It will require a lot from Europe. If all other big economies followed our example, the world would be a better place.†Even for countries as big as China or maybe India, and even there for policies with a nice fat B/C ratio like, say, 6, the smart move if you think the rest of the world will step up and act is to do nothing and coast on it, and if you think the rest of the world won’t, to do nothing and at least not be a chump. The collapse of European will results from tacit understanding of this game structure.

Human institutions have never dealt with a situation like this at this scale. Little wonder that we are invoking magical thinking (“we’ll all get rich making windmills!”. Climate stabilization is really expensive now. It’s worth it, but not soon and not for any jurisdiction acting by itself. At times like this, only the bitterness of Ambrose Bierce suffices:

A BEAR, a Fox, and an Opossum were attacked by an inundation. “Death loves a coward,” said the Bear, and went forward to fight the flood. “What a fool!” said the Fox. “I know a trick worth two of that.” And he slipped into a hollow stump. “There are malevolent forces,” said the Opossum, “which the wise will neither confront nor avoid. The thing is to know the nature of your antagonist.” So saying the Opossum lay down and pretended to be dead.

[edited for clarity 24/I/14]