At the end of the great midwinter potlatch, who does not feel a little sympathy with Pope Francis‘ diatribe against consumerism, even with Savonarola’s bonfire of the vanities in 1497 Florence? We are trapped less by our selfish greed, but by the very ancient norms of gift exchange. These were vital to the survival of hunter-gatherers, whose only way of storing perishable food is in social obligations. In a society where our friends and relations have all they need, and most of what they want, the choosing of gifts is for many of us the insoluble old riddle of kings. The Pasha of Egypt’s solution in 1827 for a present to the King of France was a live giraffe, who had to walk from Marseille to Paris.

At the end of the great midwinter potlatch, who does not feel a little sympathy with Pope Francis‘ diatribe against consumerism, even with Savonarola’s bonfire of the vanities in 1497 Florence? We are trapped less by our selfish greed, but by the very ancient norms of gift exchange. These were vital to the survival of hunter-gatherers, whose only way of storing perishable food is in social obligations. In a society where our friends and relations have all they need, and most of what they want, the choosing of gifts is for many of us the insoluble old riddle of kings. The Pasha of Egypt’s solution in 1827 for a present to the King of France was a live giraffe, who had to walk from Marseille to Paris.

The malaise becomes, in clever hands, a full-blown condemnation. The current version of the critique is that of limits to growth. I already quoted Guardian Cassandra columnist George Monbiot, but it bears repeating:

Ignore if you must climate change, biodiversity collapse, the depletion of water, soil, minerals, oil; even if all these issues were miraculously to vanish, the mathematics of compound growth make continuity impossible ….

The trajectory of compound growth shows that the scouring of the planet has only just begun. As the volume of the global economy expands, everywhere that contains something concentrated, unusual, precious will be sought out and exploited, its resources extracted and dispersed, the world’s diverse and differentiated marvels reduced to the same grey stubble.

Some people try to solve the impossible equation with the myth of dematerialisation: the claim that as processes become more efficient and gadgets are miniaturised, we then use, in aggregate, fewer materials. There is no sign that this is happening.

I argued in a post in 2014 that Monbiot is wrong, and dematerialisation is happening in rich countries. The evidence was a paper by Austrian scholar Julia Steinberger et al. But research moves on, and Monbiot has found an impressive new study by Thomas Wiedmann et al with the lovely title The material footprint of nations. Wiedmann finds that this progress is largely an optical illusion, so it was me not Monbiot who was mistaken. Join me in a short excursion into the weeds; this is worth getting right. (Tip: for the best view of Wiedmann’s charts, go to the pdf version.)

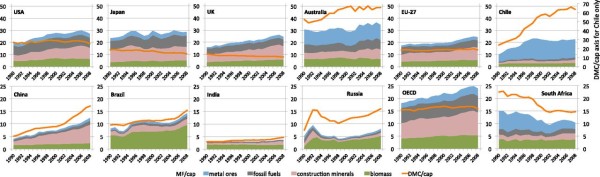

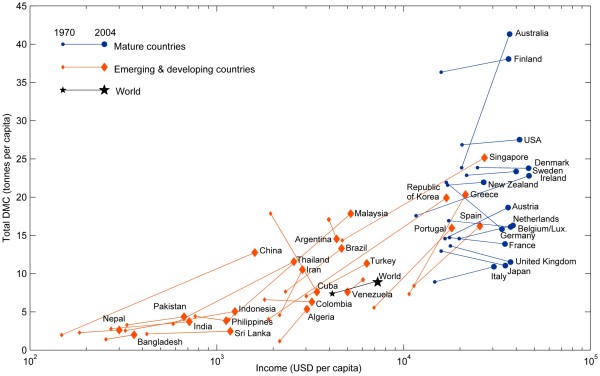

Environmental accounting looks like a resurrection of the old Soviet system of “material product†indicators: for no good reason, Gosplan decided that services were not real output but transfer payments. However, it did use real or imputed prices, so the tables were in roubles. Environmental economists go the whole hog and just use mass. Everything is normalized to tonnes. But there is more than one way of adding them up. The Steinberger paper used the indicator of Domestic Material Consumption (DMC), which has the advantage of being widely available. Her team’s analysis gave this:

A cheering story. Rich economies are dematerializing, and a few like Germany, France, Japan and the UK seem to have completely broken the link between material impact and GDP growth. Developing countries like China are not there yet but they will surely follow the same path. There may be material limits to GDP growth, but it is not a resource doomsday machine. [Update/correction 21 February: Dr Steinberger has asked me to point out that her paper recognised the trade gap in the data available to her team, and in consequence the conclusion was less positive about dematerialisation in advanced economies than I represent it here. Read it for yourself.]

Wiedmann et al found the large hole in this analysis: trade. Perhaps the DMC materialisation in rich countries simply results from shifting resource use to poorer countries though imports? To find out, they developed a new indicator, Material Footprint, also in tonnes. The MF was calculated using an enormous global input-output matrix with 14,787 industries (footnote 1). Sure enough, that is exactly what his team found.

The resource requirements of traded goods are enormous: “two-fifths of all global raw materials were extracted and used just to enable exports of goods and services to other countries.†The true global elasticity of MF with respect to GDP is 0.6. The apparently impressive dematerialisation of growth in the UK and Japan disappears entirely once you account for imports: “no decoupling has taken place over the past two decades for this group of developed countries… Our analysis does not support the observation of resource productivity increases in developed countries over the past decades.â€

This looks pretty convincing, and I think we have to accept the gloomy conclusion provisionally, subject to confirmation or refutation. However, grasping at straws, I see quite a few unanswered questions.

1. The long run

Wiedmann’s series starts in 1990. This is too short a period to show long-run trends. Perhaps the data simply isn’t available for the methodology. But If you run the tape back to 1700, it looks very likely that the first Industrial Revolution of coal, steam, iron, cannon and railways had a very very high MF/GDP, and probably the second one too, of electricity, steel, cars, chemicals and planes. Wiedmann cites estimates that “global average resource intensity (DMC/GDP) … [has] almost continuously decreased from 3.6 kg/dollar in 1900 to 1.3 kg/dollar in 2005â€, a 64% decline that cannot possibly all be due to externalising through trade. That suggests a secular dematerialisation, possibly too gradual to avoid a crisis.

2. The recent downtick

The charts show an MF intensity downturn starting in OECD countries starting in 2007. Global financial crisis, sure. But there are numerous pointers to structural shifts happening around the same time, especially in fossil fuels. US carbon emissions peaked in 2007, the world’s probably in 2014. China’s coal consumption is falling, and other indicators of heavy industry are slowing. Oil and coal prices fell, and have not recovered. Wiedmann’s data stop in 2008, and do not include the recent recovery. More recent data are needed to test the hypothesis of a global structural inflection.

3. Germany

Unfortunately Germany is not among Wiedmann’s selected rich countries, and it has been the poster child for DMC dematerialization. Reunification was responsible for some of it, as Trabant factories and other DDR dinosaurs were shut down, but this effect must have been over by 2000. Germany has kept a large manufacturing sector. If there has been an MF dematerialisation in a rich country, this is where it will show up.

4. Construction in China

An astonishing share of the global MF is made up of export-related construction materials in China: Wiedmann gives 5.2 gigatonnes for this in 2008, 8% of the world total MF. The Pearl River megalopolis, the largest conurbation in the world, has mushroomed to a population of 42 million ex-farmers, largely dedicated to manufacturing for export. However, this capital investment is mainly a one-off. Will China need to build another Pearl River megacity over the next decade? The apartment blocks, factories, roads, sewers and offices are now built, and will need little modification as the composition of exports shifts. Even an increase in volume will not need anything like the same volume of construction inputs. We can expect a large reduction looking forward in this component of export MF.

5. Inputs and inputs

The strength and the weakness of the MF indicator is its Procrustean aggregation over types of resource use. For a clearer view of the threat to sustainability, we need to differentiate. To a first approximation, there are three categories that matter: fossil fuels, construction materials, and biomass. (Mineral ores are very secondary in this analysis.)

- Fossil fuels represent an immediate threat, not because we we will exhaust them but because they will make the world uninhabitable first. There is now a global commitment and strategy to fix this well before the end of this century; not an ideal one, but il a le mérite d’exister, and deserves our wholehearted support. There is no need for a separate MF concern.

- Construction materials are largely rock, sand, and cement. There is plenty of the first two, even for building a Trantor. Cement is is under 15% by weight. It is a serious worry not because of the supply of limestone but because of the carbon emissions from the chemical process of calcining (60%), plus the energy for this which could become renewable. Here too, the concern is carbon emissions not resource exhaustion.

- Biomass is a large share of the trade footprint, mainly from food (timber hardly shows up). In Brazil, it’s the largest component of the footprint. Some biomass use is fully sustainable: humans can’t eat grass, and pasturing livestock on natural grasslands allows us to harvest it. But that isn’t typical of the modern food supply chain, including animal feedlots supplied by intensive corn and soybean farms dependent on fertilisers, and Brazilian beef and Indonesian palm oil raised on land cut from rainforests. It’s not a sustainable system. The world’s population of 7.4 billion will rise by roughly half before it stabilizes, and meat consumption rises with income. We do seem to be on a collision course with nature here.

What does this imply for policy?

What we have now is growth partially coupled to the use of limited material resources. There is no reason to think the link is immutable, and little that it will dissolve by itself. So it becomes a long-term policy issue.

- Take resource footprints seriously. Dematerialisation of growth is a policy goal.

- The indicators should be regularly published by national statistical offices and become common knowledge, like GDP or the birth rate.

- Focus on fossil fuels and biomass, where Nature’s cornucopia is running out.

[Update: I changed my mind again, here. New data, you know. Life is much simpler if you just coast on your priors.]

* * * * *

I am personally gratified by Wiedmann’s revival of Leontief’s input-output analysis, which I touted here six years ago. I’m sure my post had negligible impact, but it is still gratifying to be proved right. I/O looks an antique to a state-of-the-art DGSE macroeconomist, but in the real world it works fine, like your grandfather’s hickory-handled hammer. The problem is that environmental economists are still niche players – you don’t see them cited by Brad DeLong or Paul Krugman. I hope this post may publicise their work.

Return

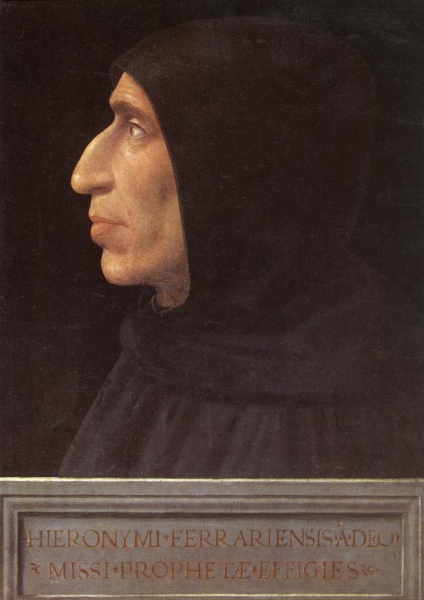

A mini-gallery of austerity prophets

They had better portraitists in 1495 Florence.

I'm sorry to say, I wasn't quite good enough at math to be an economist. I could have flogged myself through a second tier program, but why? I tend to agree with you though that all is not yet lost, though I'm glad *someone* is working on this problem of growth, bc obviously we may need to adjust ourselves and our ideas. Although maybe not.

I also agree with you that CC is the big issue, and everything else will work itself out. (Unless we blow ourselves up.) Some things that occur to me as questions are: recycling, accidents and violence decreases (what if we managed to have fewer wars? would that help?), redistribution (there is certainly a lot of unmet *demand,* if that makes anyone happy)… okay, that was all I had. Robots, to go dig up all the trash in the landfills, if that ever becomes efficient. (Sorry, thought I was done.) I guess I just think we do have a lot of "waste." Or, is waste good too? Maybe to an economist, it makes no difference?

There's an interesting comment from Arne-nl over at Cleantechnica, where the post was reproduced. He points out that the problem is resource extraction not resource use, since we need not worry about recycling (or, as I pointed out, sustainable biomass harvesting). The point may be more of theoretical than practical interest: we can clearly grow material use for a while simply by increasing recycling, but that is not what is happening today with a few exceptions like steel, and in any case you soon hit the technical limit.