Like most other liberals, I can’t say I’m overjoyed at the fiscal cliff deal. The substance isn’t so terrible. I’m especially pleased that “refundables†like the Earned Income Tax Credit, as well as the basic social insurance programs, are reasonably well-protected. I still would have much rather have gone over the cliff.

President Obama and the Democrats have a real problem in that they reinforce their reputations as irresolute negotiators. Ironically, this dynamic undercuts the position of moderate Republicans who would resist hostage taking on the debt ceiling and other matters. In making last-minute concessions and in telegraphing a (perhaps substantively-wise) reluctance to risk chaotic legislative outcomes, the President raises the perceived incentives for GOP brinksmanship on precisely those matters President Obama regards as most sensitive.

I’m worried that the GOP will be further tempted to overstep in their hostage-taking. They may thus back President Obama into a position that allows no honorable retreat. Ironically, in trying to play things safe, the President may have increased the risks of disaster a few months from now. The 2014 election may exacerbate the problem. If younger voters stay home as they did in 2010, we’ll turn back the clock and reward a new crop of intransigent Republican legislators.

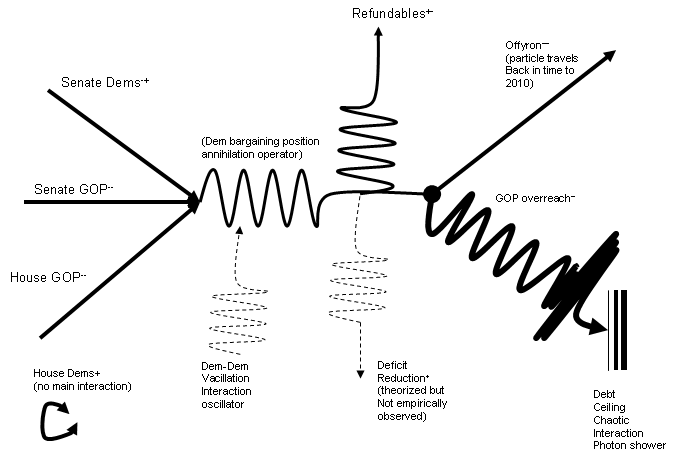

Jon Chait presents the argument in the language of poker. I prefer the language of quantum field theory. Hence the below Feynman diagram of the fiscal cliff:

Barack Obama to the first salesman who comes up to him on the lot: I really want that loaded pick-up over there. I have $2000 for a down payment and can pay $500-600 a month for as long as it takes. Can you help me?

See Ayres & Siegelman (1995) “Race and Gender Discrimination in Bargaining

for a New Car”

Well, the House will not meet until Tuesday and the Senate has not passed anything at 9:30 PM EST. So technically we are over the cliff.

Given that any deal still has to get by Rand Paul and other Senate looneys, then avoid all the Teahadist House machinations and mobilized Koch and Club for growth threats, I am not betting any money on this deal being more than an exercise in futility. Pilosi will have most of her caucus in line but will 25 Republicans, plus enough to cover Democratic defections, vote for whatever comes out of the Senate?

Whatever I think of the deal, I have great faith in right wing passion to screw 99% of Americans. An entire party of Renfields begging for small lives.

How ironic is it that Rand Paul and a band of Birchers and assorted lunatics in the House represent the last, best hope for salvaging a Democratic victory from these negotiations? I think it’s only going to get worse, too. The GOP had a 3 card draw to a royal flush and backed down a guy with a four aces who was so terrified of a bad beat that he basically folded when they went all in. That’s genuinely impressive.

I also think that Obama’s going to have real trouble for the rest of his term. He let the Republicans dominate him. He had called out one priority—takes increase for everybody making more than $250K—and said it was nonnegotiable. Then he negotiated that nonnegotiable position away. That’s very bad.

He showed that he won’t walk away from the negotiating table and take his case to the people, even though he’d just won a resounding reelection victory and all the polls showed the American people strongly supported his policies. That means he’s not walking away no matter what. It’s like a labour negotiator who says he wants a 10-hour day, the five day work week and better pay but won’t strike or call for a boycott no matter what—and then can’t understand why management isn’t making any concessions. The portends big trouble for the debit ceiling.

I really thought Obama would do better. On the other hand, this is exactly the kind of deal a David Brooks Republican would think was wonderful. So maybe the problem isn’t that Obama’s a poor poker place but simply that this is what you get when a moderate Republican negotiates with right-wing Republicans on behalf of people—-the poors, the olds and the middle class—-about whom neither of them really cares. I’m too depressed to choose.

The real problem is that the Congress and the President have not addressed the issue of the increasing debt. No matter how sympathetic anyone feels about the poor, at some point there will be no money to give them at all. If we do not address the problem of having to borrow more money from China and others to provide for the entitlements everyone wants, we will find ourselves with no more lenders and then our economy will collapse as it has in some European countries. All the wealth of all the wealthy will not be enough to balance our budget. We must reduce the amounts given to SS and other recipients soon or we will simply run out of other peoples money.

The tax base eventually needs to be broadened, but not this year.

The underlying problem is that the Bush tax cuts should never have been enacted or at the latest be repealed in the mid-aughts. They have been the single biggest contributor to the deficit.

Unfortunately, reverting them now would just pretty much guarantee another recession, which would make things worse, not better (you can look at the UK for an example of the results of enacting austerity when the economy is weak).

And in practice, there is no urgency to bring the deficit down for the next few years; we can borrow/create quite a bit more money without risking inflation (though not indefinitely). So, the idea is to get the economy back on track and then start trimming the deficit afterwards. In short, there is no “issue of the increasing debt” that needs to be addressed immediately. The public debt of a country has little in common with household debt other than the name.

What we do need is a long-term strategy to stabilize the economy; this, inter alia, will require addressing the growing inequality. For better or worse, we have a consumption-based economy: right now, the very top-heavy income structure that we have hurts consumption and promotes asset price inflation.

Our situation, incidentally, is completely different from the situation in any European country I can think of. Greece is an extremely special case to begin with (for example, Greece would likely be in pretty good shape without its record levels of tax evasion). Countries such as Spain are pretty much the posterchild for why you do NOT want austerity measures when the economy is struggling (unless you are fine with a 25% unemployment rate).

The real problem is that the Congress and the President have not addressed the issue of the increasing debt.

The public debt has pretty much increased throughout our history. The evaluation of the absolute level of the debt cannot be isolated from other factors (economic growth, interest rates, etc.). It is absolutely not “an issue”. Dick Cheney said so, or have you forgotten?

No matter how sympathetic anyone feels about the poor, at some point there will be no money to give them at all.

Political support for a society that is structured to funnel economic resources to the rich will guarantee this outcome. Please explain your support for such a social scheme.

If we do not address the problem of having to borrow more money from China and others

False. The Chinese central bank actively depreciates the value of its currency to promote its exports. Buying our paper is a result.

we will find ourselves with no more lenders and then our economy will collapse as it has in some European countries.

Ah. The USA is like Greece? Simply not true.

All the wealth of all the wealthy will not be enough to balance our budget.

Actually, yes it is.

We must reduce the amounts given to SS and other recipients soon or we will simply run out of other peoples money.

If we just eliminated Social Security but kept the FICA tax, then could we turn our attention to the “unfunded liabilities” of the Dept. of Defense? This would also put an end to the Romney assertion about the “47%’ers” and achieve the conservative nirvana of a government that does no spending but merely re-allocates money to the predator class.

Please, let us stop this ignorant “China debt” garbage. China is decreasing their bond holding in both percentage held and total amounts.

http://www.treasury.gov/resource-center/data-chart-center/tic/Documents/mfh.txt

Japan holds almost as much and off shore bankers are nearly as big.

“… our economy will collapse as it has in some European countries …”

Apart from Greece, which countries (plural) are you thinking of? Several are in deep recession - Ireland, Spain, Portugal. Spanish youth unemployment is 50%. Crisis, sure. Collapse, no. I live in Spain; Christmas shopping was normal.

The crisis in Europe has nothing to do with levels of social spending and everything to do with a giant speculative property boom and bust.

The key to your misdirection is your reference to ‘entitlements’ The whole secret to ‘entitlements is that they are self funding. In fact, Social Security is so flush that it actually is a significant creditor (like China.) So obviously your concern over deficits and your kvetching about entitlements are unrelated.

If people were willing to have HONEST discussions about the deficit, instead of using it as an excuse to push an unrelated ideological agenda, maybe we’d be in a better position to solve our REAL problems.

“we will find ourselves with no more lenders and then our economy will collapse as it has in some European countries”

Huh? Those countries are screwed precisely because they don’t control their own courrencies. We do.

I honestly don’t see where, contra Paul Krugman, the Democrats have conceded much.

While it would have been nice to have the Bush tax cuts repealed starting at a lower income, the rest of the fiscal cliff deal seems to be largely a Democratic wish list.

I also don’t see how the expiration of the Bush tax cuts as of today would have put a lot more pressure on Republicans than Democrats. Rich Republican donors would have been able to handle them just fine; the expiration would have mostly hurt those people who are dependent on their January paychecks and would have seen more money withheld on top of the expiration of the payroll tax holiday. And political blame-assignment can be tricky.

The big concessions, if any, are in the back end-a weakened negotiating position going into the debt ceiling talks. Krugman is not the best poker player around, so Katja might be right. (Krugman certainly has other strengths.)

But there are concessions. I noticed that the Federal pay freeze is extended for what-a fourth year? This is definitely part of the Republican agenda. The reimposition of the full social security tax is another problem. Although the 20% dividends/capgains tax is what the D’s wanted, I view it as a preemptive concession. Ymmv. Forcing Obama to go back on his $250K marker is another win for the Republicans, although a mere tactical one. (The loss of revenue is probably more significant.)

So, more revenue will be extracted from the rich, so they will have less money to use to buy goods and services or invest in businesses.

Maybe I’m just a simple guy, but I don’t see how this makes our entitlement programs solvent, lowers the annual budget deficits of over 1 trillion, pays down our national debt of 16 trillion, increases economic growth, creates jobs, furthers the free choices and liberty, or strengthens the protections of private property.

Anyone else know how this ‘deal’ does any of that, or are those simply problems for my children to tackle when they are bigger and more pressing and our nation has less resources with which to tackle them?

Liberal used to mean caring about freedom, liberty, life, and property protection. I think you mean to say that you are a ‘communist’- you appear to love big government, confiscation of wealth, control over other people’s personal decisions, and big statesmen who negotiate in smoke filled rooms to arrive at decisions to rule over other people. That’s not a liberal. Maybe I read you wrong though and you’re not just a Soviet but rather just confused and communicating poorly.

Wow. Pure unalloyed full spectrum conservative propaganda at its finest, from the “I’m a simple guy,” to calling out liberals for the communists they really are. Well done!

What the fiscal cliff deal mostly does is preventing a recession. A recession would hurt our entitlement programs, increase budget deficits in the long term, increase our national debt, decrease economic growth, and destroy jobs.

Obviously, the fiscal cliff deal is not a full-blown economic program. It’s the temporary aversion of a serious economic problem.

In the end, we will have to at one point raise taxes again for most people to offset spending. Right now, we “extract revenue from the rich” because they are NOT using it to buy goods and services and invest in businesses (or at least considerably less so than lower-income households). The marginal dollar of the wealthy ends up in saving accounts; the marginal dollar of the poor and the middle class ends up being used for consumption. In economics, this is known as the “marginal propensity to consume” (or, conversely, the “marginal propensity to save” if we’re talking about how much we save of our income). It declines with income: as income approaches infinity, the marginal propensity to consume approaches zero. That is, in fact, a major rationale for progressive taxation.

And frankly, yes, it’s probably that you ARE a simple guy and think that there’s no difference between macroeconomic principles and microeconomic principles and that one balances a nation’s budget in the same way that one balances a checkbook.

Typo: Should be “avoidance” instead of “aversion”.

Happy New Year everybody! I wish you all a prosperous 1983!

Why should you want to “pay down our national debt of 16 trillion”? It’s a big number, but then so it the US economy, at $15 trillion annual GDP. A debt-to-GDP ratio of 107% is well within the repeated historical experience of stable capitalist countries, including the USA itself. The ratio in Britain was 260% to 295% in 1815, by modern estimates (at the time they knew the debt but GDP hadn’t been invented). The ratio came down to 24% in 1914 not by paying back but by growth.

A large pool of low-risk long-term bonds is a useful thing to have, and only government can provide it.

Note also that the current real yield on 10-year US Treasuries is negative. New debt generated today imposes next to no tax burden on future generations, which is the operative constraint.

It’s 16 trillion, and increasing by over a trillion a year. 107% this year, 120% next year, 125% the year after… Your argument might have some weight if there were any prospect at all of our economy growing at a real rate of 10% or more a year.

I think you are confusing marginal with average numbers.

Simple question: Do you really expect a sustained growth of our economy that’s fast enough to make the debt even hold constant as a fraction of the GDP? That would be over 7%, after all, given current and projected deficits. How often has the economy actually grown at a real rate of 7% for any sustained period?

The “Fiscal cliff” deal just put us firmly on the CBO’s alternate deficit track, the one with 5-7% deficits for as far as the eye can see, while they’re only projecting growth rates in the range of 2-3%.

I keep hearing about how England managed to grow it’s way out of a debt to GDP ratio of over 200%. But England had an empire when they did that. Are we going to start charging NATO for the use of our troops? Impose a tariff on oil leaving the Gulf in return for keeping the straits of Hormuz open?

It doesn’t have to be a real rate. Real growth at 3% (latest 3.1%) and inflation at 2% (latest 1.8%) gives you 5% nominal. That’s only 2% shy of your 7% balance. The recession is responsible for a third of the current deficit; recovery to trend full employment deals with the rest. At worst you’d be looking at say 1% of GDP in taxes in 3 years’ time to get back to primary budget surplus, which isn’t too bad. A nice carbon tax will do it.

Remember: it’s not that well-ignored amateur JW saying this. Bond market professionals concur, otherwise thy would be demanding high real rates of return to compensate for the default risk implied by an unsustainable trajectory. As it is, they demand less than nothing in real terms, so they must think the ship will right itself.

Or they are fleeing from ships they think are sinking faster.

ACT,

So, more revenue will be extracted from the rich, so they will have less money to use to buy goods and services or invest in businesses.

Or to put into accounts in Switzerland or the Caymans.

James,

Note also that the current real yield on 10-year US Treasuries is negative. New debt generated today imposes next to no tax burden on future generations, which is the operative constraint.

It’s better than that. To the extent that new debt issued has a negative real rate, and is invested in such a way as to generate a positive return - an increase in real GDP - and government captures a portion of that return, the tax burden on future generations is less.

I qualified my assertion because the Fed is currently shortening the maturity profile of the national debt by open-market operations. T-bills have negative real rates just now, but won’t always, and a huge pile of T-bills does impose a tax burden looking forward.

What I like about the perpetual bonds - consols - with which Britain financed the Napoleonic wars is that you absolutely could not have a modern-style debt crisis when lenders refuse to roll over a big pile of maturing (Greek, Italian, Spanish) debt. The only default possible was not paying the interest, which requires a revolution, not a market panic.

Fiscal cliff footnote: apparently the Senate’s fiscal cliff deal includes an extension of the wind production tax credit. It’s only for one year, so the impact will be limited. And of course it’s the sort of liberal goody that the House GOP will try to cut.

Yes, each side likes to push their own areas of crony capitalism while trying to block the other side’s.

Relevance fail. Crony capitalism is the political generation of rents for specific corporate friends like defence contractors and Wall Street megabanks, not a large and diversified industry. The PTC is I admit second-best policy, even apart from the stop-go cycle that has reduced its effectiveness: but the superior incentive, national FITs, are I think constitutionally impossible in the USA. But since fossil fuels enjoy large and unmerited tax breaks - and not the swingeing carbon tax Professor Pigou recommends from Olympus - a PTC for wind, solar and geothermal only levels the playing field.

Perhaps I should have use the broader(narrower(?)) term, corporate welfare.

Tax breaks aren’t good, but they’re not as bad as low interest, no interest, no payback loans, grants and bailouts.

Since Democrats (or at least liberal Democrats) accept that the burning of fossil fuels are very the main drivers of global warming, wouldn’t it make some sense to use tax breaks, grants and other financial rewards to spur the development and widespread adoption of new, cleaner and more sustainable technologies to displace the incumbent fossil fuel technologies? This is, after all, the way in which the incumbents were developed and it would seem less economically disruptive to encourage the cleaner replacements than to simply outlaw the burning of fossil fuels.

But, specifically, you say that tax breaks aren’t good and these other mechanisms are worse. Why?

Tax breaks are self limiting refrains from taking wealth someone already has. The other mechanisms are open-ended wealth giveaways.

Dude, you didn’t even conserve charge.

There’s always some CBO score-keeper spoiling things…. At one point I counted things up and charge was conserved. I think autocorrect may have messed with -‘s. I leave the exercise for the reader.

You were given a definitely beneficial internet site, I have been here analyzing for approximately an hour. I am a novice and your fulfillment may be very tons an proposal for me.

This is my earliest rhythm i sojourn right here. I provoke so several charming overeat for your website specifically its symposium. From the lots of says in your papers, I conjecture I am nay the barely sole having sum the pleasure right here! Take a look at up the propitious procedure.

brilliant! Absolutely flush content material cloth fabric material material and relatively beneficial in series. I were given it my answer from over right right right right here. I pretty propose his/her mechanism with the beneficial educational statistics. Thank you masses