(This piece appeared first at Blog of the Century).

If you want to know what’s really surprising in economic policy, it’s sometimes helpful to listen to what people are saying. It’s sometimes much more helpful to watch what people are buying and selling with real money. On this, liberal and conservative economists are presumably in real agreement.

Thus, I’m really ticked off at Matthew O’Brien of the Atlantic, who stole a march on me with the chart of the week, shown below. O’Brien’s great column shows a graph of Aetna’s stock price over the past week. Aetna’s stock price rose 6.5 percent in a single day. Similar (slightly less dramatic) patterns can be observed for other major insurers.

Why did this happen? O’Brien notes that the insurance industry prefers one outcome, can live with a second, and is dreadfully afraid of the third. In my view, firms such as Aetna really hope that the full structure of the Affordable Care Act is struck down. These firms can also live with the entire act being upheld. They would, however, be seriously hurt if the individual mandate were overturned while the rest of the new law’s provisions for guaranteed-issue and community rating were left basically intact.

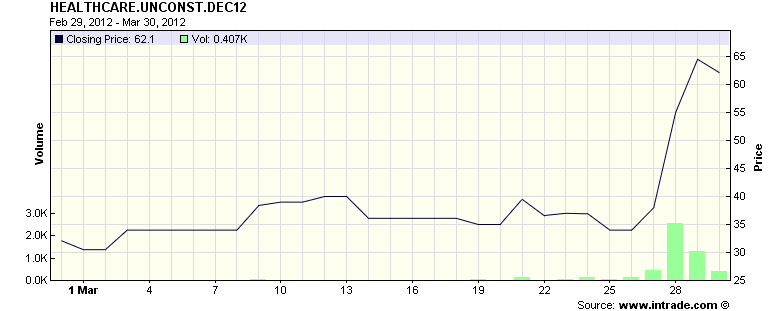

Comments by Justice Kennedy and other justices made this last outcome seem less likely. Judging by Intrade’s big swing in the probability of the mandate being upheld (shown below) the odds of health reform being upheld have noticeably declined, too.

O’Brien concludes:

Wall Street has decided that whatever the fate of Obamacare, the result will be good for health insurers. Whether it’s quite so good for the sick and uninsured remains to be seen.

I hope I’m wrong about the answer to that one.

I don’t understand the reasoning here.

The insurers have every short-term or medium-term interest in ACA being upheld. The individual market has been in a death spiral the last decade. ACA will fix this, and add millions to the ranks of the insured.

Admittedly, loss of the mandate alone would be worse for the insurers than complete loss of ACA. But the industry needs ACA, and knows it.

I don’t think they like ACA. It’s true it brings them more customers and stabilizes the playing field. But it also commodifies their product and regulates them in many ways they dislike. AHIP negotiated with Obama because they feared what would happen otherwise.

I don’t understand. A commodified market is better than no market at all, and adverse selection is beginning to mean that there is no market at all. And regulated folk in general don’t like their regulators, even when they know they benefit from them. (The banking industry is a classic example.)

Unless you are trying to say that the industry is driven more by ideology than the profit motive? I don’t find this claim wildly implausible: employers in general benefit from ACA, but gave only the most tepid support for it. Trader Joes and Costco seem to belie the notion that clearing wages are the most profitable for a retailer, yet all other retailers seem to prefer clearing wages. I’ve strongly suspected ideology behind this one.

“AHIP negotiated with Obama because they feared what would happen otherwise.”

But didn’t they *also* then spend a pile on advertising to defeat the ACA?

Once it looked like that was a real possibility, yes. AHIP’s behavior was not constant over time. When it looked like it was a certainty that some form of reform would pass, they wanted to make sure they were in on the negotiations. Once it looked like they might not have to implement it at all, they liked that idea.

Non-lawyer question: What happens if 5 Judges strike down mandate and 4 uphold the whole thing. But of the 5, only 4 strike down the whole thing. 1 of the 5 opts just to strike down the mandate.

I assume the mandate goes down 5-4. But does the rest of the law pass muster by the same score?

I’m no lawyer, but that scenario is a reason for thinking that CJ Roberts might be in play to uphold, in order to avoid the worst possible outcome for the insurance companies - and for the Court, as it would be responsible for a terminally botched counter-revolution. However, Kennedy’s question on severability suggests he at least is not thinking of striking the mandate and severing. It’s all just reading tea-leaves anyway. A real optimist could even read Scalia’s questions as theatre: giving the tea-party its day in court, before upholding his own precedent in Raich.

I have a general bias against graphs which do not go to zero on the y axis. It’s a matter of context…

Putting this in a bit more context, it appears to me that Etna’s stock started a rather significant and sustained RISE with the passage of Obamacare, compared to which your out of context snippet is a tiny blip.

if you have such a love for context in graphs, why are you so fond of pointing to the last 10 years of global temperatures as as a demonstration of the folly of the global warning? looking at the last 100 years on a graph puts that in context and shows that, despite sporadic fluctuations from year to year the trend is still onward and upward.

*crickets chirp*

The health insurers, misled by AHIP (whose CEO desperately wanted a seat at the table), thought that the second best solution (for them) was OK - that is PPACA with the mandate. They have since come to realize that PPACA will end their insurance business, only a lttle more slowly than without the mandate or with a single payor approach. The fact is PPACA is set up to fail economically and be replaced by single payor. With PPACA (mandate or no mandate) the health insurers will have an administrative role only - in effect, utility sized ROE if any.

Therefore, with the possibility of the Court derailing PPACA increased, the stocks went up on hopes it might be replaced by a system incorporating an actual risk taking role for the health insurers.