Justice Holmes said (and I’ve checked the quotation), “Taxes are what we pay for civilized society….”* The problem is that most people don’t know which civilized things they’re paying for and how much they cost—and as a result believe some bizarre things about where taxes go.

The Third Way, whose determination to evenhandedly blame liberals and conservatives for our fiscal problems generally irritates me, has come up with a brilliant solution (abstract, whole thing as .pdf): a “Taxpayer Receipt” to be sent to each taxpayer—not posted online, dammit; hasn’t anyone heard of information costs?—detailing what his or her taxes, at her level and composition of income, paid for.

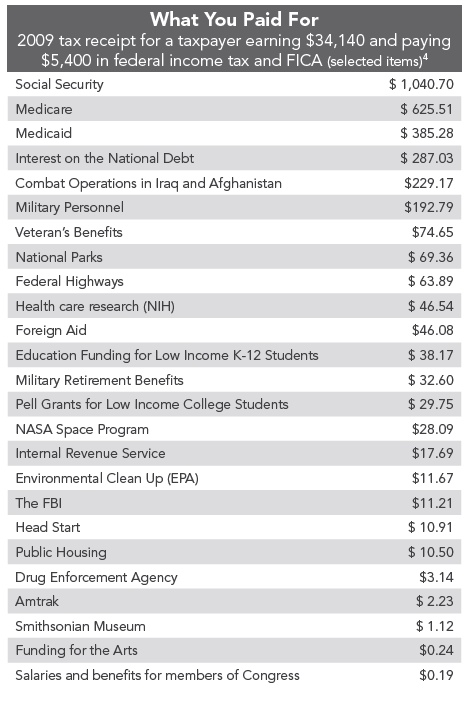

A sample would look like this:

Alas, I’m afraid that Republicans, for all their stated zeal to scrutinize federal spending, would never go for it. They benefit quite nicely from the false but common assumption that the federal budget goes mostly to foreign aid and “waste.” Still, let’s propose it and see how they squirm. My reasons are different from Third Way’s: TW thinks that if people see what government pays for, they’ll realize the need to cut the big items; I think that if people realize how much they love what government pays for, they’ll stop hating taxes so much.

Via Ezra Klein.

*Dissenting in Compania General de Tabacos de Filipinas v. Collector of Internal Revenue, 275 U.S. 87, 100; 48 S. Ct. 100, 105; or 72 L. Ed. 177, 183.

Great idea! However, those amounts only relfect a bit more than half of $5,400. To serve the purposes that you hope to serve (a hope that I share), the entire amount would need to be accounted for. Otherwise, it's an easy thing for Republicans to say that the "waste" and "foreign aid" is in the other $2,000+ not accounted for (you and I know that this GOP will claim that it is the entire $2,000). Can someone do a complete chart? I would be very interested to see that!

Something doesn't seem right. The NPS budget is $2.759 Billion, the Federal Highway Administration's budget is $41 Billion.

It's really a shame the IRS didn't think of this and start including pie charts showing federal revenue and outlays at the back of each packet of federal income tax form instructions that gets sent out to every household every year, because that would have been a revolutionary change, no doubt.

I would add that the *compilation* of the receipt should go to a non-political office, say the GAO. Otherwise we'll be treated to the spectacle of GOP compilers relabeling the "health care research" line as "abortions, etc.", lumping military funding and the DEA together under "Protecting America", and so on.

I have the same problem as anon; the numbers do not add up to $5400; they add up to 3258.51.

It should also have a section that says where the money comes and from what group:

Revenue by source:

Social Security Taxes - 55%

Personal Income Tax - 25%

Corporate Income Tax - 15%

Excise Taxes - 5%

Revenue by group:

Top 10% Rich - 20%

Bottom 90% - 80%

Another fact that I just sussed out with a very little bit of spreadsheet work:

If we had paid 6% more in taxes from '81 to '09 — 17.7% of GDP instead of 16.6%, just one extra penny on the dollar — we would not have added a single nickel to the national debt over those 38 years. A few fractions of a percent more, and we would have eradicated all the (post-war record low) debt that existed in '81.

One penny on the dollar. But of course the sky would have fallen.

Counter-counterfactual: we didn't pay that extra penny. So we got this:

http://www.usgovernmentspending.com/downchart_gs….

And guess what? The sky did fall.

Those items do not cover the total cost. (I don't care that other commenters have pointed out this. I don't care that you only describe this as a sample.)

I think this would make some people less receptive to hating taxes so much.

Conservatives would love this, if done accurately (you are missing $2 thousand as has been pointed out by other commenters. You also ignore the employer's portion of social security and medicare, or understate it for the self employed). It's just red meat. The Federal Government, with support from the progressive elites, takes $46 from someone barely above the poverty line, and redirects it toward foreign aid? You take precious pennies from this person to support the arts? Imagine the figures for a middle class earner in the 100-150 K range! Yikes! Also, while Peter John's analysis by group may be accurate for this income range (I really don't know whether it is or not), take the population as a whole and you will get the same stats you see everywhere - all of these programs are basically funded by those making over $75,000, and disproportionately by those at higher income levels.

If I am going to pay for the arts, I prefer to buy a painting and hang it in my den, or go to a concert. or make a donation to the local symphony. There is no reason on earth why that should be funneled through the Federal Government.

Please - let's publish and distribute an accurate version - it's red meat for the right, as if they needed any more.

"If we had paid 6% more in taxes from ’81 to ’09 — 17.7% of GDP instead of 16.6%, just one extra penny on the dollar — we would not have added a single nickel to the national debt over those 38 years."

More likely, we'd have ended up with the same national debt, after years of marginally higher spending. At least, that's what the outcome of the tax increase to "shore up Social Security" suggests.

@everyone who points out the missing dollars: remember that this is Third Way's chart, not mine. Address your complaints to someone who really understands the federal budget (as well as TW's assumptions), namely not me. 😉 I'm merely expressing an opinion on the idea of telling people what their taxes go to. For all I know, Third Way copied the numbers from a Ukranian deli menu.

@RedWave72: when people are asked what proportion of the federal budget should go to foreign aid, they say 5 percent: not zero, as you'd like. They're actually shocked to find out that we spend so little—though I'll grant that they'd also be shocked if their taxes went up by 4 percent on the dollar to get us up to what they think they want.

Update: I meant 4 percent on each dollar of taxes, of course-not income.

"There is no reason on earth why that should be funneled through the Federal Government."

==============

"The Congress shall have Power To . . . To promote the Progress of Science and useful Arts . . ."

Also . . .

"The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to . . . provide for the . . . general Welfare of the United States."

@Erik above, could be that Third Way treated all of Dept of Interior budget ($11-$12 billion) as National Park Service and then used a highway system total net of the highway portion of the Highway Trust Fund (call that roughly $35 billion) — still seems sloppy but the numbers are a bit closer together.

Andrew - re: foreign aid, if the total budget were some reasonable number, a small single digit percentage for foreign aid might be reasonable too.

David in Texas - I agree such expenditures are consititutional, but I don't agree that they are well spent. That's what makes horse races, I guess. If it makes you feel any better, I am not in favor of strapped municipalities building new stadiums either.

redwave72 - the reason is original intent - the framers of the Constitution considered government support of the arts and sciences to be of such paramount importance that they expressly provided for expenditures to promote the same.

Who are we, as Scalia and his cohorts might say, to deny the intended consequences and priorities of the original Constitution.

I thought that was a core Red-America principle.

The IRS tax booklet already has a pie chart that shows incoming & outgoing, though the $$ figures make this more entertaining.

The most glaring exception is the Pentagon; we get military salaries and combat operations, but that leaves a LOT out. I suspect that would account for 80%+ of the missing monies.

Of course, what they meant by "arts" had more to do with engineering than ballet… Hence the "useful".

Prescriptive definitions assert how people should use words. Descriptive definitions assert that people in fact use words as described.

The government of a locality is the largest dealer in interpersonal violence in that locality (definition, after Weber). A law is a threat by a government to kidnap (arrest), to assault (subdue), and to forcibly infect with HIV (imprison) someone, under some specified circumatances (definition). A tax is a government-mandated allocation of resources (definition).

A government-mandated transfer of wealth from A to B need not pass through the State treasury to qualify as a tax. Much regulation imposes large costs for small benefit to a few. This amounts to a very inefficient tax:

1. Unemployed young people and minorities pay a large cost for the shield against competition which minimum wage legislation provides to high-wage unionized workers. This is a very large and very inefficient tax.

2. Corvee labor is a tax, even if the cost is not denominated in dollars. In the US, children work, unpaid, as window-dressing in a massive make-work program for dues-paying members of the NEA/AFT/AFSCME cartel. This tax appears on no balance sheet. The loss imposed disproportionately on children of poor and minority parents appears as lost lifetime productivity, lower lifespan, losses due to crime, and the cost of prison for the children whose lives we trash.

3. Product-safety legislation like CPSiA imposes a large tax upon the many small business which, individually, do not produce enough to make the required product safety testing cost-effective and so must leave the market to politically-adept giant enterprises.

4. The deadweight loss due to taxation is a cost. This cost counts qualifies as a tax.

The Third Way balance sheet seriously understates the total tax burden.

Malcolm Kirkpatrick: I'll admit that government imposes many costs beyond formal taxation. Now will you agree to putting the *benefits* of government regulations somewhere in the informal ledger as well? I see little sense in valuing health and safety at zero. As for schooling: if you can prove to me that a voucher scheme would produce, on a large scale, through replicable methods, for the same kids, and at the same price, superior educational outcomes to the public system, I'll concede that the status quo is a costly, unjustifiable corvée. But since all current assertions to that effect are faith-based, I'll stick with the possibility that public education is a service provided for a price. (I'm actually not opposed to voucher schemes, properly structured. I just don't think that they mint golden eggs.)

A little unclear as to why all the War Department spending is not under a single category. Perhaps with subcategories, but it is clear that the US polity has zero understanding of exactly how large our total war spending is.

Cranky

(Andrew): "…will you agree to putting the *benefits* of government regulations somewhere in the informal ledger as well?"

Sure.

(Andrew): "I see little sense in valuing health and safety at zero."

The question for a political discussion is "What mechanism generates the greatest benefit/cost ratio in the production of these goods (health, safety)?" When does organized violence (the State) make a positive contribution? I part company with my libertarian friends on environmental issues, including population control. I accept a case for State assignment of title and operation of armed forces, police, courts, and an EPA.

This is my basic text:…

Eduardo Zambrano

Formal Models of Authority: Introduction and Political Economy

Applications

Rationality and Society, May 1999.

"Aside from the important issue of how it is that a ruler may economize on communication, contracting and coercion costs, this leads to an interpretation of the state that cannot be contractarian in nature: citizens would not empower a ruler to solve collective action problems in any of the models discussed, for the ruler would always be redundant and costly. The results support a view of the state that is eminently predatory, (the ? MK.) case in which whether the collective actions problems are solved by the state or not depends on upon whether this is consistent with the objectives and opportunities of those with the (natural) monopoly of violence in society. This conclusion is also reached in a model of a predatory state by Moselle and Polak (1997). How the theory of economic policy changes in light of this interpretation is an important question left for further work."

The case for State subsidization of education (vouchers) is weak and the case for State operation of schools is weaker still. First, what criteria determine whether State operation of an industry promises any benefit? Imagine either a dichotomous classification (likely, unlikely) or a continuum: (highly unlikely) -1_______.______+1 (highly likely). I suggest that the answer will include economies of scale, the degree to which an industry relies on local knowledge versus systematic expertise, and information assymetries. On these considerations, State operation of school is counter-indicated.

Why is the State in the education business? This "Why?" question has three interpretations: (1) the welfare-economic "why?", (2) the historical "why?", and (3) the political science "why?".

1. In abstract, the education industry is a very unlikely candidate for State operation. Beyond a very low level the education industry demonstrates no economies of scale as it currently operates. Education only marginally qualifies as a public good as economists use the term and the "public goods" argument implies subsidy and regulation, at most, not State (government, generally) operation of school. The State cannot subsidize education without a definition of "education", which then will bind students, parents, and teachers to the State's definition.

E.G. West

"Education Without the State"

"What is needed is choice in education. School choice has not and will not lead to more productive education because the obsolete technology called 'school' is inherently inelastic. As long as 'school' refers to the traditional structure of buildings and grounds with services delivered in boxes called classrooms to which customers must be transported by car or bus, 'school choice' will be unable to meaningfully alter the quality or efficiency of education."

Marvin Minsky

Interview

Communications of the Association for Computing Machinery )1994-July

(Minsky): "…the evidence is that many of our foremost achievers developed under conditions that are not much like those of present-day mass education. Robert Lawler just showed me a paper by Harold Macurdy on the child pattern of genius. Macurdy reviews the early education of many eminent people from the last couple of centuries and concludes (1) that most of them had an enormous amount of attention paid to them by one or both parents and (2) that generally they were relatively isolated from other children. This is very different from what most people today consider an ideal school. It seems to me that much of what we call education is really socialization. Consider what we do to our kids. Is it really a good idea to send your 6-year-old into a room full of 6-year-olds, and then, the next year, to put your 7-year-old in with 7-year-olds, and so on? A simple recursive argument suggests this exposes them to a real danger of all growing up with the minds of 6-year-olds. And, so far as I can see, that's exactly what happens.

Our present culture may be largely shaped by this strange idea of isolating children's thought from adult thought. Perhaps the way our culture educates its children better explains why most of us come out as dumb as they do, than it explains how some of us come out as smart as they do."

Richard Arkwright was homeschooled. Cyrus McCormick was homeschooled. Thomas Edison was homeschooled.

Numerous lines of evidence support the following generalizations:

a) As institutions take from parents the power to determine for their own children the choice of curriculum and the pace and method of instruction, overall system performance falls.

b) Political control of school harms most the children of the least politically-adept parents.

2. Compulsory attendance and State operation of schools originated in Protestant evangelism and anti-Catholic bigotry. Google "Martin Luther". Google "That Olde Deceiver, Satan".

3. The NEA/AFT/AFSCME cartel commands a US $500 billion+ per year revenue stream. This buys a lot of political support.

Empirical support for vouchers? For another comment. See West, E.G. (World Bank Research Observer, Feb. 1997) and Angrist, et. al., NBER Reporter. (??), and much more.

Some scattered points about an interesting idea.

1. Pie charts are one of the worst ways to display numerical data; they are an abstraction on top of an abstraction. This type of receipt is a much clearer way of translating vast numbers (millions vs billions vs trillions) to a scale a reader can actually understand. I worked on a congressional budget game with an educational component back in the 1990s, and I wish that I had thought of the idea of pro-rating the topline numbers to a typical taxpayer's share.

2. As noted about the highways, this is just the portion of highway spending which comes from federal general revenue. Most but not all federal road spending is funded by use taxes on gasoline.

3. It strikes me as fair to break out the Iraq and Afghan wars from the rest of DOD spending because they were, for the entire Rutherford Bush administration, paid for by special appropriations.

4. As noted, a chart like this that doesn't cover at least the top 95% of expenditures is of very limited value.

(Andrew): "As for schooling: if you can prove to me that a voucher scheme would produce, on a large scale, through replicable methods, for the same kids, and at the same price, superior educational outcomes to the public system, I’ll concede that the status quo is a costly, unjustifiable corvée. But since all current assertions to that effect are faith-based, I’ll stick with the possibility that public education is a service provided for a price."

It's the supposition that organized violence (the State) makes a positive contribution to the education industry, beyond what governments contribute to commerce generally in a market economy, that's faith-based and in need of defense, seems to me.

Gandhi opposed compulsory attendance at school. Einstein opposed compulsory attendance at school (by a reasonable interpretation of this):…

Albert Einstein

"Force and Fear Have No Place in Education"

"To me the worst thing seems to be for a school principally to work with methods of fear, force and artificial authority. Such treatment destroys the sound sentiments, the sincerity and self-confidence of the pupil. It produces the submissive subject… It is comparatively simple to keep the school free from this worst of all evils. Give into the power of the teacher the fewest possible coercive measures, so that the only source of the pupil's respect for the teacher is the human and intellectual qualities of the latter."

Proof? Let's start with a proof by contradiction.

It does not take 12 years at $12,000 per pupil-year to teach a normal child to read and compute. Most vocational training occurs more effectively on the job than in a classroom. State (government, generally) provision of Social Science instruction is a threat to democracy, just as State operation of newspapers would be, and is in totalitarian countries like Cuba and North Korea. What we in the US call "the public school system" originated in Congregationalist indoctrination and, later, anti-Catholic bigotry. The policy which denies to individual parents the power to determine which institution, if any, shall receive the taxpayers' age 6-18 education subsidy has become an employment program for dues-paying members of the NEA/AFT/AFSCME cartel, a source of padded construction and supplies contracts for politically-connected insiders, and a venue for State-worshipful indoctrination. If this is not so, why cannot any student take, at any age and at any time of year, an exit exam (the GED will do) and apply the taxpayers' $12,000 per year education subsidy toward ppost-secondary tuition at any VA-approved post-secondary institution or toward a wage subsidy at any qualified (say, has filed W-2 forms on at least three adult employees for at least the previous four years) private-sector employer?

If it is fraud for a mechanic to charge for the repair of a function motor and if it is fraud for a physician to charge for the treatment of a healthy patient, then it it is fraud for a teacher, school, or government to charge for the instruction of a student who does not need our help.

Proof?

Belgium, Hong Kong, Ireland, the Netherlands, and Singapore subsidize a parent's choice of school.

Gerard Lassibile and Lucia Navarro Gomez,

"Organization and Efficiency of Educational Systems: some empirical findings"

__Comparative Education__, Vol. 36 #1, 2000, Feb. , pg. 16,

"Furthermore, the regression results indicate that countries where private education is more widespread perform significantly better than countries where it is more limited. The result showing the private sector to be more efficient is similar to those found in other contexts with individual data (see, for example, Psucharopoulos, 1987; Jiminez, et. al, 1991). This finding should convince countries to reconsider policies that reduce the role of the private sector in the field of education".

Joshua Angrist

"Randomized Trials and Quasi-Experiments in Education Research"

__NBER Reporter__, summer, 2003.

"One of the most controversial innovations highlighted by NCLB is school choice. In a recently published paper,(5) my collaborators and I studied what appears to be the largest school voucher program to date. This program provided over 125,000 pupils from poor neighborhoods in the country of Colombia with vouchers that covered approximately half the cost of private secondary school. Colombia is an especially interesting setting for testing the voucher concept because private secondary schooling in Colombia is a widely available and often inexpensive alternative to crowded public schools. (In Bogota, over half of secondary school students are in private schools.) Moreover, governments in many poor countries are increasingly likely to experiment with demand-side education finance programs, including vouchers."

"Although not a randomized trial, a key feature of our Colombia study is the exploitation of voucher lotteries as the basis for a quasi-experimental research design. Because demand for vouchers exceeded supply, the available vouchers were allocated by lottery in large cities. Our study compares voucher applicants who won a voucher in the lottery to those who lost. Since the lotteries used random assignment, losers provide a good control group for winners. A comparison of voucher winners and losers shows that three years after the lotteries were held, winners were 15 percentage points more likely to have attended private school and were about 10 percentage points more likely to have finished eighth grade, primarily because they were less likely to repeat grades. Lottery winners also scored 0.2 standard deviations higher on standardized tests. A follow-up study in progress shows that voucher winners also were more likely to apply to college. On balance, our study provides some of the strongest evidence to date for the possible benefits of demand-side financing of secondary schooling, at least in a developing country setting.(6)"

Proof?

Evidence for parent control:…

Across the US, States which maintain numerous small school districts outperform States in which a large portion of total enrollment attends a few large districts. The correlation between the percent of total enrollment assigned to small districts and NAEP 4th and 8th grade Reading and Math scores is positive (smaller is better). Across the US, the correlation between age at which States initiate compulsory attendance and NAEP 4th and 8th grade Reading and Math scores is positive (later is better). Across the US, the correlation between the fraction of total enrollment assigned to large districts and per-pupil budget is positive (smaller is cheaper).

Alaska subsidizes homeschooling (enrollment in "public" correspondence schools). The homeschoolers take standardized tests and the homeschoolers' median performance is close to the 80th percentile of Alaska's conventionally-schooled students. Homeschooled children of parents with no schooling beyond high school outperform the students of Alaska's college-trained government school teachers.

These and other lines of evidence support policies which enhance parent control.

Proof?

Clive Harber

"Schooling as Violence"

__Educational Review__ p. 10, V. 54, #1.

(Quoting) "…It is almost certainly more damaging for children to be in school than to out of it. Children whose days are spent herding animals rather than sitting in a classroom at least develop skills of problem solving and independence while the supposedly luckier ones in school are stunted in their mental, physical, and emotional development by being rendered pasive, and by having to spend hours each day in a crowded classroom under the control of an adult who punishes them for any normal level of activity such as moving or speaking."

Clive Harber

"Schooling as Violence"

__Educatioinal Review__, p. 9 V. 54, #1.

"Furthermore, according to a report for UNESCO, cited in Esteve (2000), the increasing level of pupil-teacher and pupil-pupil violence in classrooms is directly connected with compulsory schooling. The report argues that institutional violence against pupils who are obliged to attend daily at an educational centre until 16 or 18 years of age increases the frustration of these students to a level where they externalise it."

E. G. West

"Schooling and Violence"

Carleton University, Department of Economics,

Ottawa, Canada

"We conclude that so far there is no evidence to support the 19th century Utilitarian hypothesis that the use of a secular and public school system will reduce crime. Beyond this there is some evidence indeed that suggests the reverse causality: crime actually increases with the increase in the size of the public school sector."

In Hawaii, juvenile arrests fall when school is not in session. Reported house burglaries fall when school is not in session (auto burglaries rise). Juvenile hospitalizations for human-induced trauma fall when school is not in session.

In my humble opinion, social security should be converted to a defined contribution plan for everyone under some age, say 45. Everyone over that age would remain under the current law until they die. Anyone under that age would continue to pay 6.2% of their wages (plus employer 6.2%) to the feds. In exchange they would receive TIPs (inflation protected treasury bonds) equal to the face value of their contributions. TIPs earn roughly 2% in real terms. When an 45 crowd. It would limit the future payouts of the <45 crowd to what they actually paid in plus interest.

Interesting. The 4th line of my last comment disappeared.

It said: When a under 45 person reaches retirement age their aggregate TIPs would be converted to an annuity based on the face value, life expectancy, and a TIP interest rate.

PS. I endorse Malcolm Kirkpatrick's view.

Jeff,

Thanks.

(Andrew): "…if you can prove to me that a voucher scheme would produce, on a large scale, through replicable methods, for the same kids, and at the same price, superior educational outcomes to the public system, I’ll concede that the status quo is a costly, unjustifiable corvée…"

Proof?

From the point of view of a legislator deciding between a voucher-subsidized market in education services and the policy which reserves to one supplier of education services an exclusive position in receipt of the taxpayers' pre-college education subsidy, the most reasonable consideration would be overall system performance against overall K-12 tax expenditures. It shouldn't matter whether voucher-accepting students do better or worse than students in government-operated schools, but only which system (monopoly or competitive market) delivers better overall performance for a given level of funding.

Here's a link to J.P Greene's summary of voucher evidence on the impact of subsidized parent choice on the NEA/AFT/AFSCME cartel's schools. The cartel's schools improve when faced with voucher-subsidized competition.