You won’t read this to the end. All it offers is confirmation of things I’ve said already. The System 1 Energizer Bunny processor in your brain – or more classically, the Hare – that runs most of your decisions using strong priors and dodgy rules of thumb already made your mind up for you on both points. The lazy Tortoise, the System 2 processor that can think systematically but drains the battery, doesn’t think it’s worth waking up for anybody less than James Hansen or a Cochrane meta-analysis. Is that a half-open eye? Quick, before it closes, let me make my play. And Bunny, before you scamper away, there are shiny NEW anecdata at the end!

Carbon emissions are peaking

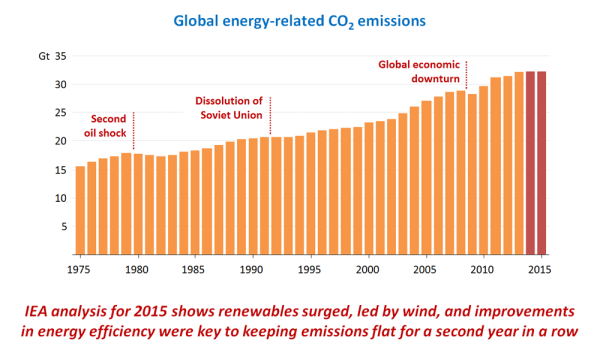

I made the claim here, in fine. The confirmation is from one of the three sources, the IEA.

Global emissions of carbon dioxide stood at 32.1 billion tonnes in 2015, having remained essentially flat since 2013.

If this were a second independent observation, it would pretty dramatically lower the probability of error in a peaking hypothesis drawn from one year. It isn’t that, only a second report from a source subject to the same measurement risks as before. But most of these will be systematic - maybe there are huge steelworks in China that under-report their coke use, but this will affect the total for all years, not the trend. You could argue that political pressures in China for under-reporting have increased. That effect would have to be gigantic to invalidate the peak, involving hundreds of millions of tonnes. The Chinese fall is consistent with reported drops in coal and steel production; the conspiracy would have to be very widespread, reaching the top levels of government. I don’t buy it.

The doomsayers have shifted to the Keeling curve, the unchallengeable record of CO2 concentrations high on Mauna Loa. That is still going up – as it will until net carbon emissions reach zero, which is a long way ahead. No deceleration is yet visible. But as John Quiggin observes, it’s unsound to prefer a second derivative extracted from a noisy signal to reasonable direct measurements.

The costs of solar energy will keep falling

Previous claims here (preen on getting the impact on coal right) and here.

The confirmation is the seventh edition of their PV technology roadmap from the VDMA association of German suppliers of pv manufacturing equipment. (For once, prefer the fuller version to the executive summary – the context makes it more comprehensible.) The projections cover every aspect: silicon refining, wafer cutting, cell types, doping, silver and copper busbars and connectors, backplate schemes like PERC, encapsulation, frames, and more. They conclude that the historic 21% learning rate (Fig. 46) is good for another decade. Of course, how this maps on to actual prices depends on the installation growth, which is more variable, and may be slowing a bit from the historic 44% CAGR.

The point here is the status of the authors. Nobody, not even the module manufacturers, knows more about this technology than the VDMA members. They have a very strong incentive to get the roadmap right. If anything, the bias will be conservative. A Delphi process like this may be blindsided by some lab breakthrough, but this is unlikely from the history: plain old silicon has seen off as many sexier rivals as Angela Merkel. They do think – like the eminent Martin Green of UNSW – that perovskite-on-silicon tandem cells will enter mass production around 2019, which should allow the learning curve a good many more years of life.

One of the benchmarks of the US SunShot programme, $1 per watt system costs, is being reached: the VDMA expect it to be hit around the end of this year in Europe and the USA (fig. 45). Mexico has just awarded 1.7 GW of solar generation in an auction at an average price of $45/Mwh, HEY BUNNY. This handily beats previous records in Texas and Dubai around $60/Mwh unsubsidised. Such a rapid drop is more likely to be down to a rerating of the risks by investors and a lower cost of capital than to the technology. Renewable energy has become the safe haven in the turbulent energy industry.

It was a masterstroke by German Green politicians like Hans-Josef Fell fifteen years ago to style the energy transition as an unthreatening Energiewende, “energy turnâ€. It doesn’t look like that to the 1.3 million coal miners in China who are about to lose their jobs HEY BUNNY. Nor to the bankers mulling over Greenpeace’s latest well-placed shiv, a report on the $981 billion of coal generating plants being planned worldwide, most of which would lose money if they went ahead HEY BUNNY. It’s a revolution, and revolutions are messy.

This one is speeding up. Not that the GOP dwarfs are noticing.

James

Solar production prices are falling and government subsidies are generous, so one would expect these are salad days for the industry. I am curious therefore why big solar companies (e.g, SunEdison, Abengoa) are teetering on bankruptcy. Any ideas?

These are different cases. Abengoa is a large player in a secondary technology, concentrating thermal solar (CSP). This offers the advantage of 24-hour running through hot salt storage, or at much as you need. But costs are still higher than photovoltaics. Another big player, Brightside, also made a meal of cutting-edge CSP technology at Ivanpah. The problem is that for all the talk of STORAGE!, its not actually that valuable - for the moment. What CSP needs is recognition that its despatchability (like that of geothermal) justifies a premium subsidy for a long-term payoff, which it isn't getting. It's not a doomed industry: the Saudi developer ACWA and the American SolarReserve are both doing well with it in the right locations, and Abengoa - with sound technology - will probably get bailed out.

SunEdison is classic dotcom or railway boom-plus-CEO ego stuff. It's in a very healthy industry, but tried to expand too fast and it seems started cooking the books. Watch if its Terraform yieldco follows it into bankruptcy. If as I expect it survives, this will prove the model of splitting medium risky development from the very low risk operational stage. Investing in a built solar farm with a 20-year PPA takeoff contract is safe enough for grandmothers, unlike coal and oil.

I knew you would know! Thanks.

James, while you are on the subject of how our otherwise adaptive cognitive processes tend toward error, I think I might have stumbled onto a habit of mind that explains economics.

The question is, how does one explain the persistence of economics? Given this: https://rwer.wordpress.com/2016/01/29/fundamental…

The answer, I think, is promiscuous teleology, which causes school children to believe in intelligent design until taught otherwise: https://www.theguardian.com/science/head-quarters…

My thinking, in short, is that economics and its Marxist critics both attempt to use Newtonian mechanics as a metaphor to understand a dynamic complex system of the type that we now know is understood through the science of Darwin.

Since both sides are wrong for the same reason, no progress can be made. But why does 200 years of being wrong not cause somebody to break free? Because selection pressures have produced human beings that prefer Newtonian cause and effect that can be translated in the language of purpose (i.e., teleology). The purpose of markets is to spread information. The purpose of wages are to keep the proletariat down, etc, etc.

I post this here because the incentives of academia and publishing make this even more invisible. My only hope is that enough of my fellow blogosphere gadflies can finally get the nudist colony of Emperors to wake up to the world outside the colony walls.

I admit it, I skimmed! This - "But as John Quiggin observes, it’s unsound to prefer a second derivative extracted from a noisy signal to reasonable direct measurements." - I only sort of got.

Sharing anyway. Keep hope alive.

Mauna Loa measures concentration, say C. This goes up. The rate of increase is the first derivative, dC/dt: it reflects the percentage change in CO2 concentration over time. That's the first derivative. The IEA claim is that the increase (in energy and industrial emissions, leaving out land use) has decelerated: the first derivative is still positive but the second (dC2/dt2)has shrunk to zero. So far this slowdown is undetectable at Mauna Loa. But then it wouldn't be. I'm sorry I can't trace the Quiggin comment, which was a response in a discussion thread at his blog not a post.

To my (shiny-obsessed) mind the question is what, if anything, the action in the second derivative means. Some people will cast it as an argument for business as usual — see, emissions are peaking and heading down without any massive centralized efforts. Others may see it as an argument against business as usual, insofar as we're not so clearly and obviously doomed as we thought we were.

The PV roadmap thing made me think, though, of the amazingly misnamed Moore's Law. Everyone outside the semiconductor industry seemed to think (and I've been following this since the early 80s) that it was really some kind of inexorable law of increases in transistor capacity that somehow just happened. Whereas instead it was what we got from the maximum efforts of thousands up thousands of researchers, engineers, production technicians usw working their asses of to create and debug new processes.

Yes. Learning rates can't simply be mysterious essences of a technology. They are in part herd agreements of a technical community about feasible goals. For a long time, Moore's Law was carried forward by the huge investment of Intel in new processes. As Intel's margins have come under pressure from the ARM ecosystem - it still apparently loses money on mobile processors and is under threat in servers - the pace is slowing down. Intel have abandoned the" tick-tock" cycle for a statelier three-stage cadence. It will take longer to get to 10nm from 14nm than previous jumps took. I doubt if this slowdown matters very much, as long as progress doesn't stop.

I would definitely subscribe to your "not obviously doomed" group. What I expect to see is that as the 2 degree C target comes in sight, its inadequacy and danger will also become more evident. The struggle will shift to the more ambitious 1.5 degree C target. This looks impossible without massive sequestration, implying a carbon tax (and sequestration premium) or functional equivalent. I can't imagine any free-market solution.

Perhaps interesting here, there has long been an argument that the focus on Moore's Law and raw doubling may have been good for Intel (because no one else could keep up with the investment pace, rather the way that the US supposedly spent the USSR into the ground during the later part of the cold war) but were bad for the computer industry as a whole. A lot of ideas that could have led to better scalable performance, more computing per watt, or less horrific software have fallen by the wayside because they couldn't compete with the steady progress of commodity chips. One hopes that PV doesn't get stuck in analogous local maxima.

Much better, thanks!!!

That actually was in response to me. See his Parallel Universes post of March 11, my question at #47 and his response at #52. I still think that a joint post between JQ and Tamino would be interesting.

The reference to your comment seems to be here. JQ seems to have removed his reply - I'm glad to have confirmation that I didn't imagine it. Maybe he is working on something more technical and considered, perhaps with or against Tamino, who also knows what he's talking about.

There were huge forest fires in 2015 in Indonesia. The IEA doesn't try to measure such impacts. Climate change makes them more likely, so there is a trend term, but there will be very large year-on-year variations.

I was referring to the thread at Crooked Timber.

Ah. The perils of cross-posting. Here (with your link to Tamino) and JQ here.

Hey what?

My Bunny/Hare and Tortoise are just more picturesque labels for Daniel Kahneman's System 1 and System 2 mental modules, to which I linked. Freud got a lot of mileage out of clever labelling (id, ego) and Kahneman was IMHO missing a trick.

My Bunny/Hare processor thought that this was going to be about Republican Senators and Merrick Garland. I realized it wasn't long before my Tortoise processor even woke up and at that moment, Bunny saw another shiny object.

In self-defence, I scored 7 comments quite quickly, which is good going by the current benchmarks of the blog. The post titles are aimed to catch Bunny's attention. As long as they are not actually false …

BTW, I suspect Barack Obama, a paradigm Tortoise, is playing the Garland nomination in a longer view than most think. The GOP convention is likely to be a shambles leading to an unelectable nominee. The Presidential election will effectively be over a week after the nicely choreographed coronation of Hillary Clinton as the Democratic nominee. GOP Senators will then only care about their own reelection (1/3) and plotting armed coexistence with Présidente Clinton (2/3), who will have tacked left to placate Sanders' supporters. They will have five months to consider whether Garland is the lesser evil and bipartisanship the best camouflage.

Squirrel!

"[Keeling Curve] is still going up – as it will until net carbon emissions reach zero"

I don't think this is correct on human timescales. I've read that natural carbon sinks would fully absorb human emissions at about 10%-25% of current levels, so anything below that would start reducing overall CO2 levels.

On very long timeframes those sinks would get saturated, and even on our timeframe this doesn't account for tipping points and other unexpected surprises. We need to get to zero and then negative emissions around 2050 or soon thereafter.

I did write "net". Google doesn't quickly throw up a consensus on the prudent natural sink percentage. As you say, it's very iffy to rely on it because of surprises. More CO2 absorbed acidifies the oceans, which does not look a good idea. Humans are in the driving seat on cropland and forests. The Paris Accord includes a net zero objective in scientifically informed language: "to achieve a balance between anthropogenic emissions by sources and removals by sinks of greenhouse gases in the second half of this century" (Article 4.1).

Something I failed to add was that James was one of the first people I read that both noticed renewable prices had dropped down a lot and predicted they would continue to drop to levels competitive to fossil fuels. That was at least six years ago, I think, maybe more, and it's proven correct.

"Not obviously doomed." My new mantra.