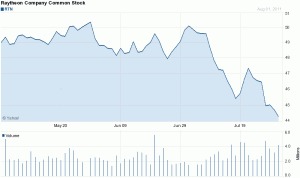

Do you see a trend break in the graph presented below for Raytheon‘s stock price?  While it is hard to read, Raytheon’s stock price falls 10% in one month.  The analysts  are worried that defense cuts mean lower profits for defense firms.  Did you own these shares before the “new news” was announced? Are you buying now?

Matthew, I feel that you’re trying to do something here, but I don’t get it. Perhaps you should revise your post.

If this has to have any political validity (ie be a statement about military companies and not a statement about Raytheon) then wouldn’t it be a whole lot more useful to be plotting an index of US military companies?

For all I know what happened two months ago was that the CEO of Raytheon resigned. Or Raytheon lost a lawsuit. Or Raytheon was accused of bribing officials in South America. Or one of a dozen other Raytheon-specific issues.

Or we can be a decent economist look at more than one stock like a defense fund index and see that its volatile and has basically been flat YTD.

http://finance.yahoo.com/echarts?s=^DXS+Interactive#chart3:symbol=^dxs;range=ytd;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined

Rob, Rob, Rob - whatever will we do with you? One doesn’t become a Chicago economist by doing that. Rather, one cherry-picks the data point needed.