This is a very tough post to write, because I have to confront a collision of legitimate values I hold strongly.  I just received an invitation to sign the petition here. I am not going to sign, even though I am the world’s biggest fan of learning languages. I regret that among the six with which I have some competence, none is really foreign (to me, that is, non-Indo-European). I think real command of at least one foreign language, meaning conversational comfort, writing a business letter, and reading a novel, not passing a written exam, should be a graduation requirement at any college that respects the idea of a liberal education. Requirement, period. I deplore the feeble command my students have of languages they have studied for two and three semesters in courses.  And by the way, every new language is easier than the one before. Continue reading “Languages”

Category: Economics

Kenneth Arrow, RIP

Kenneth Arrow just passed away at age 95. He founded modern health economics, social choice theory, and so much beside. His doctoral dissertation proved the famous Arrow Impossibility theorem. His career didn’t let up until virtually his dying day.

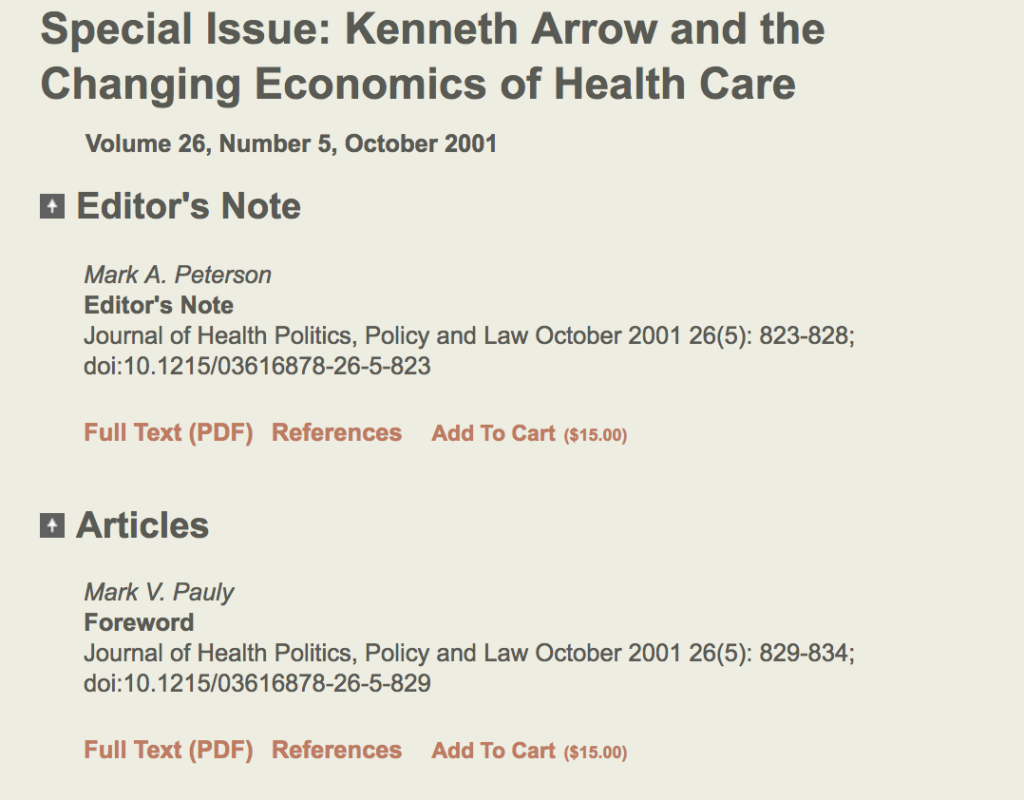

I won’t try to summarize Arrow’s Nobel-Prize-winning career. Fortunately, the Journal of Health Politics, Policy, and Law published a 2001 special issue that considered his contributions to health policy. It is a just great, great read by some of the best in the business-Mark Peterson, Uwe Reinhardt, Mark Pauly, Mike Chernew, Frank Sloan, and many others-with a terrific response these essays by Arrow himself. Check it out. It is a lovely read.

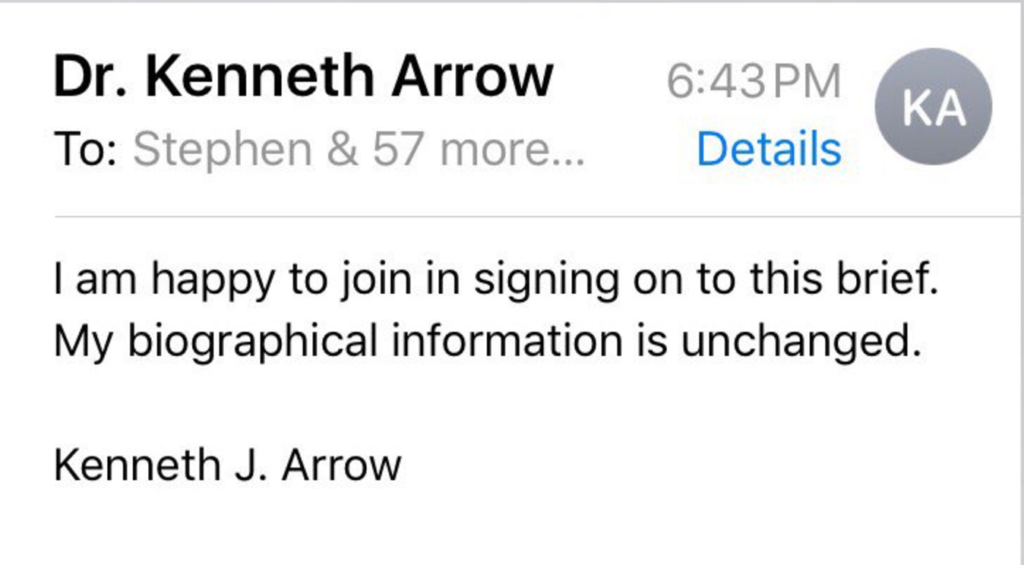

Professor Arrow was an active participant in Stanford seminars well into his tenth decade. He combined the highest mathematical virtuosity with a passion for social justice and a real curiosity about societies and institutions. I never had too many dealings with him. We did occasionally cross paths on political matters related to health reform. I found this 2016 email especially charming given the source. The man contributed more after age 80 than I’m likely to do over my entire career.

Why “Sweet Spots” Are Neglected in Political Debates

Over at The Incidental Economist, I have a post on “sweet spots” in public policy. When you understand sweet spots, you will know that many absolute policy positions many people adopt (e.g., More spending on schools will help children learn more, cutting healthcare spending doesn’t harm health, more cops reduce crime, increased incarceration doesn’t reduce crime etc.) are all, for lack of a better word, wrong. The same policy can be effective, ineffective or counter-productive depending on whether the current intensity at which it is applied is already in the “sweet spot” or not.

If you want to review examples of this phenomenon from education, crime, health and labor policy, please see the TIE piece. What I am writing about here is why the sweet spot reality is so underappreciated when people argue sincerely about public policy (I emphasize sincerely because of course some people know about sweet spots and ignore them anyway to further their own agenda, but here I am talking about people who truly believe what they are saying).

Our cognitive system has frailties. Kahnemann and Tversky showed how vivid, easily-recalled examples seem more representative than they are. Someone may “know” that more education spending always helps kids because they had a highly memorable experience of seeing a crumbling, underfunded school being turned around by additional investment. In contrast, a different person may be aware of a vivid example of where massive spending (e.g., Mark Zuckerburg’s $100 million dollar gift to Newark’s school system) didn’t help kids learn at all. By definition, single examples are going to be sampled from a range of possibilities that may or may not be in the sweet spot for a given policy, and because we are prone to misjudge such easily recalled instances as representative, we are often insensitive to counter examples that fall outside the range whence our example comes.

Continue reading “Why “Sweet Spots” Are Neglected in Political Debates”

Trump’s German debt bomb

Merkel has the power to bring down Trump, through the Deutsche Bank loans.

Deutsche Bank is in trouble. WSJ in September, December.

The $14bn fine levied on the bank by the US Justice Department has exposed Deutsche’s thin capital cushion. It is retrenching, and struggling to avoid a bailout. The German government’s formal position is against bailouts. But that’s for show: you always deny these things to the last minute, like devaluations. In reality, it could not afford to let the country’s largest bank (and the 11th in the world) crash. We can safely assume Bundesbank and Finance Ministry officials are riding herd on the bank’s every move and keeping up the pressure.

The bank is also the largest creditor of the Trump Organization, to the tune of $364 million. Which creates a very interesting situation for all parties, in the sense of the Chinese curse. Continue reading “Trump’s German debt bomb”

Art on the economic rack

All what I said yesterday about the economics of content applies in spades to music. US recorded music sales (CDs, streaming, and LPs) are down about half in real dollars since 2006. Musicians depend on live performance, and treat their CDs as advertising for concerts: live performance revenue is about double recording sales.

What this means is that the music itself has to change: every gig is under pressure to get as many people in the seats as possible. Some music is designed for this: it’s simplified to survive amplification in a stadium, where what you see from distant seats is out of sync with the garbled auditory signal, and it can be improved with fireworks, lighting, and I guess ecstasy distribution. Some music is not suitable for this kind of venue, but a series of club dates or performances in 500-seat halls with good acoustics cannot support a band, or even a soloist. The relentless pressures resulting from the impossibility of monetizing nearly all person-hours of music listening (recorded content) leads to ridiculous, absurd events like the concert for which I just received an ad from Cal Performances: Yo-Yo Ma, Edgar Meyer, and Chris Thile (great, wow!)…at the 8500-seat open-air Greek Theatre at Berkeley. At the what??!!

These guys are virtuosi of acoustic instruments, none nearly loud enough to be heard in that space. Their musicianship comprises the subtlety of fine distinctions in timbre, intonation, and rhythm, absolutely none of which will be audible potted up for that venue and bounced around in it, not to mention that from most of the seats (toward the rear), Ma’s right arm will zig while the sound he’s making zags. How is a pasticcio like this a better experience than hearing the same performance as recorded in a good studio, perhaps as a video? Nothing wrong with big crowds getting together for a social event, but this is a truly bizarre sound track to accompany that.

What about dynamics, if timbre, pitch and rhythm don’t work? Well, another interesting thing has happened to music, more gradually, over the last century or so. Once upon a time, loudness was the most expensive element of music with which to get a big effect: to sound twice as loud, you need ten times as many musicians, which is why the chorus at the opera doesn’t sound anything like fifty times as loud as the soloist. Now, dynamics is the cheapest element; just turn up the pot on the mixing board (or your iPhone)! At the same time, the relative (to everything else) cost of excellent musicians and singers for live performance has gone up enormously because they have seen none of the productivity improvements that have made almost everything else cheaper-it still takes two person-hours of trained talent to perform a half-hour string quartet  same as it took in Mozart’s time. So: make it louder, enough louder that an audience accustomed to really loud will think it is hearing something special. Sound levels, in earphones and at venues, drive a positive feedback loop that has measurably deafened the audience with volumes OSHA would forbid in a workplace: they can’t hear subtleties at higher frequencies, so the only thing to do is…louder still!

If Ma and his pals could make a living from recordings, they wouldn’t have to collaborate in deeply anti-musical outrages like this concert. Fewer people would be able to attend live concerts, but those who did would actually hear the music. How to allocate the scarce resource of small-hall seats at top-level talent events, other than by price and scalping, is a legitimate problem, but making a hash of this kind of music through zillion-watt amplification in a stadium isn’t distributing the experience.

It is the media, but it’s not their fault

This is the time we bit-stained wretches compete to identify “the cause” of the election debacle. Â Hillary was a bad candidate; no, Comey put his thumb on the scale; no, racism/sexism… Â Stop it; when your house burns down because you left something on the range frying instead of boiling, and the grease ignited, and your kitchen fire extinguisher was out of date and didn’t work, and the fire department got there late, there are just multiple ’causes’: Â if any had been otherwise, the outcome would have been different.

This doesn’t mean nothing mattered; everything did. One of those was completely atrocious coverage in print and video, as well as the ‘off-the-books’ discourse on social media, and that has mattered so much that if we fixed everything else we would still be in terrible trouble.  “The media”, wrapping up facebook, blogs, real newspapers, and tweets, created an uninformed electorate voting in the dark from the heart instead of the head, and from fear and anger instead of hope and reflection. TV news, and print media, uncritically peddled Trump’s nonsense hour after hour as though it were the considerable discourse of a basically serious person;  wallowed in vacuous ‘damn email stuff’ and horserace opining rather than policy; and so on.  These are sound criticisms, but it’s not Wolf Blitzer’s fault or the New York Times‘ that they didn’t do better. All the media are deep in a downward spiral not of their making, and it will get worse before it gets better. There may be incompetent journalists, cynical meretricious tweeters and bloggers, and venal production company execs, but even Edward R. Murrow could not have fixed this. Continue reading “It is the media, but it’s not their fault”

Quote of the Day

This is not the republic of my imagination.

-Charles Dickens, letter to William Macready, from Baltimore (1842)

The end of big trade deals

In their current form, large international trade negotiations are politically illegitimate.

The last global trade deal was the Uruguay round, finally agreed in 1994 after seven years of negotiations. The deal included the setting up of the WTO, a stronger organization than GATT, which it replaced. But no further global trade deal has been agreed. The WTO launched the Doha round in 2001, but it has fittingly run into the sand.

Trade negotiators are nothing if not obstinate, and tried a new tack. If a global deal is too difficult, why not try regional ones? So TTIP, the transatlantic deal, and TPP, the Pacific one, were born. Well, conceived.

Both are moribund. Hollande has declared France’s opposition to TTIP in its current form, which is also under sustained attack in the European Parliament, especially over ISDS. [Update 30/8: the French trade minister has called for the talks to be suspended. If this is a negotiating tactic, it’s reckless hardball - it would be very hard to walk back.] TPP is opposed by both Clinton and Trump. Obama still officially hopes to get TPP through the Senate in the lame duck session. (See supportive comment from Harold Pollack.) Do you credit this? McConnell has not shifted from his policy of Adullamite obstruction of every Obama proposal. Even if he allowed a vote, would senators really vote against the platforms of their parties, which accurately reflect a hostile public opinion?

This widespread failure of the trade liberalisation agenda is usually put down to a widespread turn in public opinion against free trade, now seen by many on both left and the populist right as a callous neoliberal plot to enrich capitalists at the expense of workers. (It is true that the compensatory support for workers who lost their jobs as a result of past agreements like NAFTA somehow failed to materialise.) Some trade advocates resort to the absurd argument that the failure of TTIP and TPP would put existing trade at risk. But there is very little support for proposals to roll back existing trade agreements, from NAFTA to Uruguay to the European single market. There is something in the trade negotiation process of these new deals that gets voters’ goat.

Let me nail up a thesis to the trade church door. Modern trade negotiations are illegitimate. In their current form they cannot possibly lead to a democratically acceptable result. That is why they are doomed to fail.

The argument has two parts. Continue reading “The end of big trade deals”

Why do grownups say stuff like this?

I just got a fundraising email from California Attorney General Kamala Harris, for whom I will almost certainly vote in the senate race this fall. She has jumped on the private prison issue with the following piece of complete nonsense:

It is morally wrong for corporations to profit off the mass incarceration of millions of people in this country.

As it happens, I think prison privatization as usually understood (contract with Wackenhut or some such outfit to just run prisons with private-sector financing, employees, etc.) was a bad idea from the get-go; many years ago Bob Leone and I wrote a chapter for the book MacDonald edited that tried to untangle the false binary choice into a structure that could support intelligent debate.  Our basic take was that everything is privately produced (absent slavery) at the beginning of a production sequence, and the key question was where in a sequence of stages from there to finished product/consumer it was most useful to insert a contract (rather than employment relationships).  Guess what: it turns out to be a complicated and interesting managerial analysis, generally studied under the heading of “make or buy”, and no, it isn’t settled just by comparing prices and taking low bids.

What Harris says implies that every potato on the inmates’ plates, and every brick in the building, and all the guards’ shoes, must be made by a government agency (or, I guess, donated by a nonprofit), or right there in the prison. Maybe it would not be morally wrong if all that stuff were just confiscated from farmers and manufacturers to be sure they don’t profit? Does she demand that the prison be built entirely by inmates and civil servant hardhats?

Come on, Kamala: there are plenty of reasons to demand that incarceration be a government function, not contracted out at the end stages of ‘production’, without pandering to people who think profit is an offense to the moral order. And there are plenty of morally appropriate opportunities for corporations to profit by making useful stuff and selling it to governments, including inputs to incarceration, like those bricks.

[corrected 21/VIII/16]

Developing new drugs

All over the world, new pharmaceuticals are developed more or less the same way. Governments and foundations spend money on fundamental research on diseases, but once a specific molecule has been identified - and sometimes long before that - the focus shifts to the private sector.

A pharmaceutical company puts its own money first into animal trials, then into human safety studies, then into small-scale efficacy trials, and finally into the big, expensive “Phase III” trials required to obtain approval from FDA or its equivalents elsewhere. About 80-90% of the time, the compound turns out to be a loser.

In the minority of cases in which the drug actually gets approved, the average time-lag between starting work and getting it on the market is most of a decade. Since the pharma business is risky, the cost of capital is high. That’s the justification Big Pharma offers for the price-gouging that patent protection allows: if the payoff isn’t there, the R&D won’t get done.

If you’re going to risk millions of dollars that costs you 10% per year on a longshot, the payoff if it hits needs to be very large. So pharmaceutical companies focus on “blockbuster” drugs: those with potential revenues of more than $1B/yr. That means drugs that (1) have to be taken frequently - ideally, every day for a lifetime - and (2) deal with the diseases of people with good health insurance.

None of this makes anything but a twisted sort of sense. It leads to not enough new drugs and to excessive drug pricing. In particular, it leads to the absurd situation where there’s an obvious social need to develop a drug but no economic mechanism for doing so. Today’s big example is a Zika vaccine, but the same is true of antibiotics and of innovative pain-relief formulations (e.g., pain-appropriate dosages of buprenorphine, opiate-and-antagonist combinations) with less addiction risk.

There are lots of proposals for fixing the whole system: my personal favorite is to at least partially replace patent protection with large cash prizes as the incentive for bringing new drugs through the approval process. (Since the U.S. federal government winds up bearing much of the cost of pharmaceuticals anyway - through Medicare and Medicaid, through VA health, through health coverage for its own military and non-military employees and their dependents, and finally through the tax deduction for employee health benefits - it could write some very big checks and still come out ahead, if the result was marginal-cost pricing for the drugs themselves.)

But in the meantime, there’s something much simpler. If drug development were financed at Treasury rates rather than at the pharmaceutical-company cost of capital, lots of socially important projects that aren’t financially attractive now would become attractive. That could be done by creating a publicly-owned pharma R&D firm to get socially needed drugs through the FDA process and license the resulting patents to generic drug manufacturers, or by lending the money at concessionary rates to current phama outfits to develop drugs serving identified needs and then sell them at controlled prices.

Of course the details matter - the details always matter - but in this case almost any set of details would leave us much better off than we are now.

Footnote

There’s a broader issue here: Right now, the whole world is eager to lend money to the U.S. Treasury, and as a result we can now borrow money for 30-year terms at 2.2% nominal. If our political system can just get out of its fixation on deficits and debt, we ought to be borrowing some of that money and investing it in things with good long-term returns: not just drug development, but R&D more generally (especially, I would say, basic science), infrastructure, and education.

One side effect would be to boost final demand, kicking the economy out of the slow growth that has been so marked since the beginning of the Great Recession. Â There’s not much wrong with this country that ten years of tight labor markets couldn’t cure.