You won’t read this to the end. All it offers is confirmation of things I’ve said already. The System 1 Energizer Bunny processor in your brain – or more classically, the Hare – that runs most of your decisions using strong priors and dodgy rules of thumb already made your mind up for you on both points. The lazy Tortoise, the System 2 processor that can think systematically but drains the battery, doesn’t think it’s worth waking up for anybody less than James Hansen or a Cochrane meta-analysis. Is that a half-open eye? Quick, before it closes, let me make my play. And Bunny, before you scamper away, there are shiny NEW anecdata at the end!

Carbon emissions are peaking

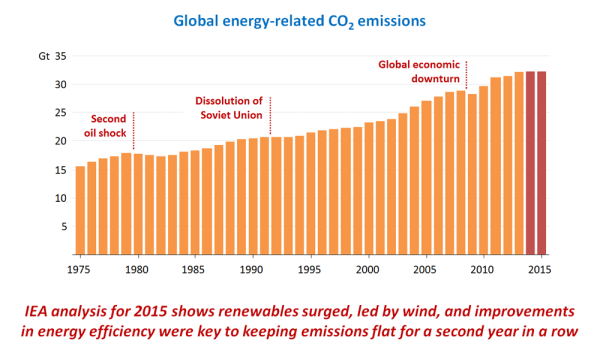

I made the claim here, in fine. The confirmation is from one of the three sources, the IEA.

Global emissions of carbon dioxide stood at 32.1 billion tonnes in 2015, having remained essentially flat since 2013.

If this were a second independent observation, it would pretty dramatically lower the probability of error in a peaking hypothesis drawn from one year. It isn’t that, only a second report from a source subject to the same measurement risks as before. But most of these will be systematic - maybe there are huge steelworks in China that under-report their coke use, but this will affect the total for all years, not the trend. You could argue that political pressures in China for under-reporting have increased. That effect would have to be gigantic to invalidate the peak, involving hundreds of millions of tonnes. The Chinese fall is consistent with reported drops in coal and steel production; the conspiracy would have to be very widespread, reaching the top levels of government. I don’t buy it.

The doomsayers have shifted to the Keeling curve, the unchallengeable record of CO2 concentrations high on Mauna Loa. That is still going up – as it will until net carbon emissions reach zero, which is a long way ahead. No deceleration is yet visible. But as John Quiggin observes, it’s unsound to prefer a second derivative extracted from a noisy signal to reasonable direct measurements.

The costs of solar energy will keep falling

Previous claims here (preen on getting the impact on coal right) and here.

The confirmation is the seventh edition of their PV technology roadmap from the VDMA association of German suppliers of pv manufacturing equipment. (For once, prefer the fuller version to the executive summary – the context makes it more comprehensible.) The projections cover every aspect: silicon refining, wafer cutting, cell types, doping, silver and copper busbars and connectors, backplate schemes like PERC, encapsulation, frames, and more. They conclude that the historic 21% learning rate (Fig. 46) is good for another decade. Of course, how this maps on to actual prices depends on the installation growth, which is more variable, and may be slowing a bit from the historic 44% CAGR.

The point here is the status of the authors. Nobody, not even the module manufacturers, knows more about this technology than the VDMA members. They have a very strong incentive to get the roadmap right. If anything, the bias will be conservative. A Delphi process like this may be blindsided by some lab breakthrough, but this is unlikely from the history: plain old silicon has seen off as many sexier rivals as Angela Merkel. They do think – like the eminent Martin Green of UNSW – that perovskite-on-silicon tandem cells will enter mass production around 2019, which should allow the learning curve a good many more years of life.

One of the benchmarks of the US SunShot programme, $1 per watt system costs, is being reached: the VDMA expect it to be hit around the end of this year in Europe and the USA (fig. 45). Mexico has just awarded 1.7 GW of solar generation in an auction at an average price of $45/Mwh, HEY BUNNY. This handily beats previous records in Texas and Dubai around $60/Mwh unsubsidised. Such a rapid drop is more likely to be down to a rerating of the risks by investors and a lower cost of capital than to the technology. Renewable energy has become the safe haven in the turbulent energy industry.

It was a masterstroke by German Green politicians like Hans-Josef Fell fifteen years ago to style the energy transition as an unthreatening Energiewende, “energy turn”. It doesn’t look like that to the 1.3 million coal miners in China who are about to lose their jobs HEY BUNNY. Nor to the bankers mulling over Greenpeace’s latest well-placed shiv, a report on the $981 billion of coal generating plants being planned worldwide, most of which would lose money if they went ahead HEY BUNNY. It’s a revolution, and revolutions are messy.

This one is speeding up. Not that the GOP dwarfs are noticing.