The pricing of distributed solar energy has become the object of fierce struggles: not only in Arizona and Nevada, but in previously generous Germany and Britain. Utilities in US states claim that solar households enjoying net metering are getting a free ride from their unpaneled neighbours – they will still rely on the grid in the evenings, but no longer pay their fair share of its costs. Several utilities are proposing to replace net metering by a much lower feed-in tariff, generally close to wholesale, plus higher fixed charges. In Nevada they the PUC [corrected, see comments] even initially proposed making the change retroactive, an underhand manoeuvre previously only carried out in Spain, the Czech Republic and a few other jurisdictions indifferent to their reputation with investors.

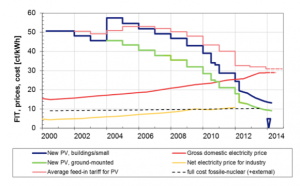

In Germany, the feed-in tariff (FIT) for solar has been cut to 12.3€c/kwh, under half the retail rate of 29€c. In the UK, the government will cut the residential solar FIT to 4.39p/kwh, under the wholesale price of about 5p/kwh. In both countries, there is a suspicion that the slowdown is a pander to the hurting fossil fuel interests.

Solar advocates are crying foul, and accuse the utilities of trying to stifle competition from an upstart technology that is cutting into their profits. SolarCity has ostentatiously suspended operations in Nevada. What should the non-expert concerned citizen make of the disputes?

I have two suggestions. One is the standard heuristic of amateurs in technical matters. Don’t try to make yourself an expert, just understand enough to make an informed judgement as to whom to trust. Look for unbiased and qualified sources of information first, which gives you a handle on the self-interested ones, since you can’t avoid dealing with them entirely.

Here Margaret Thatcher’s electricity privatisation in 1990 comes to the rescue. It was the one she got right. The key measure was to split the grid from generation. The grid is a technical monopoly and has to be run either as a public service or a tightly regulated chartered private corporation, a Ma Bell. Generation can and should be competitive. The grid doesn’t just transmit the electrons and bill customers. It runs the market in generation. The model was copied in Texas (IMHO, the equivalent for Governor G.W. Bush of Stalin’s Moscow metro). The EU Commission got enthusiastic and secured the adoption of the model as a European norm. In France it’s a Potemkin separation: the grid operator RTE is a wholly owned subsidiary of the state monopoly generator EDF. In Germany it’s real, and the grid is divided into four large zones run by different management companies (TSOs). Oddly, the largest TSO, Tennet, is wholly owned by the Dutch government. India and China have also split grid from generation.

The alternative model is the monopoly regulated utility, as in most of the American South. (New York and California have confusing and complicated hybrids that I do not pretend to understand.) The US war on residential net metering is concentrated in these ancien régime states. The utilities have more or less guaranteed returns on assets, generating as well as transmission. They have a clear financial interest in stopping rival generators on their territory, and their claims should be read with s hefty dose of suspicion.

The statements of unbundled grid operators are quite different in tone, and supportive of the energy transition.

China, the chairman of State Grid Liu Zhenya:

The fundamental solution was to accelerate clean energy, with the aim of replacing coal and oil….The only hurdle to overcome is ‘mindset’. There’s no technical challenge at all.

UK, Steve Holliday, CEO of National Grid:

The idea of baseload power is already outdated. I think you should look at this the other way around. From a consumer’s point of view, baseload is what I am producing myself. The solar on my rooftop, my heat pump – that’s the baseload. Those are the electrons that are free at the margin.

Germany, Boris Schucht, CEO of TSO 50 Hertz:

[Schucht] believes that integration of 60 to 70 per cent variable renewable energy – just wind and solar – could be accommodated within the German market without the need for additional storage. Beyond that, storage will be needed.

I couldn’t find statements from these network operators about grid integration costs (which, remember, apply to all generators – lowest for highly reliable despatchables like hydro and geothermal). Here’s an academic study commissioned by the EU, Pudjianto et al, Imperial College London, September 2013:

The study concludes that grid integration cost of PV [in the EU] is relatively modest, and it will increase to around €26/MWh by 2030.

So independent expert opinion is that high penetration of solar electricity is entirely manageable at reasonable cost. It does look as if the alarmism of Nevada Energy is down to vested interest.

That does not mean that net metering, the policy being attacked, is a good idea. It was basically the simplest way of getting rooftop solar connected to the grid. The old electromechanical meters ran backwards when the current flow was reversed, and that was the least effort solution, so it took hold. There is no reason to think it is optimal, apart from its brain-dead simplicity.

So here’s my second suggestion. Distinguish between two issues:

1. What is the right level of subsidy for solar electricity from any source?

2. What a fair price for rooftop electricity, independently of the subsidy?

Take the second first. In 20 years at most, rooftop solar will not need any subsidy, and the grid will be 90% renewable. Let’s try to set our fair price for solar in this world. We assume away the vested interest of Nevada Energy in its generating assets; the commissars have introduced the Thatcher-Xi-Bush unbundling. The wholesale market for generation has two forms: a long-term PPA, enabled by the complete stability of renewable generating costs – this is the only remaining useful sense of baseload; and a spot or day-ahead market to deal with variations in demand. A rooftop solar supplier sells electricity into a local distribution grid, where most of it is re-used without calling on the high-voltage system. The residential and commercial resource therefore lowers the need for investment in transmission, especially if it is coupled with decentralised storage. However, it needs higher-cost backup: imports, grid storage, load management, geothermal, overbuild. It looks as if the rooftop owner should get a rate better than spot wholesale but worse than retail.

Technology may make it possible for aggregators to offer a long-term PPA rate, close to the one for utility solar farms. So far as possible, the pricing decision should be pushed on to the market in such a way. Attempts to manage the price will have perverse results. In Germany (and I think Australia) today, a policy of cross-subsidising industry by overcharging households is leading to a boom in inefficient domestic battery storage. (Inefficiency is my a priori, but it’s pretty solid: network operators can always buy any form of storage cheaper than households, and some like pumped hydro households can’t buy at all.)

There is no reason why rooftop suppliers should get the full retail rate through net metering. Access to the grid has a value for sale as well as purchase. Why should it come free?

That is the end state. Where we are now is a world of massive unpriced carbon externalities. Absent an infeasible direct carbon price, renewable energies deserve to be subsidised, or incentivised by regulation.

This brings us to question 1: how should this be organised? It’s a question of public policy, not one for utilities. The feasible schemes will be suboptimal. We want to choose ones that

- get a good bang for the subsidy buck in terms of installations,

- do not create too many distortions, either between providers and technologies, between social groups within the current generation, or between generations,

- offer a comprehensible and predictable glide path to wards the all-renewable. subsidy-free end state we have sketched out.

German solar FITs over time. Source: Fraunhofer, via GTM

The German solar FIT, as it operated between 2000 and 2014, scored high on these tests. The rate was explicitly linked to the falling cost of installation, and aimed to secure a reasonable ROI (7%) for early as well as late adopters. It was based on output, so left incentives intact for buyers to seek out keen prices and competent installers. It differentiated between technologies of different maturities, to secure a diverse portfolio. It recognized the value of energy democracy, in that FIT rates were higher for small than large installations. (The Germans did not go overboard on this. The FIT rates for wind supported 10 MW farms set up by village cooperatives, but not inefficient 50 KW turbines on single farms.)

Net metering scores badly. It does not decline over time, and is more valuable to late adopters than early ones. By the same token it becomes more costly to other grid users, just as the need for the break gets weaker.

It really does look as if net metering will have to be replaced in the USA by a more complex value-of-solar tariff (VOST), as in Minnesota and (surprisingly) Maine. The political problem is that deep suspicions have been created by the current war on residential solar by the silo utilities, egged on by the odious ALEC front of the Koch brothers. The path forward passes through breaking up the monopolies and their incestuous relationship to state regulators.

* * * * *

Footnote on trusting experts, or not

Mike provoked this post by passing on to me a blog post by Professor Catherine Wolfram on the site of the Energy Institute at Berkeley’s Haas School of Business. Good stuff, you would expect. But then I ran into this:

Solar customers in much of Europe are in a buy-all, sell-all model. Consumers continue to pay for 100% of their consumption and the utility installs a second meter to measure the solar production and compensates it with a “feed-in-tariff” (FIT) rate.

I know of no country that actually has a residential FIT that operates like this. The key paragraph of the EEG, Article 11 (1) , does not mention any sell-all requirement, nor do the cross-references. Stripped of these, the article reads (my translation and emphasis):

Network operators must immediately and physically accept, transmit and distribute all the supplied electricity from renewable energies. When the operator of the installation so requests, this obligation also includes commercial acceptance.

The term I have translated as “supplied”, veräußert, is clearly distinct in meaning from “produced”, which would be erzeugt, hergestellt, or produziert. Besides, there was a special subsidy in Germany for self-consumed solar electricity from 2009 to 2012. This would make no sense if householders legally had to “sell all”.

What must have happened is this. The early German FITs were well above retail, starting at 50€c/kwh in 2001. It made sense for early adopters to sell all their solar output at this advantageous rate, then buy all their needs at the lower retail rate 0f 15-20€c. The FIT matched retail in 2011 (29€c) and fell well below it in April 2012 (19.5€c). At this point solar roof-owners acquired an incentive to maximise self-consumption (Eigenverbrauch, Eigenstrom) and minimise exported current. They were always free to do this.

I don’t think this is a minor niggle. The German FIT for solar energy created the mass solar market. As a public policy measure in technology, it rates in historical importance with DARPA’s development of the early Internet and the British Air Ministry’s support of radar in the 1930s. My confidence in Professor Wolfram has taken a big hit.

I don’t think this is a minor niggle. The German FIT for solar energy created the mass solar market. As a public policy measure in technology, it rates in historical importance with DARPA’s development of the early Internet and the British Air Ministry’s support of radar in the 1930s. My confidence in Professor Wolfram has taken a big hit.

And so should yours. When experts make significant mistakes on fact on things you know about, they should lose credibility. Not completely, as with detected lies: falsus in unum, falsus in omnia. For simple mistakes, it’s erratum in unum, dubium in alia.

And bloggers? Yes, up to a point. In mitigation for my own mistakes in reporting, I claim a lower bar. I don’t advertise any credentials outside the field I used to work in, and I link to my sources. I don’t generally have the resources to double-check these, and you should not expect it. It’s up to you what credence you give to say Greenpeace on Chinese coal production.

Leave a Reply

You must be logged in to post a comment.