Last week’s ABC mini-series chronicled Bernard Madoff’s $50 billion Ponzi scheme, which so devastated wealthy individuals and major institutions within the American Jewish community. I’m still taken aback by Madoff’s icy lack of communal conscience or apparent self-limitation. He wiped out Elie Wiesel’s life savings, and stole $15 million from Wiesel’s foundation. Madoff stole from Sandy Koufax. Madoff even defrauded Hadassah. Nobody does that. That’s like mugging your grandmother.

I wrote about the case yesterday at the Atlantic website. Not everything could fit in that piece. Here’s some additional observations.

There’s much to be said about his crimes-not least about the incompetence of the regulatory apparatus that failed to stop him despite repeated warnings and what researchers Greg Gregoriou and Francois Lhabitant quite properly called “a riot of red flags” over many years.

The biggest red flag was the simple knowledge that almost no investment reliably outperforms a simple index fund or can promise anything approaching the stock market’s overall returns without the market’s accompanying downside risks. Anyone who promises otherwise is likely deluding himself or trying to delude you….

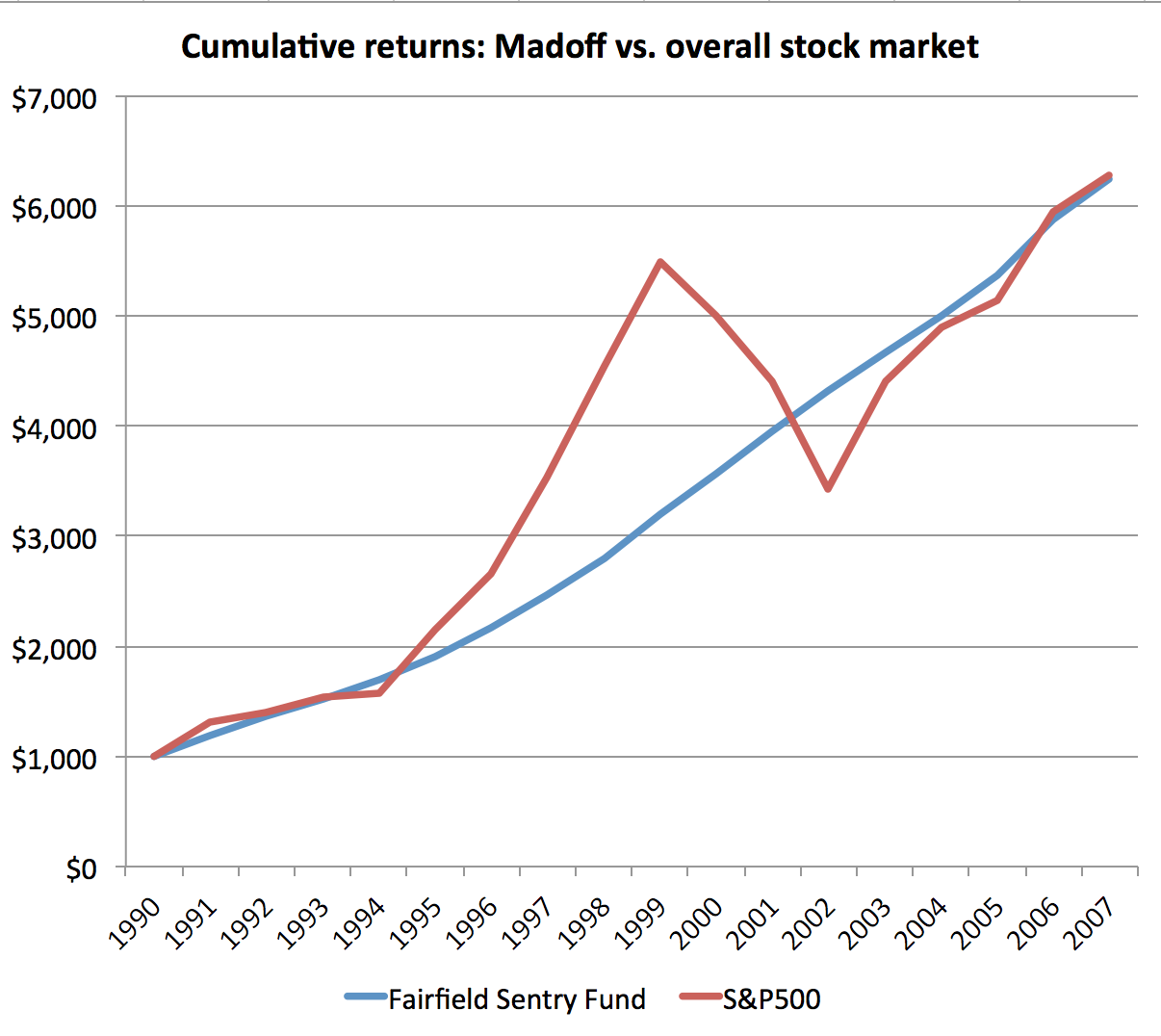

Knowing that, many people should have asked serious questions that would have detected Madoff’s fraud long before it blew up. The below graph, based on Gregoriou and Lhabitant’s report, shows the supposed cumulative returns if one invested $1,000 in a Madoff feeder fund (Fairfield Sentry), verses what would have happened if one simply invested in the overall stock market.

Madoff’s supposed returns are shown on the blue line. The stock market’s overall returns for a simple index of the 500 largest firms are shown in the red line. For various reasons, this is a rough calculation, but the pattern is obvious. Madoff claimed to deliver the same returns as the overall market with almost no volatility whatsoever, during one of the most turbulent stock market periods of the postwar period.

Ordinary investors can hardly be blamed for not knowing that this is extremely implausible. As a matter of public policy, it amazes me that government regulators and the highly-paid financial professionals duped (and paid) by Madoff failed to follow up with the hard questions and rigorous independent auditing that probably would have stopped Madoff before things blew up.

Damaging the bonds of community

Madoff’s was only the most glaring example of much more widespread regulatory failures that came to light with the mortgage meltdown of the Great Recession. State and federal regulators must devote substantial and sustained resources to address continued widespread fraud on Wall Street, but also in every large and small community across the country.

Whatever policymakers might do to address these problems, we as individuals should be especially skeptical of any financial product embraced by influential people in our religious, cultural, or political communities. Sadly, an entrepreneur’s deep involvement with your community’s political or cultural leaders, or with local philanthropy, is, itself, at least a yellow flag of caution. After all, firms that make outsized profits within a particular community have, by definition, the greatest incentive and resources to make these communal investments.

That’s a chronic problem within low-income communities that desperately need philanthropic support, but that also need to regulate predatory financial products that specifically harm these communities. A sad development in the subprime crisis was the effort to con or to coopt community leaders and community institutions to steer families into overpriced loans.

One former Wells Fargo official described cynical tactics to the New York Times, noting that the bank “had an emerging-markets unit that specifically targeted black churches, because it figured church leaders had a lot of influence and could convince congregants to take out subprime loans.”

Communities were financially devastated when the foreclosure crisis came to light. That’s the most obvious harm. By co-opting or exploiting local institutions and the informal bonds of trust that hold communities together, the practitioners of affinity fraud do another kind of damage, too. This may be at least as hurtful, and as long-lasting.

Leave a Reply

You must be logged in to post a comment.