My latest Wonkblog column is based on a recent NBER working paper that examined 401(k) contributions and withdrawals among continuously-employed workers at a single firm between 2003 and 2010.

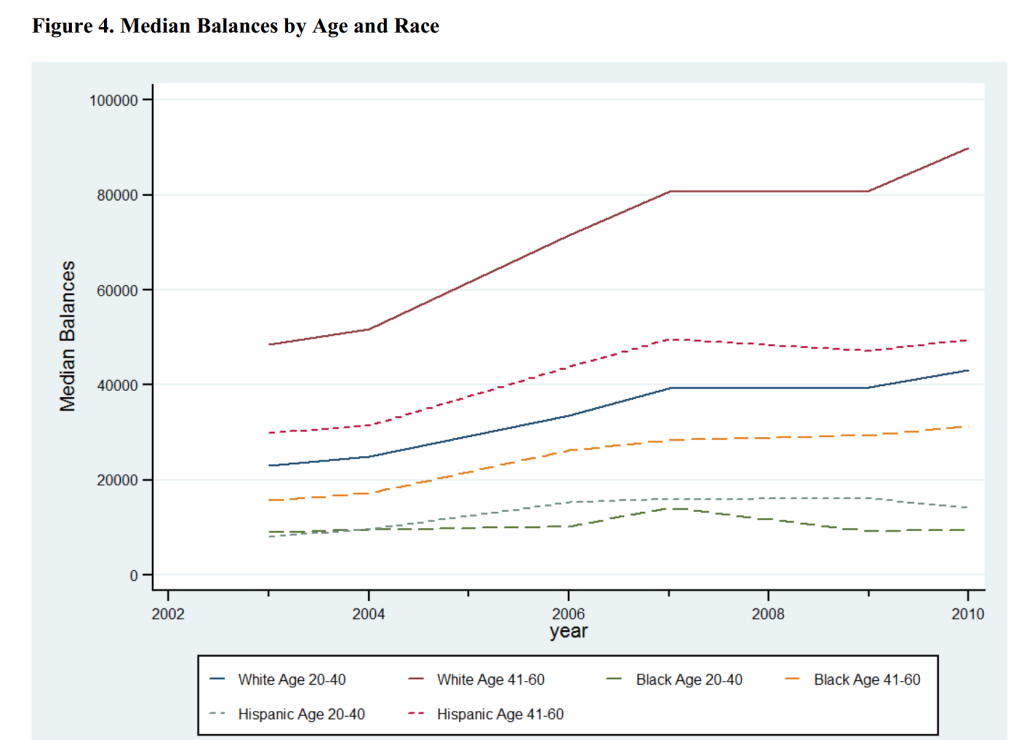

Few workers at this firm set any land speed records for saving and investing. But the race/ethnic disparities in saving remained really striking. Ironically, minority workers contributed surprisingly similar amounts to their non-Hispanic white counterparts. Yet they were vastly more likely than their white counterparts to make withdrawals or to borrow against their 401(k) funds. Minority workers were also much more likely to invest their money in money market funds and other safe assets that bring really low rates of return.

In effect, these workers were using their 401(k) accounts as current savings reserves or as an emergency fund. As my writing collaborator Helaine Olen noted over email, these apparently foolish savings behaviors suddenly seem to make a lot more sense in the life-context of the people who are actually making these decisions. Upper-middle-class people who already have a secure financial foundation can invest at age 40 or 50 for the long-run, and thus accumulate significant nest eggs. Many others realistically can’t or won’t.

The American employer-based retirement system increasingly relies upon tax-advantaged savings vehicles exemplified by the 401(k). In so many ways, 401(k) accounts are basically designed for upper-middle-class and affluent people. This system works reasonably well for us, because (a) we have money to contribute, (b) we have other money we can use for short-term emergencies; (c) we face high marginal tax rates that provide strong incentives to contribute to tax deferred accounts, and (d) we possess basic comfort and familiarity with the general world of mutual-fund investing. Most of us are also guaranteed a pretty decent Social Security benefit when we retire. With these floors in place, we’re free to take reasonable risks making long-term investing for our eventual retirement. Outside this top economic layer, this system works much worse….

I’m sure many minority (and non-minority) workers would benefit from better choice architecture that channels people’s investments into more sensible low-fee investments. But that’s not the main issue. People really need a better basic Social Security retirement benefit. That’s the only way millions of people will have a secure retirement.

Leave a Reply