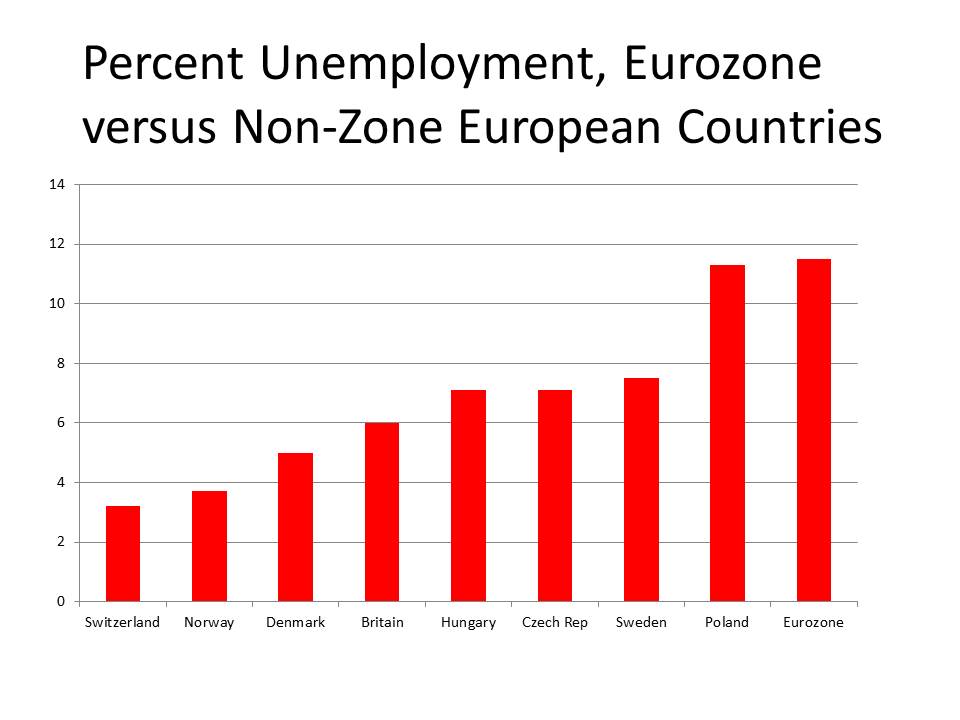

The turmoil in Greece is but one instantiation of the broader crisis in the Eurozone. I chart below the latest jobs data to illustrate that the zone’s unemployment rate is worse than that of any non-zone European country. That big red bar on the far right reflects substantial human misery.

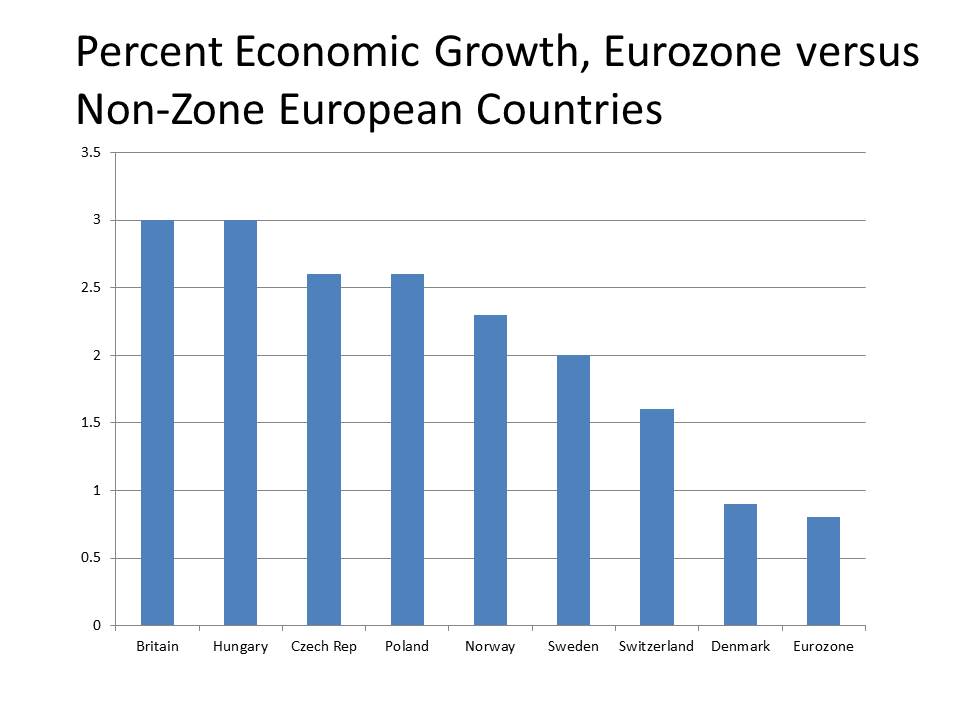

Charting economic growth adds insult to injury. The Eurozone is dead last here, generating not even a third of the growth of the best performers, Britain and Hungary.

Numbers like the above, both in themselves and relative to other European countries outside the Eurozone, create enormous pressure and something’s gotta give. But what will it be?

Will it be a massive stimulus package? European Commissioner Jean-Claude Juncker announced an impressive sounding 315 billion Euro investment package, but upon close inspection it turns out to be quite puny, and in any event Juncker’s future is unclear as revelations emerge that he may have helped wealthy corporate friends evade taxes. Meanwhile, Germany ordoliberals remain committed to spending restraint, suggesting that the Eurozone isn’t likely to go on a spending binge in order to avoid a deflationary spiral.

Another alternative is that the pain continues to mount until populist movements gain control of member governments and start taking radical action, for example defaulting on their debts, or, exiting the Eurozone entirely. The Euro doesn’t have a well of democratic legitimacy upon which to draw. It was always an elite project designed with little regard for (or understanding of) the man and woman on the street. The elite commitment to not owning up to the basic flaws of the system will therefore not count for much if the suffering masses get their hands on the levers of power.