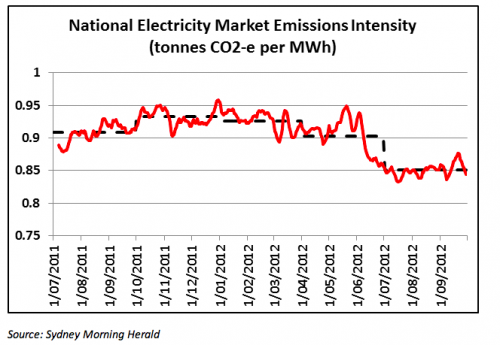

Australia introduced a carbon tax on July 1. The emissions intensity of Australian electricity in the third quarter was down 7.6% from the 2011-2012 mean, 5.6% from the previous quarter:

The takeaway from this chart is that the response of businesses to clear policy and price signals can be very rapid. In fact, most of the change took place in June, just before the policy took effect.

That’s just the short-run impact. Further reductions are working themselves through investment decisions, for instance the mothballing of coal plants. It doesn’t help coal that Aussies are installing solar roofs as if there might be a tomorrow.

Julia Gillard’s Labour government has has a difficult couple of months over the issue. Gillard had to deal not only with rabid opposition from Tony Abbott’s Opposition but her own U-turn. Politics has now moved on, and it’s Abbott who is stuck with an unpopular position, even seen as obsessive. The policy has had no dramatic effects on the standard of living of voters, since the tax is largely recycled as tax rebates. Reality is winning out over spin.

I wonder if anybody will be watching Oz when the negotiations begin in Washington over the fiscal cliff (assuming Obama wins, touch wood, finger rosary, spin prayer wheel, slay chicken). There are several carbon tax and cap-and-trade proposals floating unloved round the Capitol. Perhaps some smart operator like Henry Waxman can get one of them on to the table in January.

Though it would be better if Candidate Obama had a climate change policy to go with the clean energy tie.

So the argument of the conservatives is that the market doesn’t work?

Three debates and the closest you’ll get to climate change in a transcript search is Ryan’s green pork comment.

And that from the youngest debater with the three youngest children.

That juxtaposition ought to be a classic moment in human history…

Assuming of course there is any sort of civilization 100 years from now that can look back and exclaim: Look how arrogant and stupid some of them were even in 2012!

All this of course means every question asked so far is apparently more important than: 391 ppm CO2 and rising and the breadbaskets of the world going to deserts…

Honestly I can’t ever remember being more embarrassed by this nation of overfed and under read oafs.

Our leadership can’t discuss, can’t even mention, the clearest, most obvious, most pressing existential threat to civilization.

And the debate moderators and the citizens that have abetted this? Their dumber than dog dirt too. All they apparently want is lower gas prices…

We are a nation of intellectual sissies and imbeciles.

For shame Acirema. For shame.

I was going to say that with the upcoming foreign policy debate there’s one more window to slip this in but then I remembered Bob Schieffer is moderating.

[...] Community Everyone is entitled to his own opinion, but not his own facts. « Elasticities | Main October 19th, 2012 Why your kids’ trust fund portfolio should short coastal [...]

I am fairly sure that almost every, if not every, wealthy country still has per capita carbon emissions that are fairly above the estimated levels needed to stabilizate the climate. I suppose the rich countries could all carbon tax themselves to lower their emissions and hope that clean technology advances to a point where their emissions falls even farther and that poor countries do not emit a lot more in order to become richer (or even emit less). But maybe that’s a lot of work and we should just adapt instead.

Note the “we”. What happens to “they”?

This is a TAX. Why is James pushing the idea of cap and trade? We know from bitter experience across the world tha a cap and trade system is vastly more easily gamed than a tax. It is insane to imagine that the US will not have such a cap and trade system even more rigged than the European experience.

I didn’t think I was. On the whole like you I’d prefer a tax, as it sends a clearer long-term price signal. Cf. the success of the German renewable energy FITs. But cap-and-trade would do if that’s where the votes are.

The Australian carbon tax is actually a hybrid; it’s flat-rate tax of A$23/tonne ($24 US) on industrial emissions until 2015, when it is supposed to morph into a cap-and-trade system linked to the European ETS. Since the Australian tax is working better than European cap-and-trade, I wonder if this will happen.

The bills floating round the US Congress are of both types: Waxman-Markey is cap-and-trade, Stark-Larson an Aussie-type rebated tax.