Righteous fun is being had at Standard and Poor’s expense after their downgrading of the US government’s credit rating from AAA to AA-: Nate Silver; Matthew Yglesias; John Quiggin; and a long comment thread at Crooked Timber.

There’s just one aspect in the hatchet job that worries me: the idea that the financial markets, and specifically the prices of credit default swaps (CDS) on sovereign debt, can do a better job. The wisdom of crowds to the rescue!

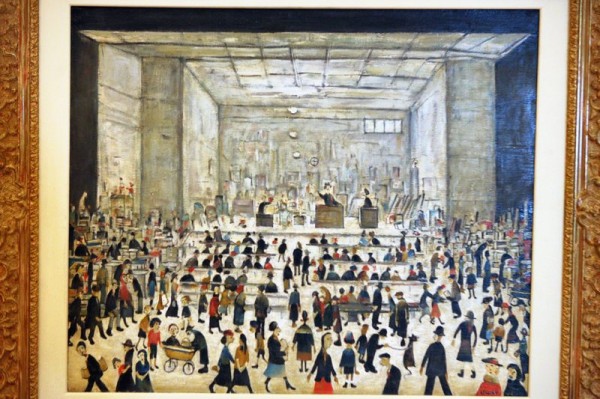

The Auction, JS Lowry, 1958.

Not so fast.

You are thinking of buying 10-year bonds from the government of Cyprus. S & P give it an A- rating, which looks OK. But the CDS price is very high: 8% per year, putting Cyprus as the fifth riskiest sovereign borrower in the world, behind Pakistan but ahead of Ireland, Argentina, Ukraine and Lebanon. That is certainly valuable information, and you need to dig deeper before signing a cheque. Either the ratings agencies or the CDS market are wrong. But is it automatically the agencies? Consider how many professionals will invest the time in learning about the finances and politics of Cyprus, as opposed to say Brazil. Of those that do, how many won’t have personal ties and emotional investment? “The wisdom of small cliques” doesn’t have quite the same ring to it.

The CDS market for US treasuries may not have that problem, but it does have another. Derivatives, like any financial instruments, have their own default risks. If you buy the 10-year CDS on Cyprus from Goldman Sachs, the risk of GS defaulting, low at any event, is more or less independent of that of Cyprus defaulting. The joint probability - where you lose all your money - is so low as to be negligible. But that does not hold for the USA. A default by the Bachmann Administration on US Treasuries would unleash a financial tsunami - made universal by these very same derivatives - and no major bank in the world would be safe. Buying a CDS on these bonds is like buying insurance against another giant asteroid’s hitting the Earth: you could never cash the claim.

That being so, you really have to wonder about the common sense of participants in the US Treasury CDS market. I question whether these particular prices can in principle supply any useful information. The same surely holds for the CDS markets on the bonds of Britain (most recent default: 1672), Germany, France and Japan. That explains why the CDS market absurdly rates the bonds of France (AAA) as riskier than those of Colombia (BBB-). The Colombian price reflects real efforts to assess the genuine risk of default; the French one, just a silly betting game.

A crowd of strangers may well tell you something you don’t know. So may your relatives. So may Warren Buffett.

James, the ratings agencies helped in a multi-trillion dollar fraud. Anybody who doesn’t mention that is not mentioning the most important thing about anything that they do.

You may want to add this link to the list in the first paragraph: http://economicsofcontempt.blogspot.com/2011/08/on-s-downgrades-and-idiots.html

I’d like to switch the focus on the “crowd” yet again…

Really to where it needs to be…

Consider for a second: The wisdom of the small insider crowd.

Of course I don’t mean the insider crowd of Nate Silver, Matthew Yglesias, John Quiggin, and the bent thread at Crooked Timber.

What they say counts for practically nothing. They don’t have the President’s ear.

The insider crowd I am talking about is the small group of Wall Street banksters who make up Barack’s bubble.

We got a real good indication of their temperament the other day in the NYT’s article: Attorney General of N.Y. Is Said to Face Pressure on Bank Foreclosure Deal. Kathryn S. Wylde is described in that article as “a member of the board of the Federal Reserve Bank of New York who represents the public”. As such, she represents the typography of information that makes up the walls of Barack’s bubble. This is what she said in regards to the NY AG’s attempt to hold banksters accountable:

I like to suggest that this oligarchy of ours, is no longer worth pledging allegiance too…

It reeks of banksterism. In two short sentences: Wall Street owns the White House. Period.

As for the global financial house of cards, that Wimberley dances with up above, that just scratches at the surface of the cancer…

On the alleged benefits of CDS to the informational efficiency of markets, neither analysis nor evidence fully supports the positive view. They may, in fact, disable the informational efficiency of target markets. But, try to get an economist to say that clearly.

Our politics depends on technocrats to do the governing, and our technocrats are corrupt, ignorant fools. This doesn’t seem likely to work out well.

The CDS market is only one part of the picture, though. Interest rates also price in the prospect of default. So there’s a lot to be said depending on which signals are moving in synchrony, and which in opposition.